The “Amazon Effect” – Pharmacies, Healthcare, and Disruption

Posted by | Michael Ratcliffe

CVS, Walgreens, and Walmart control over 20,000 bricks & mortar stores, or some 40% of all U.S. retail pharmacies. But Amazon has sent shock waves through these incumbents’ corporate offices with its recent move into the healthcare market via PillPack, Amazon Pharmacy and Amazon Care. Suddenly, the old guard are faced with the “Amazon Effect” – a highly disruptive, user-friendly virtual care model that bundles telehealth, big data, and free and fast mail order delivery directly to patient homes with, if necessary, home visits by a physician or nurse. Lack of competition can lead to lack of innovation, which Amazon is, yet again, taking advantage of, this time bringing a one-stop-shop to the pharmacy and healthcare markets.

As if this was not enough, the internet has simplified the ability of entrepreneurs to target specific segments of the healthcare market. These VC-backed startups also offer telehealth and mail order delivery services, with a focus on markets like male- or female-specific lifestyle issues, behavioral health, substance abuse, mental issues, and nutrition. Adoption of virtual world and home delivery had begun, albeit slowly, in the years leading up to COVID. But the voluntary shutdown of global economies has forced an accelerated adoption of these trends, presenting solid opportunities for these disruptors to gain traction as consumers become accustomed to the benefits of managing and receiving their healthcare online.

These new disruptive forces have resulted in a new, omni-channel model for primary care driven by consumer preferences rather than the entrenched players’ business models. An initial consultation with a doctor or nurse can now be done virtually or in-person, while medications can be filled in vials or pouches, and be acquired via in-store purchase, curb-side pick-up, or delivery service.

Forces Playing Out in the New Omni-Channel Retail Pharmacy Market

All of the big pharmacy chains have been testing out expanded care models with in-store health clinics for well over a decade in an attempt to supply services beyond simply drug sales. The problem was that previous attempts had very mixed results, often resulting in scaled back efforts limited to areas of the country with high levels of uninsured and limited use of family doctors. The exception was CVS, which built out a network of 1,100 nurse-managed Minute Clinics.

All of the big pharmacy chains have been testing out expanded care models with in-store health clinics for well over a decade in an attempt to supply services beyond simply drug sales. The problem was that previous attempts had very mixed results, often resulting in scaled back efforts limited to areas of the country with high levels of uninsured and limited use of family doctors. The exception was CVS, which built out a network of 1,100 nurse-managed Minute Clinics.

It just so happens that as Amazon appeared on the scene, the big pharmacy chains were already considering moves into more ambitious in-store clinic models that looked more like urgent care clinics than travel vaccine centers. These would compete directly with family doctor practices and existing urgent care clinics. Overnight, Amazon was vying to become the face of the big pharmacy chains, not just in the fulfillment of prescriptions with PillPack and Amazon Pharmacy, but also with their plans for health clinics with Amazon Care.

CVS has laid out plans to upgrade its Minute Clinics to nurse- or physician assistant-managed HealthHUBs by the end of 2021. These will be able to provide care for many common conditions like throat and ear infections, high blood pressure, high cholesterol, sleep apnea, diabetes and depression.

Walgreens has closed most of its 400 Take Care in-store clinics to replace them with a VillageMD partnership, and plans to build between 500 and 700 physician-managed clinics within their pharmacies over the next 5 years. These will offer comprehensive primary care across a broad range of physician services and will look more like traditional family care clinics, taking up a significant proportion of the footprint of each Walgreens store.

New Retail Pharmacy Clinic Strategies

Walmart had been planning for an even more ambitious move into healthcare. It has announced plans to install 4,000 primary care “supercenters” in its stores by 2029. These will include primary care, laboratory testing services, X-rays, and dental, eye, and ear care, as well as health insurance. Rather than using healthcare to drive business into stores, Walmart says it wants to become a healthcare player in its own right.

Taken together, these are radical departures from the traditional retail pharmacy model. They also potentially offer a competitive defense against Amazon allowing the chains to own patients, but will they be successful?

