Reverse Timeline Analysis: The Future after Boeing Buys GE Aviation (Part 2)

Posted by |

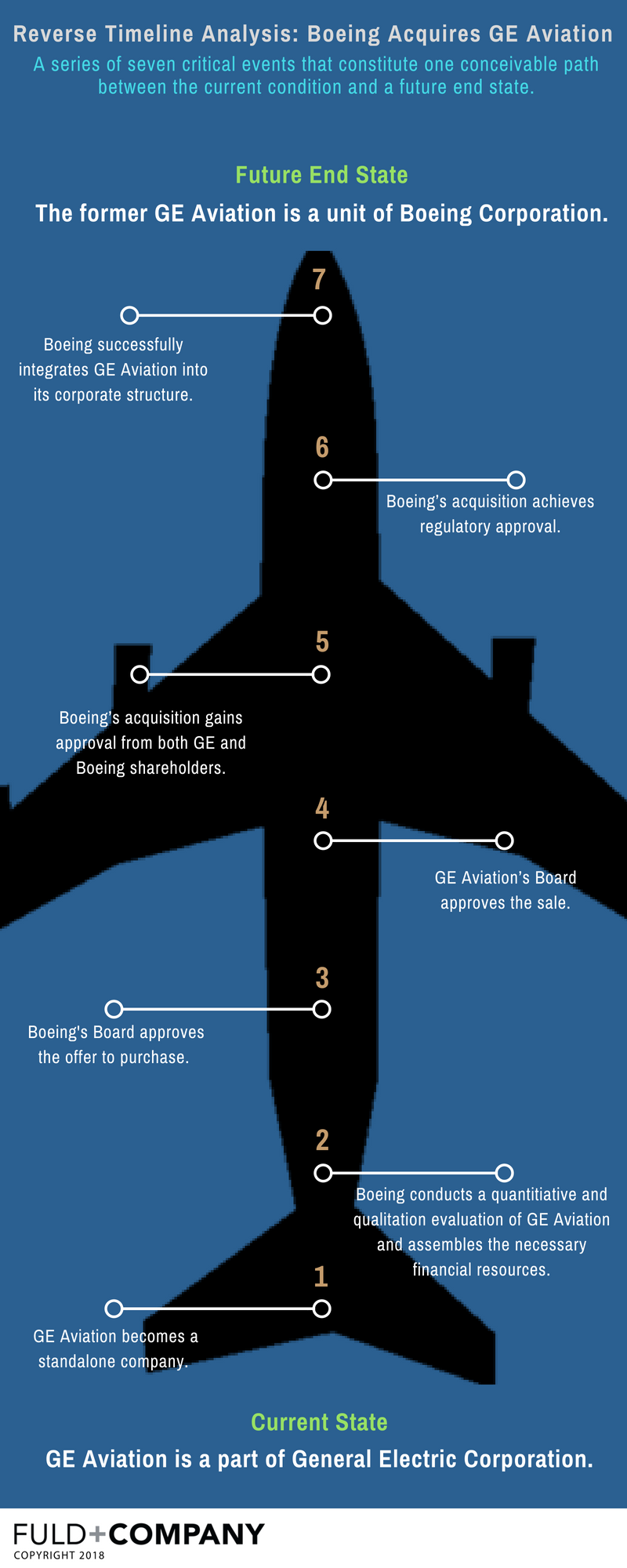

Assuming that Boeing purchases General Electric Aviation, industry stakeholders are asking what will that look like? How will this disrupt the marketplace? This presents an opportunity for us to demonstrate a valuable but underappreciated structural analytical Framework (SAF), Reverse timeline analysis, in combination with our Indications & Warning mechanism.

A reverse timeline analysis begins with an end-state of interest (usually generated through a formal scenario planning process) – in this case, the acquisition of GE Aviation by the Boeing Company – and works backward to the present day using a series of critical events to connect the two. By working backwards, we tie ourselves to a known point in the future and a known point in the present, leaving our judgement and expertise to envision the path between Points A and B. Because there are infinite paths from the current condition to our end-state of interest, we’ll need to generate enough timelines to cover the most likely eventualities depending on the complexity of the issue, level of understanding, and ability to monitor the landscape. Once we build a viable narrative timeline, we look at the critical events connecting the present to the future. These critical events have a footprint of visible indicators or signposts that we can monitor. Let’s look at a sample timeline connecting the present day to Boeing’s acquisition of GE Aviation.

Working Backwards on the Hypothetical Boeing Acquisition of GE Aviation

Critical Events: Future End-State of Interest: The former GE Aviation is a unit of Boeing Corporation.

- Boeing successfully integrates GE Aviation into its corporate structure either as an operating unit or

- wholly-owned subsidiary.

- Boeing’s acquisition achieves regulatory approval.

- Boeing’s acquisition gains approva

- l from both GE and Boeing shareholders.

- GE Aviation’s Board of Directors approves the sale.

- Boeing’s Board of Directors approves the offer to purchase.

- Boeing conducts a quantitative and qualitative evaluation of GE Aviation and assembles the necessary financial resources.

- GE Aviation becomes a standalone company.

Current Condition: GE Aviation is a part of General Electric Corporation.

Example Application of Event Analysis

In our first pass, we’ve identified a series of seven critical events which constitute one conceivable path between the current condition and our future end-state of interest. Keeping in mind the hypothetical nature of this exercise, we identified key elements for the first critical event.

- GE Aviation becomes a standalone company:

- GE continues to experience poor financial results.

- GE’s upper management selects a sale or outright breakup as a course of action.

- GE’s Board of Directors and shareholders consent to a sale or breakup.

Thus, we see some of the key elements necessary for GE Aviation to become a standalone company. Further segmenting these key elements, we can identify some outward indications for effective monitoring, let’s assume that GE’s financial results continue to disappoint and the upper management sees no other path forward than a corporate breakup. Here are three possible outward indicators or signposts:

- Signs of GE’s Board of Directors and shareholders consenting to a corporate breakup:

- GE positions new additions to the Board of Directors who are likely to support a breakup.

- Key opinion leaders on Wall Street give a positive assessment of a corporate breakup.

- Activist shareholders publicly advocate or promise to not block a breakup bid.

Early Warning Monitoring

These signposts can now be integrated into a monitoring effort. As we see, an increasing number of these and other signposts fall into place, we can begin to plan a strategic response or (preferably) begin implementing a previously-generated contingency plan.

Bear in mind, this example is a minor component of what would be a comprehensive monitoring effort encompassing a number of drivers across the market landscape. Fuld & Company regularly works with companies across a wide range of industries to implement scenario planning, strategy development, and early warning solutions.

While Boeing’s acquisition of GE Aviation remains a remote possibility (GE Aviation is one of GE’s best performing business units), the potential impacts on the commercial aircraft industry make it a fascinating and worthwhile analytic exercise. Early warning techniques can position organizations to effectively recognize and respond to such low probability-high impact.

Tags: Aerospace & Defense, Competitive Strategy, Disruption, Early Warning & Monitoring, Mergers & Acquisition, Other Industries