A Winning Competitive Strategy Needs More Than Market Research

Posted by | Fuld & Company

There’s no denying that business leaders are under constant scrutiny to perform. Their business strategies must deliver results that meet or exceed stakeholder expectations for increased market share, improved margins, and consistent growth. But in an age of twisting economies, political upheaval, volatile currencies, and the rapid pace of innovation, executives are faced with aggressive competition. All signs point to universal market disruption in which no company is invincible. In response, it is imperative for executives to gather and leverage as much data as possible to ensure that they are equipped to make the best decisions and to be prepared for an uncertain future.

Implementing a Winning Competitive Strategy

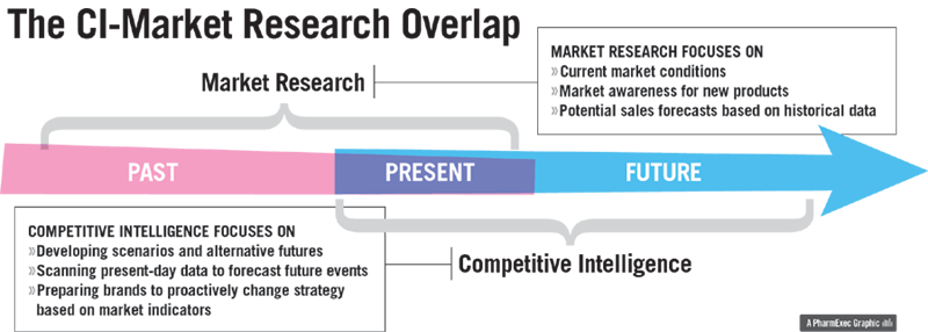

To formulate, and effectively implement, winning competitive strategies a firm must have a formal mechanism to collect, process, analyze, and disseminate data. But data is like a puzzle that cannot portray the full picture until all the pieces are in place. We broadly classify business information into two categories: Market Research (MR) and Competitive Intelligence (CI). There is often confusion regarding the difference between the two, compromising the value of CI as an independent art and science. As a business leader in this new and fast-moving global economy, it is important to acknowledge the strengths of both MR and CI and leverage both correctly. Let’s discuss their definitions individually:

Market Research: Market research is current-focused, capturing what has occurred to result in today’s state or identifying what is occurring in today’s market. It focuses on analyzing historical data with the help of opinion polls, focus groups, surveys, voice of the customer, and other techniques, specifically to determine market opportunity, market penetration and market development metrics. Market research is more science than art, delivering data points that describe a knowable or identifiable element of the market – market share, brand awareness, customer experience, and the like.

Competitive Intelligence: CI is a way to see through and stay ahead of business disruptions, distortions, rumors and smoke screens, resulting in action. As a future-oriented discipline, competitive intelligence enables managers to understand what the competition can and will do. Beyond analyzing the competition, it describes scenarios in which the full array of stakeholders, including regulatory bodies, partners, suppliers, and others, may act or not act, and how. The primary deliverable, then, is an evaluation of market forces and insight into the likelihood of or potential for future events, crafted to support specific business goals and executive decisions.

As a future-oriented discipline, CI necessarily works with a broader mix of art and science than does market research. To achieve such a forward-looking perspective, experts in CI make use of scenario planning, early warning system, win/loss analysis, business war gaming and so forth. The basis of CI techniques and the source of its value lies in the analysis undertaken to identify future-oriented events. CI analysis transforms today’s data points into insight about what is, in essence, the unknowable future.

Source: http://www.pharmexec.com/pairing

The evolution of Competitive Intelligence to Competitive Strategy

It is important to move beyond the realms of either/or and instead work towards recognizing the value of combined MR and CI efforts. It is only through these joint disciplines that one can address “the hypercompetitive nature of most industries”. Market Research may be a step, but competitive intelligence is the must step towards understanding the external environment to build a robust competitive strategy that withstands disruption, differentiates in the market and solidifies unique offerings that customers are willing to pay for.

Competitive Intelligence is a necessary extension of market research and serve as the critical element for informing decisions towards achieving a strategic goal and competing in your industry. To illustrate this, let’s consider the matrix below which highlights a few common business challenges that any leader in any industry is most likely to come across and how MR and CI help in solving those:

| MR – Current Focused | CI – Future Focused | |

| Failing Product | Identify issues with the product and current consumer perceptions compared to perceptions tracked over the years. | Assess the success of alternate products and unmet needs in the market, capture competitors’ go-to-market plans, identify external factors that impact this product’s market presence and stress test probable solutions to combat this challenge. |

| Stagnant Growth | Capture economic data over the years, evaluate current industry dynamics, log publicly available data about competitors. | Capture data on competitors, analyze the potential of emerging markets, identify partnerships or M&A prospects, develop contingencies and conduct a win/loss assessment for growth opportunities. |

| Obsolete Technology | Study current company operations and technology, collect all probable technology developments in the market and track how technology has evolved over years. | Interview industry experts for their opinions, discover what upgrades competitors have already employed or are scheduled to employ, benchmark best practices, understand technologies in the context of your business. |

| New Entrant/Disruptive Start-up | Research about the new company based upon publicly available information. | Prevent being blindsided by an irreversible market shift with early warning detection and monitoring. Develop and execute, counter-strategies and conduct gap-analysis for how you can do it better |

The Combination of Disciplines Creates Differentiating Strategies

For any of the four challenges described above, when a company combines its current-focused data with future-oriented intelligence, it is better positioned to effectively execute its market strategies and achieve its goals. Advancements in technology have increased the availability of data, which in turn makes it harder to process the vast information into actionable strategies. The upside—more opportunity for executives to develop a more refined corporate strategy, with more levers to pull and more ways to make a winning decision. Combine that with a competitive strategy that accounts for past trends, explores the current internal and external factors and plans by looking ahead, then you’ve found the recipe to compete in the disruptive market.

Tags: Competitive Intelligence, Competitive Strategy, Consumer Products & Retail, Emerging Markets, Energy, Financial Services, Growth Analysis, Healthcare & Life Sciences, Information Technology, Market Research, New Entrant Strategy, New Product Launch, Other Industries, Product Lifecycle Management