Why MedTech is Moving Towards Rapid Innovation: Exploring the FDA’S 510 (k) Change

Posted by | Fuld & Company

As the FDA modernizes processes, medical device manufacturers in the MedTech sector must capitalize by developing cutting-edge, well-differentiated products.

The medical device industry does not maintain a reputation for embracing earth-shattering innovation nor implementing improvements quickly because it’s highly regulated and risk-averse. That said, it’s time MedTech companies focus on promoting innovation, pushing boundaries for positive patient outcomes and move away from incremental improvements on products. The good news is the aforementioned are achievable, as the FDA’s proposed updates to the 510(k) clearance will force companies to prioritize meaningful innovation and base new products on devices that are no older than 10 years.

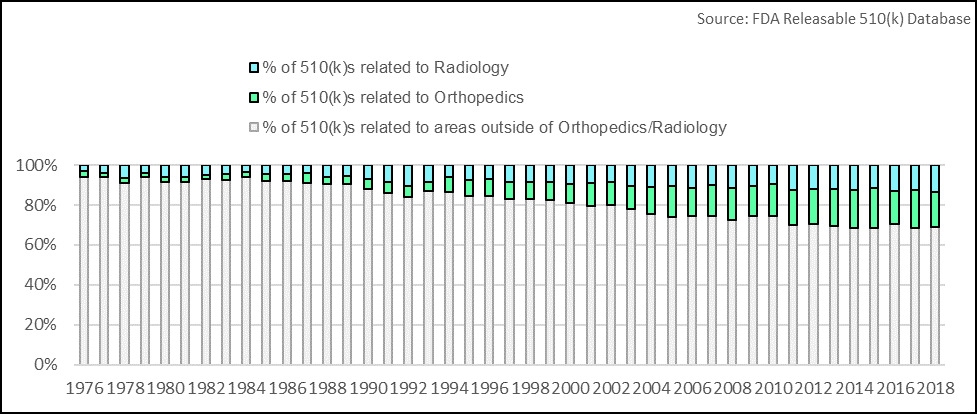

Medical device companies that can successfully take advantage of the FDA’s process modernization will create a unique opportunity for competitive differentiation. Analysis conducted by Fuld & Company shows that the number of 510 (k)s related to the areas of orthopedics and radiology have increased. These areas have expanded at an astonishing rate compared to other therapeutic areas, with the number of filings growing at a compound annual growth rate (CAGR) of 6.9% and 6.3%, respectively, from 1976-present. While the findings suggest these spaces are becoming increasingly competitive, it also shows there is opportunity for companies to effectively differentiate in these areas.

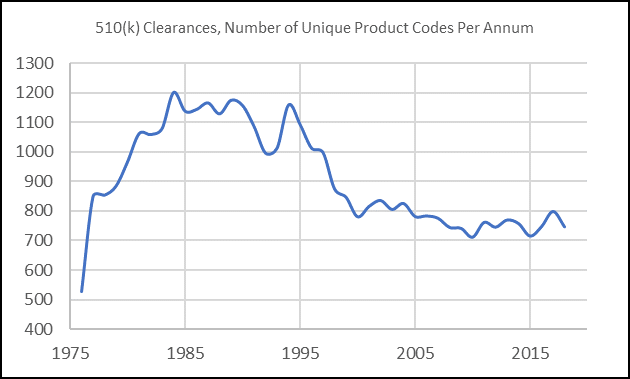

We also note the number of unique 3-digit product codes (which we used as a proxy for this data) within a given year has declined in recent years.

Taking both analyses together, the data suggest that overall, MedTech R&D for relatively low-risk devices is becoming increasingly concentrated in select areas; thus, further reinforcing that differentiation is key.

While the data underscore a narrowing industry focus with regards to 510 (k) submissions, we also note that the pace of innovation in both orthopedics and radiology has been relatively slow; outside of a few key advancements, these two segments are where we have historically seen incremental improvements rather than paradigm-shifting advancements in a commercial setting. We deduce that this is due to these being segments that rely heavily on a pathway built on establishing substantial equivalence rather than superiority. With the FDA’s new public-facing mission on promoting innovation, MedTech companies that are focused on bringing well-differentiated, cutting-edge devices to market (even if they are low-risk) are poised to out-compete laggards.

All factors considered, innovation in lower-risk med devices has been much needed and while there has been some skepticism, the proposed 510 (k) change indicates a step in the right direction on the path to modernization.

There are three reasons why we believe the medical device industry will experience a shift away from incremental innovation due to the change:

1. Inclusion of software components for critical functionality is on the rise

If the proposed 510 (k) changes are codified, companies will be forced to introduce devices based on more novel predicates. As a result, the marketplace will see an increase in the number of devices that are software enabled. As such, Fuld & Company anticipates devices with critical software components will become the “new normal” by 2028.

