How Cognitive Bias Can be a Bigger Threat than the Competition

Posted by | Fuld & Company

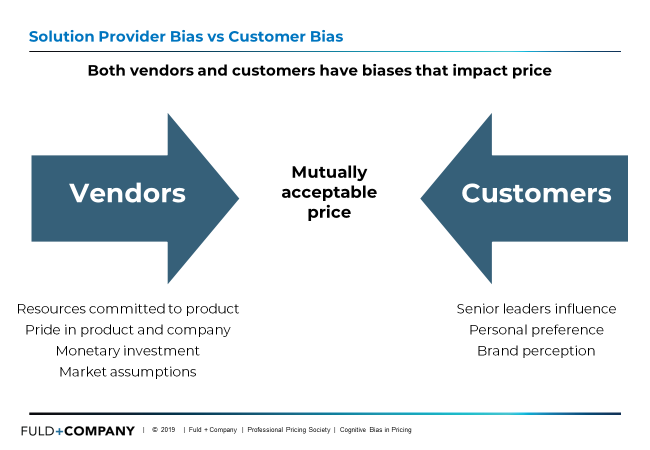

Cognitive bias, by definition, is a mistake in reasoning, evaluating, or remembering that occurs as a result of holding onto one’s own preferences and beliefs regardless of receiving contrary information. For many, cognitive bias occurs subconsciously every day and inevitably influences the decision-making process which can lead to undesirable or unintended business outcomes. While cognitive biases may be indirectly expressed socially, it’s something that can be troublesome in the business world, particularly when it comes to developing new products and their respective go-to market strategies. From pricing to product, to marketing and management professionals, it is imperative for all business to recognize that both sellers and buyers have unique cognitive biases that directly impact a company’s ability to make decisions and execute effective strategies. To fully understand both stakeholders’ viewpoints, here is an overview of the most common seller and buyer biases.

Sellers’ cognitive biases are typically rooted in awareness of company dynamics/politics, and emotional attachment, such as:

- Acknowledging the existing commitment to develop the product or service, and the resources allocated to a successful delivery;

- Engaging only senior leaderships’ years of industry experience about the potential market opportunity leading to flawed market assumptions and potential blind spots;

- Feeling so much pride in their company or product that they have a misguided perception of the true value of the company’s products and services

Unlike sellers, buyers’ cognitive biases are driven more by brand perceptions and personal experience, such as:

- Pre-conceived perceptions about available products and brands in the marketplace (e.g., low cost vs. premium-priced, in-house resources vs. outsourcing functions) can lead to flawed assumptions about sellers’ capabilities and attention to customer experience;

- Direct personal experiences with brands inevitably influence their current purchasing decisions (when they’ve used them before and have familiarity);

- Senior decision-makers from buying company personal preferences; buyers are affected by leadership’s years of experience working with various brands, their professional relationships, and network. All of which influence purchasing decisions

How Cognitive Biases Can Affect Pricing Strategy

Because of these existing thoughts and experiences, strategic pricing professionals must defend their pricing strategies against both seller and buyer cognitive biases. The best defense starts with being aware of the biases and is supported by actively engaging in revenue management and pricing throughout the entire product lifecycle (beginning with design and development), and having a thorough understanding of the external environment and ecosystem (e.g., competitors, buyers, partners, suppliers, etc.).

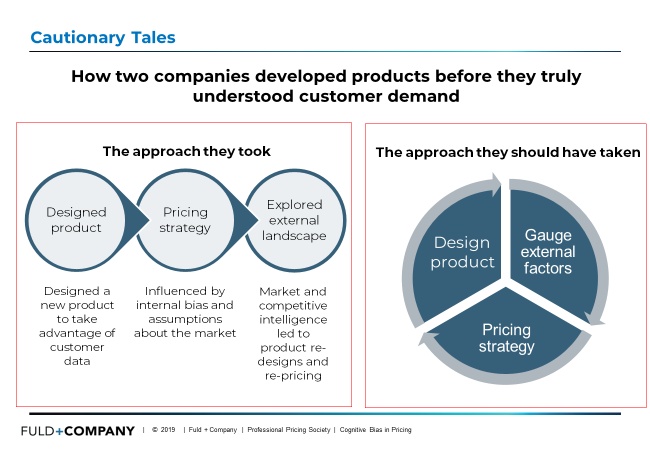

Taking a linear approach to product development ensures that revenue management and pricing isn’t engaged until after a product has already been developed—doing so is a flawed approach. Instead, revenue management, pricing, and external factors should inform product design and actively influence the entire development phase and beyond.

A Cautionary Tale—What Happens When Biases Get in the Way

Fuld & Company experienced this type of backward product and pricing approach with one supply chain management client with more than $400M in annual revenue and more than 2,000 employees nationwide, had developed a highly sophisticated workflow tool, featuring many bells and whistles designed to improve customers’ procurement processes. After the tool was developed and in beta testing, the client engaged us to explore competitors’ tools and identify the buyers’ perspective on the workflow tools currently available. The client intended to use the research findings and analysis to inform their value proposition, sales messaging and pricing strategy to launch their new tool.