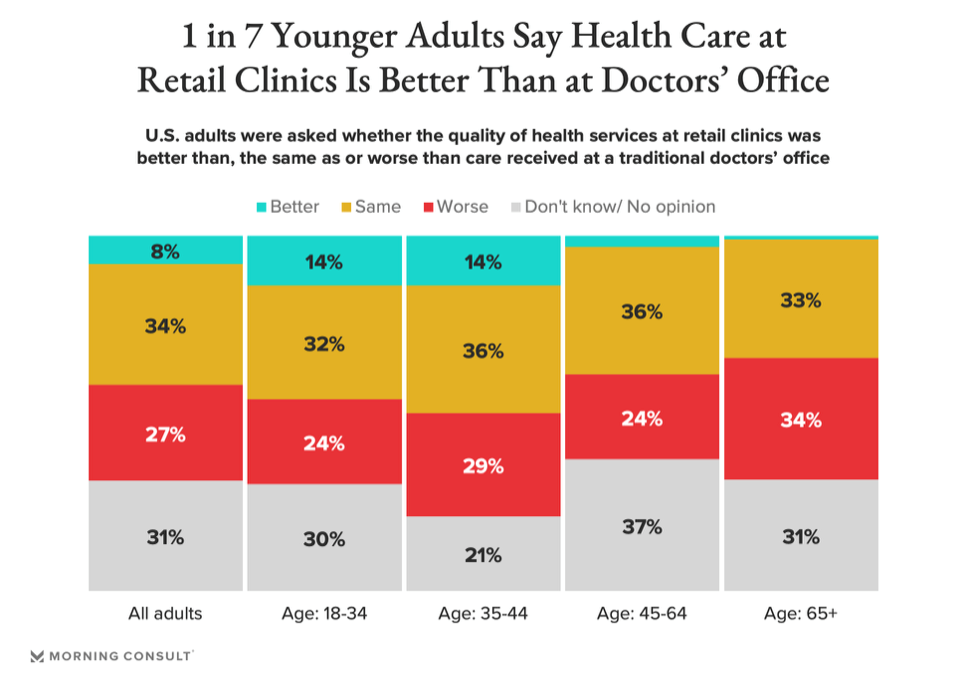

A May 2021 survey by Morning Consult of 2,200 US adults resulted only in 8% of all respondents stating that they thought retail clinics are better than family doctors’ offices. This implies that it may not be easy for traditional retail pharmacies to persuade large numbers of patients to switch to their clinics for one-off primary care. Perhaps this is why Walmart is looking to become a primary healthcare provider, rather than a manager of clinics that might be used in case of emergency.

While the outcome remains highly uncertain, what we can say is that new and existing players are preparing to radically change in the general health care market. On one side, the new-age disrupters, led by Amazon, are touting a virtual model supported by home visits and free, fast home delivery. On the other hand, the old guard pharmacies are looking to offer new and improved healthcare through their brick & mortar facilities. In the middle sit the established family practices, which are either independently operated clinics or owned by hospitals and large integrated delivery networks like Kaiser Permanente. It is far from clear who will win. If we look at other markets that have been, or still are, being impacted by the same types of new-age forces, the outcome is often a mix of all models, with individual players winning dominance in specific niche segments of the market.

The important point to realize is that we are only at the start of the battle with the ultimate winners and losers proving difficult to identify. This means that all the players, whether new-age or old guard, need to closely monitor the moves of the other players, set up highly flexible competitive strategies that can account for various potential outcomes, and be prepared to adjust their plans in real time to ensure they come out on top, even if in just niche segments of the market.

How Fuld & Company works with our clients

We help our clients navigate through disruption and create robust and concrete strategies to compete in highly dynamic business environments. Applying competitive intelligence, we can identify the risks and opportunities our clients face, to help them objectively understand their market and take appropriate action to thwart those risks and capture those new opportunities.

More about the author:

Michael Ratcliffe, Senior Director at Fuld

Michael leads Fuld’s Health & Life Sciences practice, bringing more than three decades of experience in strategy and competitive intelligence, underpinned with a deep understanding of the forces driving change. He helps our clients better understand their competitive environments whether in major hospital systems, specialized clinic markets, or retail and specialty pharmacies, for pharmaceutical and biotechnology products, diagnostics, delivery devices, pharmaceutical and biologic manufacturing, disease management, electronic medical record systems and health insurance markets.

Michael leads Fuld’s Health & Life Sciences practice, bringing more than three decades of experience in strategy and competitive intelligence, underpinned with a deep understanding of the forces driving change. He helps our clients better understand their competitive environments whether in major hospital systems, specialized clinic markets, or retail and specialty pharmacies, for pharmaceutical and biotechnology products, diagnostics, delivery devices, pharmaceutical and biologic manufacturing, disease management, electronic medical record systems and health insurance markets.

His creative consulting approach includes a combination of qualitative and quantitative real-world research skills to help clients understand issues around competitive strategy. He has worked for a number of leading strategic consulting firms including McKinsey & Co, DRI-McGraw Hill, Stanford Research Institute Consulting and Wood Mackenzie.

Tags: BioPharma, Competitive Insights, Competitive Intelligence, Competitive Strategy, Consumer Products & Retail, Disruption, Healthcare & Life Sciences