Private equity trends signal the market turned a corner in Q3 2024

Posted by | Nilesh Sharma

Nilesh Sharma, Senior VP at Fuld, shares his insights on recent shifts in the private equity landscape.

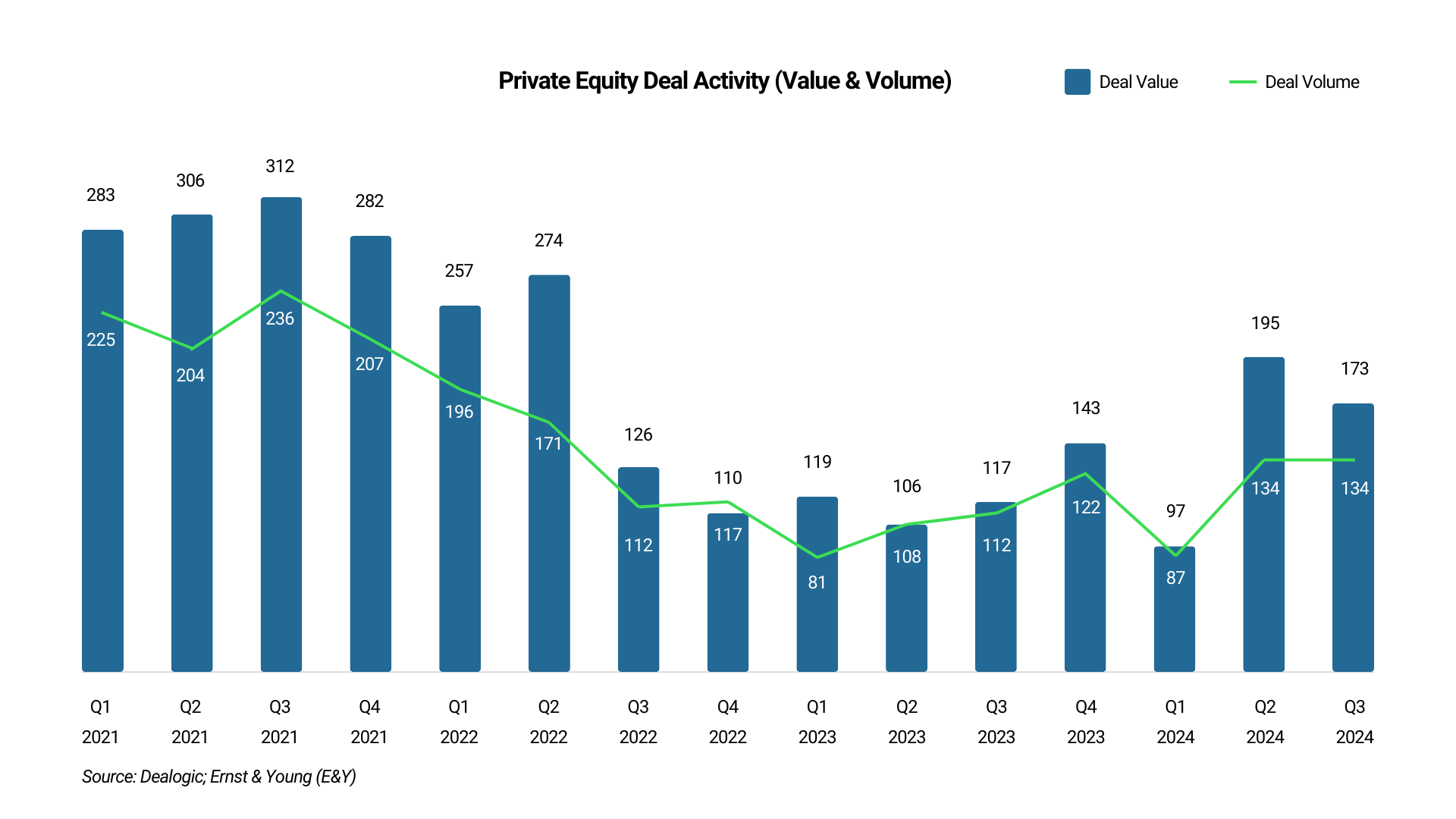

As deal activity marginally improved in Q3 2024, the global private equity trend finally seems to be turning the corner. The resurgence in deal activity was driven by a slightly better-than-expected 50 basis points reduction in benchmark interest rates by the US Federal Reserve, along with amended seller valuation expectations and heightened activity in the technology, healthcare, and financial services sectors, contributing to improved market sentiment.

The technology sector continues to dominate deal activity, accounting for 40% of the private equity deals in Q3 2024 – up from 31% in Q1. Within the sector, artificial intelligence (AI) and data infrastructure have attracted significant investor interest. Crunchbase report that venture investments in AI and AI related companies reached US$38 billion in H1 2024, compared to a total of US$53 billion in 2023. As firms continue to invest in AI adoption, particularly in Generative AI applications, demand will only increase, likely driving further private investment in this space.