However, as the research progressed, the client was increasingly surprised to learn that competitors offered procurement tools that were more streamlined, intuitive and easier to use than the tool they designed. The client was further surprised at the frustration buyers expressed with the overly complex tools available and admitted to only using the most basic features; the buyers also revealed that the bells and whistles are not required nor desired. After discovering these perspectives from the external environment through in-depth interviews with competitors and buyers, the client decided to re-visit the tool design, which required additional resources and led to a delayed launch.

This is a good example of a pricing and product development approach as the client designed a tool influenced by senior leaders’ beliefs that procurement workflow tool users are technically savvy and demand robust features and functionality. These assumptions were disproven, and it was a tough lesson for the company to learn. The client ultimately decided to offer customers two versions of the tool, with the intention that they would start with the basic version and eventually upgrade to the premium, (i.e. higher cost) version.

Does Cognitive Bias Influence Your Product & Pricing Strategies?

Identifying the extent to which cognitive bias impacts product development and pricing, and avoiding the undesirable scenario described above, requires revenue management and pricing professionals to ask uncomfortable questions like:

- When should revenue management be engaged to consult on pricing?

Revenue management should be engaged from the very beginning and actively inform product design and development.

- Do we take a proactive or reactive approach to pricing strategy?

Staying informed of market trends, buyer preferences and competitors’ intentions ensures pricing professionals can anticipate disruptive market activity and adjust their pricing strategy accordingly; adjusting pricing strategy after the market is disrupted should be avoided.

- Do we have insight into—and– understand the problem our product or service solves for buyers?

Product pricing vs. solution pricing require different approaches, and unless a company is willing to risk its product being viewed as a commodity, solution pricing is the best approach. However, obtaining and maintaining this perspective requires vigilant objective, unbiased exploration and monitoring of the external environment and ecosystem.

- Are we more focused on competitors’ prices rather than the value our product or service brings to customers?

Pricing to meet a competitor’s results is a flawed strategy and could potentially lead to pricing wars and ultimately commoditization. Understanding competitors’ approach to pricing is important when developing a pricing strategy, but the primary driver for pricing should be the value derived from solving customers problems.

- Do we lower prices or offer discounts in order to win new business even though it may not lead to long-term customer loyalty?

Taking this approach devalues the product or service and doesn’t lead to a viable long-term pricing strategy. Therefore, it should be avoided.

Recommended Practices for a Better Pricing Strategy

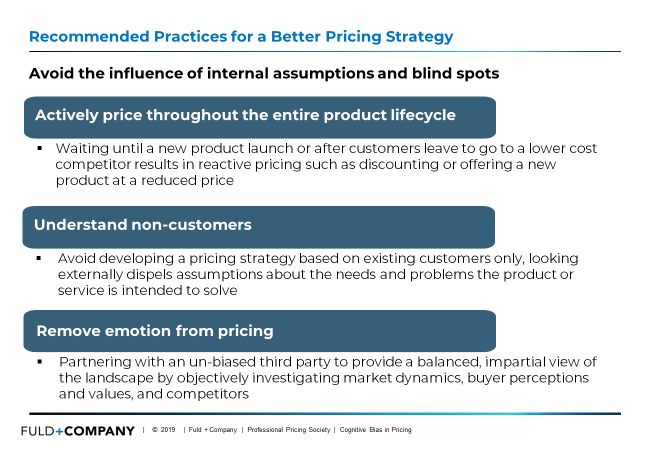

Despite the fact that cognitive bias is real and is a threat to even a well-developed pricing strategy, there are still practices that can be put in place to improve the decision-making process and minimize negative implications like:

- Actively price throughout the entire product lifecycle, because setting a pricing strategy is not a one and done exercise.

Active pricing throughout the lifecycle also avoids ill-advised reactive pricing practices such as discounting or reducing prices when customers leave to go to a lower cost competitor.

- Vigilantly monitor buyers’ rationale and motives for not purchasing the company’s product or service, which is just as valuable as the views and feedback from the current customer base.

Limiting buyer perspectives to current customers is an insular approach and should be avoided. Gauging and measuring non-customers’ perspective is an important part of monitoring the ecosystem and their perspective should also inform the product lifecycle and pricing strategy.

- Partner with an objective, un-biased third party to investigate and monitor the external environment and ecosystem.

The data provided by a third-party will reflect a balanced, impartial, evidence-based view of the entire landscape that cannot be obtained through internal resources.

Conclusion

Interestingly, we have seen three distinct reactions to this guidance. First, there were many who agreed with the insights, had encountered cognitive bias within their organization, and had first-hand experience with the implications it had on their company’s pricing strategy.

Second, there was a group who needed time to digest how cognitive bias could be impacting their organization and pricing strategy. We’re assuming the impact of cognitive bias was just not something they had really considered before.

Finally, there were sthose who simply did not agree either with our premise on the negative impact of cognitive bias or on our suggested approach to developing a pricing model to avoid the potential for cognitive bias. We would simply suggest that the folks in this group check themselves and make sure they and their companies are not falling victim to cognitive bias.

In our work at Fuld & Company, there are any number of times when the results of our research and analysis really stress tests and contradicts a client’s internal beliefs and assumptions. Fortunately, more often than not, our objective, unbiased, evidence-based conclusions are welcomed. When companies resist considering evidence that contradicts their existing beliefs, they put themselves at risk. In our view, the risk imposed by cognitive bias is potentially more formidable than that imposed by any competitor.

Tags: Competitive Intelligence, Competitive Strategy, Events, Other Industries, Pricing Strategy