As digital technologies improve, an increasing number of MedTech companies are also evaluating where they can integrate software into products and developing more digitally-enabled solutions that will improve patient engagement and experience. Companies are stepping outside their comfort zones and including sensors or other software on med devices for basic or critical functionality. If manufacturers are essentially forced to rely on more modern devices to bring products to market, the FDA’s updated guidelines will help push an increased focus on software components such as:

- Device speed

- User-interfaces

- Interconnectivity

- Data privacy

In this way, it’s possible that the type of software used in lower-risk devices, like Class I and Class II, move into increasingly critical and creative functionality. The FDA has already taken note of this trend, signified by its Software Pre-cert Pilot Program which was outlined in the Digital Health Innovation Action Plan—this too indicates an evolving regulatory infrastructure equipped to handle the changes.

2. Generation of more clinical data

Unlike the pharmaceutical industry, which requires clinical trials and extensive quality control measures, lower-risk medical devices have been commercialized without the completion of robust clinical trials.

However, the existence of a regulatory pathway that allows for approval on the basis of substantial equivalence means that many manufacturers were previously able to bypass lengthy and costly clinical trials. Without the data however, informed decisions on improvements for lower-risk devices have been relatively nonexistent. Further, clinical data is important for the industry as a whole, as it can inform future R&D and clinical trial designs and also help boost an overall understanding of a device’s safety and effectiveness. The availability of more data could spur innovation in itself, as it will help companies understand where to invest in development or licensing. The FDA is taking measures to ensure more data will be available which will inevitably lead to devices that can address more specific, medical issues.

Hopefully, access to clinical data and the introduction of more trials could lead to fewer errors caused by medical device failures– such as the Transvaginal mesh debacle.

3. Increased interest from venture capitalists and private equity firms

With the FDA’s Center for Devices and Radiological Health (CDRH) now exhibiting a public focus on innovation, long-term venture capital and private equity firms will almost certainly catapult their interest back to the medical device innovation where it has been absent. As entrants from the larger tech sector pursue new products in medical devices, VC and PE firms alike will have more investment opportunities. Traditionally, VC firms have ignored med devices because of the lengthy time it takes to see returns. However, as software and technology entities enter med devices, capital will flow in the sector and facilitate the adoption of new, cutting-edge products.

As the changes unfold, large medical device companies should build robust programs to understand patient and provider needs, and understand where the most promising opportunities for growth are, such as:

- Calculated acquisitions of innovative technologies

- Licensing opportunities

- Strategic partnerships with software companies

With the groundwork set, many wonder: Where are the biggest opportunities for innovation?

Orthopedics: While there is currently a high degree of commoditization, we believe there will continue to be steady demand for orthopedic devices because of a growing elderly population and lack of effective substitutes. The proposed changes from the FDA may force existing players in this saturated segment to take advantage of the above three areas in order to stay relevant. Thus, exciting but costly emerging technologies such as “smart” implants, equipped with chips and embedded with sensors that monitor for infection and incorporate biofeedback, could garner more interest and investments from key players.

Radiology and Diagnostics: Looking forward, based on our analysis, we anticipate the greatest impact from software advances will be in these areas, where enhancements in artificial intelligence and hardware automation will subsequently increase diagnostic speed, accuracy, and precision in MedTech. Companies that are operating in this space are well advised to continue building in-house teams with expertise in artificial intelligence/machine learning (AI/ML) or partner with software outfits with these capabilities. If they don’t, they risk being left behind by the competition.

While the regulatory landscape is clearly developing to cope with technology advancements, it’s imperative companies evaluate the impact these changes will have on the competitive dynamic moving forward. It’s becoming increasingly important for medical device and MedTech companies to not only be aware of emerging developments but to also invest in actionable, long-term strategic plans that help them to determine how they can improve their own competitive strategy and position in the market.

Learn More About Innovation in the Medical Device Sector

While declining availability of venture capital will not directly, or immediately cause a decline in device innovation decreased investment does serve as a significant barrier for seed-stage companies that do not have the funding to advance the product to a point where M&A or other liquidity strategies make sense for the parties involved. Thus, large device firms and investors maybe allowing potentially disruptive technologies, cost-effective alternatives to current treatments, and other device-based treatment solutions to fall by the wayside, impacting innovation and future growth potential in the space overall.

Author Premdharan Meyyan, is an Associate Director in our Life Science Consulting Practice

Tags: Competitive Strategy, Disruption, Healthcare & Life Sciences, Medical Devices