Market Sizing & Opportunity Assessment for Global Energy Company

Posted by |

Background + Challenge

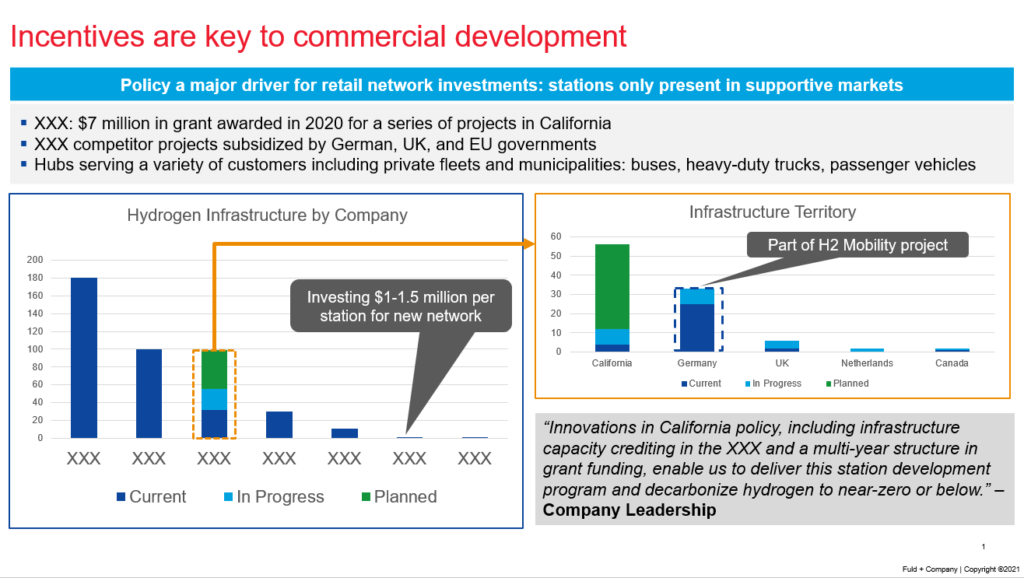

A global energy company wanted to learn more about how competitors were developing positions along the hydrogen value chain. Specifically, they wanted to find out how leading energy companies in both the renewable power industry and oil and gas were making investments to produce, transport, distribute, store, and market green and blue hydrogen. Hydrogen from renewable sources is increasingly seen as a solution for decarbonizing carbon intensive sectors such as transportation, heavy industry, and heating. Working with Fuld & Company, the client was able to gain insight on the policy frameworks, price, partnerships, and technologies competitors leveraged to deploy this technology in key markets.

While long researched for its potential benefits as an energy carrier, the build-up of hydrogen infrastructure to meet the needs of the energy transition and contribute to climate goals is still in its early phases. It is seen as a highly-capital intensive technology with large-scale hydrogen production plants costing in the tens of millions of dollars to build, and markets to facilitate its use have not been established; low-carbon hydrogen could still cost up to five times the price of hydrogen produced from fossil fuels depending on the target market. Hydrogen refueling stations for fuel cell vehicles can cost up to a million dollars apiece to build. The client understood the opportunity of hydrogen to expand its renewables business, however with high-costs and uncertain business outlook, the client wanted to track how its competitors identified markets in which to invest and which part of the value chain they were participating in. By understanding the costs, key-partnerships, incentive structures, and market development strategies of its peers, the client could determine how to best develop their own approach to this growing technology area.

Fuld & Company Solution

Fuld & Company engaged with a wide variety of sources at peer companies to learn more about the metrics, tools, and marketing strategies competitors used for deploying hydrogen infrastructure. Leveraging our business network to connect with a variety of industry sources, Fuld & Company was able to collect data on the extent of competitors’ hydrogen infrastructure in key markets, with estimates on metrics such production capacity, number of refilling stations in network, and electrolyser technologies used. In addition, key secondary research was conducted to communicate how policy frameworks incentivized investment and offset capital costs.

Results for the Client

Through our analysis, the client gained a better understanding of how competitors are developing foundational assets to eventually build out a largely presence along the hydrogen value chain. The client was provided with key details on partnerships with renewable power producers, electrolyser manufacturers, and key customers and offtakers. Fuld & Company intelligence was key for the client to benchmark against their own activity and relationships in the technology and point to market development opportunities tied to their energy transition and renewable technology goals

Download Case Study