The 3 Pillars of Sales Acceleration & How They Help You Win

Posted by |

Sales acceleration is a form of competitive intelligence (CI) in the sales enablement ecosystem. An effective accelerated sales strategy arms your business with timely data and insights that ramp up the velocity and relevance of sales conversations. With the right up-front research, your product positioning will be calibrated with market demand, your sales cycle will get more efficient, your pipeline will speed up, and your reps will gain the strategic clarity and tools to help them win.

The sales acceleration umbrella encompasses numerous potential initiatives, but by and large they can be broken up into three major areas:

- Pre-Sale

- Active Selling

- Post-Sale

Let’s take a closer look at the top priorities and representative strategies in each area. Together, these sales acceleration efforts will deliver 360° competitive sales intelligence across the full sales cycle.

Pre-Sale

How well do you know your customer or prospect? Are you well-positioned, even before assessing the competition? Pre-sale research is a key building block to accelerate sales success.

Advance sales intelligence about the buyer helps your sales team to develop an effective, detailed plan of attack even before active selling starts. This is a time for in-depth persona evaluation, prospect and buyer profiling, or even profiles of your competitors.

Perhaps you’re kicking off the early stages of an RFP process, or need to complete benchmark profiles of your best opportunities. If you work in the B2B space, there may be half a dozen companies you believe you should be doing business with. Pre-sale research can uncover answers to critical questions such as:

- What are their buying triggers?

- What are their requirements?

- How do they view the value of the particular offering you want to sell (considering their budget and investment strategy)?

Bid support strategies can begin even pre-RFP. You’d start by speaking with key buyer stakeholders to understand their likes and dislikes about their current provider, who the decision-makers will be, and what they’re looking for in a contract. DISC style personality profiles are a useful method for profiling key influencers in the buying process to help salespeople get “inside the heads” of decision-makers.

Active Selling

At this point, you’ve engaged the client and the sales team needs targeted insights to lead effective sales conversations, control the narrative, and win deals. Competitor analysis can provide clear intelligence about your competition and market dynamics to inform your talking points. Arming your sales, product and marketing teams with the most current and relevant content is a must. You will want answers to questions like:

- Who are the other companies likely to be bidding in this area?

- Who are their buyers?

- What is their value proposition, and how does ours compare?

- How do their salespeople sell?

- What do competitors say about their competition (i.e. you)?

Detailed competitor profiling research, perhaps on your top 2 or 3 competitors, will help your business understand how you stack up so you can approach active conversations from a position of strength. The research leads directly to battlecard creation—probably the most recognizable strategic asset for active selling, and a highly effective sales enablement tool when maintained and distributed regularly.

Battlecards are cheat sheets that you’ll want to limit to 1-2 pages, likely in an infographic style that highlights important comparables. Showcase top competitors, by product area, and use diagrams with checkboxes, pros and cons, and color-coding to position your value proposition. Battlecards can also include compelling media announcements, notable clients won, competitor statements, and other material to help the salespeople negotiate with a customer and counter what they’re hearing about your competitors.

