Rethinking China: A Key Assumptions Check

Posted by | Fuld & Company

CKGSB’s 5th Economic Symposium

Last month, I had the opportunity to attend the 5th China Economic Symposium, hosted by the Institute of Directors in London (of which Fuld & Company is a member) and the Cheung Kong Graduate School of Business (CKGSB). The conference theme was “What’s Next for the Golden Era of UK – China Relations?” The event provided a window into not only the strong political and economic relationship between London and Beijing, but also served as an opportunity for European companies to perhaps revisit deep-seated assumptions about China and its role in the global economy. With that in mind, I offer three perceptions commonly held about China that, upon reflecting on some of the themes from the conference, may need reexamination.

1. China is not a responsible trading or investment partner.

This is certainly the message coming from Washington these days as the United States threatens significant tariffs on Chinese imports. However, while the bilateral U.S. – China trade relationship is on rocky ground, China clearly sees an opportunity to organize global trade and investment blocs to its advantage. Several speakers, including CKGSB professor Xiang Bing, addressed China’s plans for becoming a much more influential player in global trade. Professor Xiang mentioned the creation of a Confucian Economic Sphere consisting of Greater China (commonly defined as mainland China, Hong Kong, and Taiwan), Japan, South Korea, Singapore, and Vietnam. These territories comprise 23% of the world’s population and represented $19 trillion in GDP in 2016 – an amount larger than the combined GDP of the United States and the European Union. He also noted that China would “take responsibility” for this trading bloc, which is no doubt enabled by the U.S. decision to withdraw from the Trans Pacific Partnership.

China is the driving force behind one of the most ambitious global infrastructure initiatives ever.

The awkwardly named Belt and Road Initiative, a development campaign through which Beijing is aiming to boost trade and stimulate economic growth across Asia and beyond, aims to build massive amounts of infrastructure connecting China to countries around the world. Ratings agency Fitch, calculates that some $900 billion worth of projects were planned or underway as of last year. The initiative includes plans for pipelines and a port in Pakistan, bridges in Bangladesh, and railways to and from Russia, all with the objective of creating a “modern Silk Road” trading route that China believes will catalyze a “new era of globalization.”

The Impact

According to global consultancy McKinsey, the plan could overshadow the US’s post-war Marshall reconstruction plan, and European countries are taking note. Douglas Flint, the U.K. Special Envoy for the Belt and Road Initiative, said at the conference that there are opportunities for the U.K. beyond just the investments China is making in building infrastructure and his office is working to position the U.K. as a source of capital, as well as a connector bringing investment partners together.

2. Chinese companies copy and steal intellectual property and do not innovate.

China is likely to take the lead in global R&D spending within the next five to ten years.

Participants in a CEO panel during the conference spoke about the relaxation in obstacles and challenges associated with doing business in China, including fears of intellectual property loss and a lack of innovation. The CEO of Jaguar-Land Rover, Ralf Speth, said that his company has made a 15-billion renminbi (£1.7 billion) investment in constructing a manufacturing plant in China with its Chinese automotive partner Cherry. Few CEOs would make that kind of investment if they were worried about losing intellectual property.

Chinese companies are investing heavily in research and development, making China increasingly a source of innovation and disruption.

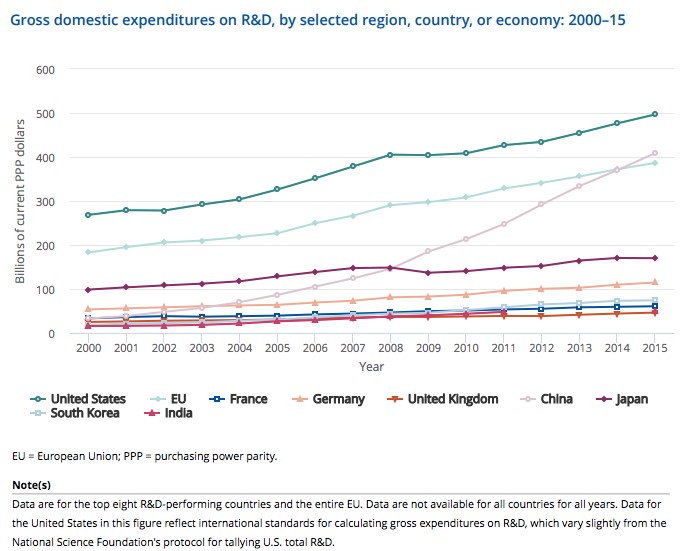

Data from the U.S. National Science Foundation, as reported by the World Economic Forum, show that China has become the world’s second-largest spender on research and development after the United States, accounting for 21 percent of total global R & D spending of nearly $2 trillion in 2015.

3. China’s burdensome regulations, and the burden imposed by propping up its state-owned enterprises (SOEs), are a perpetual drag on the economy.

While any expectation that China will become a low-regulation liberal economy within the next five years is foolish, Beijing is aware of the constraints to its growth that are caused by the severe inefficiencies its economy faces. CKGSB Economics Professor Xu Chenggan admitted that Chinese SOEs would go bankrupt without state support – with devastating consequences for both the Chinese economy and social stability – but that China was working hard to “deleverage” SOEs. Professor Xu admitted that Beijing’s efforts to date have been insufficient, and that SOEs continue to constitute a drag on the economy. However, several business executives during an afternoon panel discussion advised conference attendees to put aside their impressions of perpetual inefficiencies in the Chinese economy, noting that the regulatory atmosphere has changed considerably.

Undoubtedly, foreign companies doing business in China continue to face challenges in initiating, maintaining, and scaling operations there, particularly in the areas of securing reliable domestic funding, human resources, partner identification, due diligence, relationship-building, and culture and communications. But, Professor Xiang offered words of encouragement, noting that China is accelerating its pace of opening up and loosening regulations. Ambassador Liu reinforced this message, claiming that China is resolved to trade promotion and liberalization—a step in the right direction for global trade.

Overall, the perspectives shared at this symposium not only provided insights into UK-Chinese relations and the global operating environment but served as a reminder of the importance objectivity and elimination of bias. China is far from a democratic society with a liberal market economy but what once was a reality is not true today. Checking your long-standing assumptions about any object of inquiry be it competitor, customer, trading partner, supplier, or foreign actor could provide a clearer view of how to perhaps take advantage of the emerging opportunities that come with change.

Tags: China, Competitive Intelligence, Competitive Strategy, Conference, Emerging Markets, United Kingdom (UK)