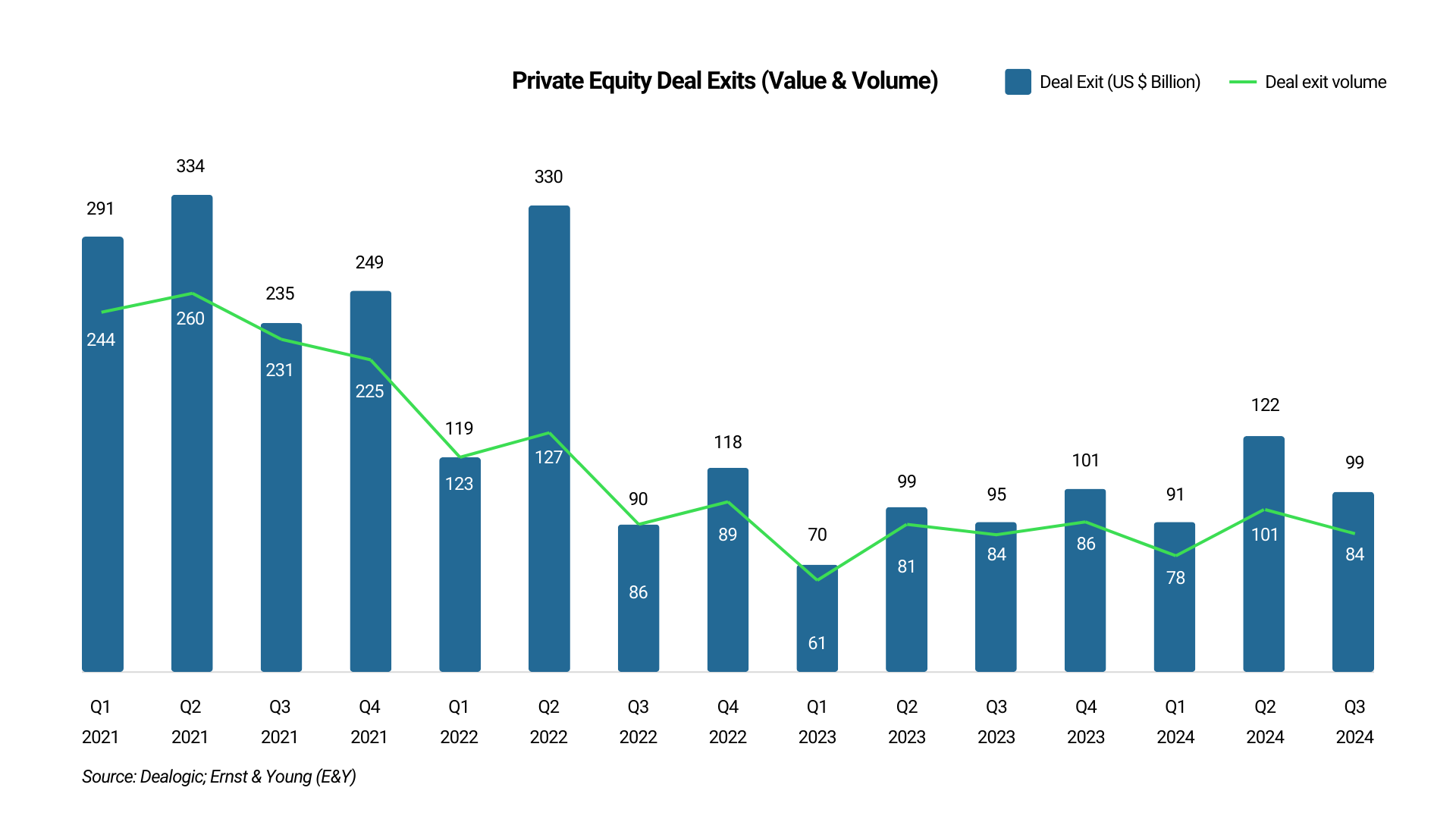

Private equity exits though have yet to experience the same level of recovery as financing or investments. In many developed markets across Europe and North America, private equity firms’ holding periods have exceeded typical norms – in the UK, nearly half of PE firms have held certain portfolio investments for over five years. The situation is similar in the US with many firms expressing frustration over limited exit opportunities through either private or public channels. As a result, limited partners (LPs) are exerting pressure on the management teams to deliver successful exits.

According to Dealogic, the total global value of private equity exits reached just below US$100 billion in Q3 20241, a slight increase from US$95 billion in the same quarter last year. This slow rebound is largely due to strategic buyers’ reluctance to participate fully, with corporate acquisition values either stagnating or declining in recent quarters. Public market exits have also been subdued, constrained by high interest rates and inflationary pressures. Concerns over valuations further contributed to many strategic acquirers preferring to remain on the sidelines. By the end of Q3 2024, only 26 private equity-backed companies had launched an initial public offering (IPO), compared to 30 in all of 2023.

In response to limited exit opportunities, we have seen many private equity firms shifting focus toward growing their portfolio companies by deploying additional financing and offering operational and strategic expertise. Operating partners at many PE firms are also helping portfolio companies streamline and manage their supply chain and logistics better, build digital capabilities and platforms to capitalize on emerging growth opportunities, and maintain financing for any add-on opportunities. These factors continue contribute to building a compelling growth story positioning the company for an exit at the right time.

The market outlook for private deal activity seems to be improving, supported by a more favorable macro-economic environment and improving financing market conditions. Both traditional lenders and other private capital providers including private credit firms are competing for deals, even at slightly higher risk levels. Market participants also anticipate the US Federal Reserve will maintain its monetary easing stance in the coming months, adding further momentum and improving investor confidence. As a result, we expect private equity trend of deal activity to close out 2024 on a high note, and we remain upbeat about 2025 activity.

Read more:

Fuld’s Financial, Equity, and M&A Research services

The rise and rise of private credit

The AI revolution: Transforming private investments

Decoding the Role of AI in Private Equity Deals

Tags: Financial Equity and M&A Research, Financial Services, Investment Banking, Market Analysis, private equity