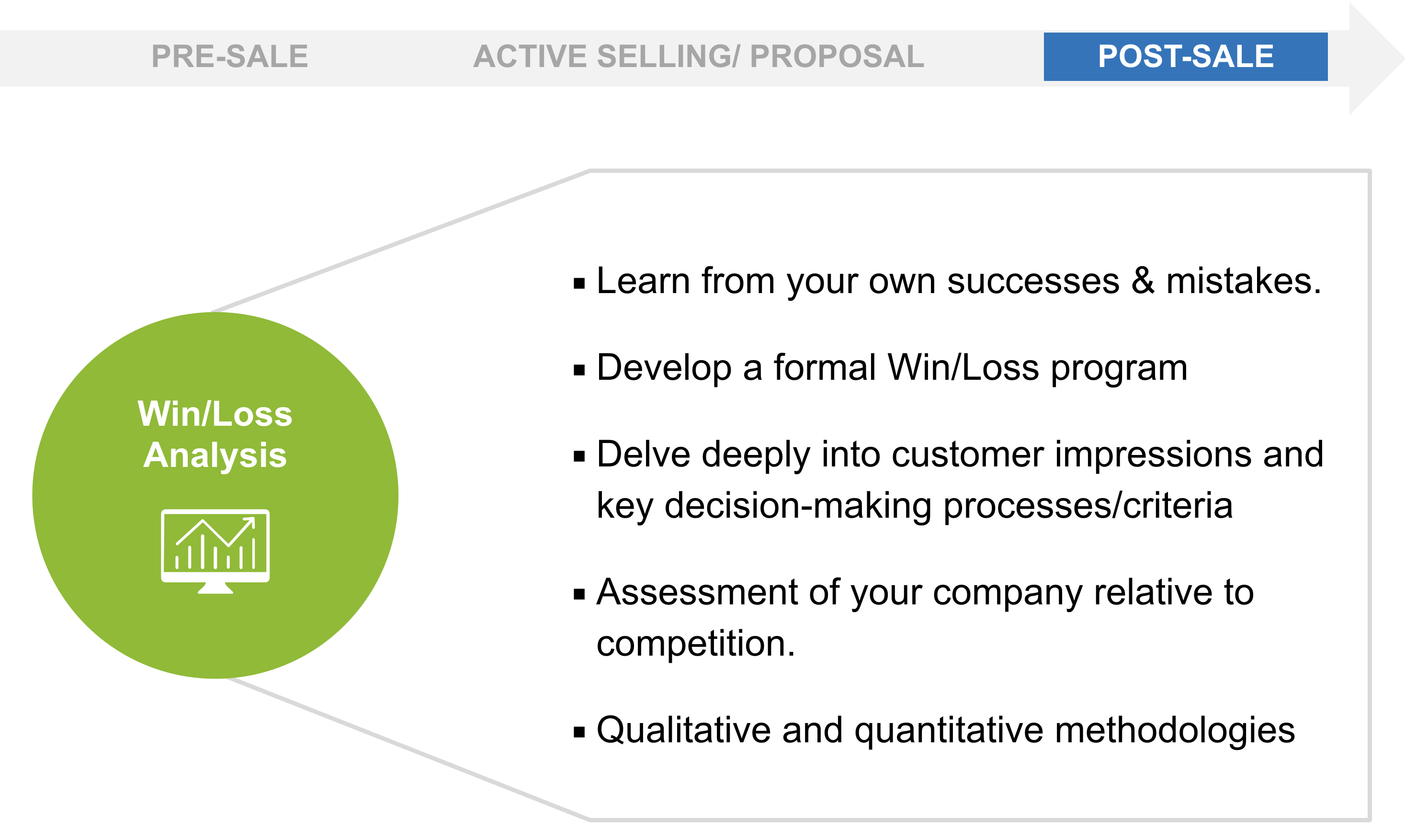

Post-Sale

Reflecting on deals won/lost is a key component of sales acceleration. It’s necessary to both quantitatively and qualitatively evaluate your sales conversion rates on deals, how you’re winning or losing those deals, and the criteria you’re using to assess these trends.

A business with strong CRM information is well-positioned to succeed in this. An analysis of rich sales diagnostics and reliable process inputs from salespeople will reveal answers to questions like:

- How many deals made it to each stage (pre-qualified to qualified to proposal to closed won/closed lost)?

- Why did certain deals take longer than they should have?

- Which industries did we sell more of and when? Which industries did we lose?

- Which products or offerings sold? Which ones didn’t sell?

- Who are we winning against, or losing to, more often?

This process of analyzing what went right or wrong will inform all future sales efforts, guide the creation of new sales enablement resources, and improve your win rate. Successful companies use their data to drive strategy and make informed decisions. Conducting win/loss analysis can uncover insights that will pay dividends, and can be tied to revenue growth when implemented as a standard practice.

Sales Accelerator: Strategic Takeaways

If you are responsible for product management or product marketing, or you’re in a sales leadership role, these are all things that matter to you and your teams. Starting, and maintaining, a sales accelerator program will enable your salespeople, marketers, and product managers to keep ahead of change and be more competitive. This, in turn, will lead to improved sales performance and—most importantly—visibility to leadership that sales intelligence and accelerator programs are essential to the business and worth your investment.

Looking for more insights and advice on how to boost your sales and marketing efforts? Fuld & Company can show you more about how we’ve succeeded with sales acceleration in the past and what we’ve accomplished for other clients. Contact our team today and let’s get started.

Tags: Competitive Insights, Competitive Intelligence, sales acceleration, sales enablement, sales intelligence, Strategic Planning