How To Compete Against The Five Technological Giants

Posted by | Fuld & Company

The Big Five: Amazon, Facebook, Alphabet (Google), Apple + Microsoft

Betty wakes up craving a bagel. It’s her spring break and she has been binge watching The Crown on Netflix all week. She quickly Googles Bruegel Bagels to check their morning hours and hops into the shower while her Google Mini plays her favorite songs on YouTube. She rides to Bruegel Bagels, where she ApplePays for her favorite bacon and cheese and Instagrams her #food. Finishing her breakfast, she readies herself for another round of Netflix before working the Excel spreadsheets for school.

Betty’s digital routine is a set of technologies that rings true to everyone today. Consumers have habituated themselves to the digital age, driving the success of businesses like Amazon, Facebook, Alphabet (Google), Apple and Microsoft. Every digital device that is owned today has some form of interaction with one of these big five platforms, a small set of extremely large businesses driving the U.S. economy. A technological oligopoly.

How the Big Five Have Bolstered Their Competitive Position

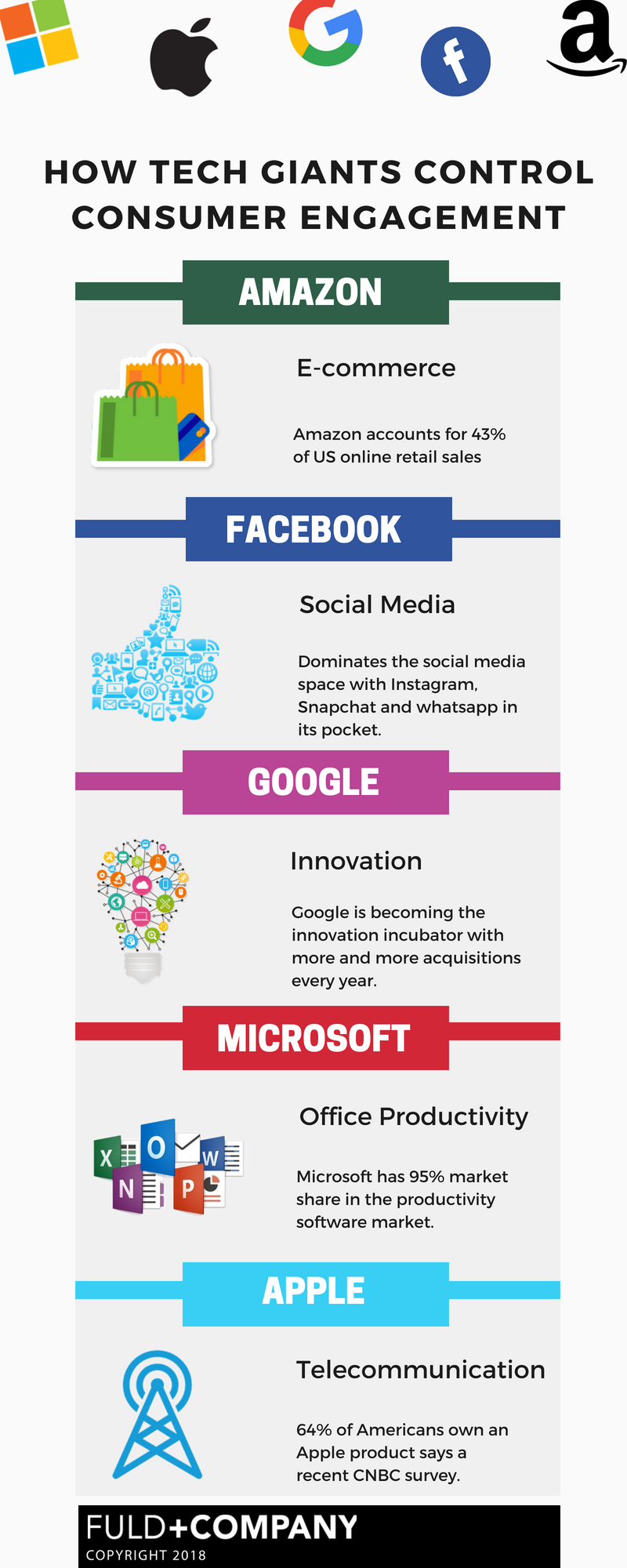

Consumers engage with technology in five different contexts – social, office productivity, retail/e-commerce, innovation and connectivity/telecommunication – which are all monopolized by at least one of the five technology giants.

Consumers engage with technology in five different contexts – social, office productivity, retail/e-commerce, innovation and connectivity/telecommunication – which are all monopolized by at least one of the five technology giants.

- Facebook dominates the social media space with Instagram, Snapchat and WhatsApp in its pocket

- 64% of Americans own an Apple product as of 2017

- Microsoft has 95% market share in the productivity software market

- Amazon accounts for 43% of US online retail sales

- Google is the innovation incubator with hundreds of acquisitions every year consisting of the world’s most forward-thinking products and solutions

The strategy that enables such dominance can be attributed to two specific focuses–eliminating the threat of substitutes and acquiring consumer intelligence.

Eliminating Substitutes

Horizontal Integration

Consumers opt for these platforms because these giants use a competitive strategy that leaves consumers no option. By growing through horizontal integration, these five increase revenue and thwart competition, thereby staying ahead of the pack. From news to entertainment to healthcare to finance, just consider Amazon’s recent acquisitions – Wholefoods, Washington Post, joint-partnership with Berkshire Hathaway and JP Morgan. Otherwise, the not so successful businesses are either getting bought in or rooted out.

Necessary Interdependence

The proliferation of growth for the big five is also accelerated by other successful businesses. Netflix for example, equally well-known and thriving with its disruptive business model, depends on Amazon’s Web Service Platform (AWS) [4][3]. Netflix’s dependence on Amazon, like most others, is more of a necessity than a choice because the market for cloud computing is driven by four of the big five. AWS holds 49% of world’s cloud computing market share given its capacity is six times as large as any other, Microsoft Azure is second with 10% market share followed by single digital share for Google Cloud.

Acquiring Consumer Intelligence

Aside from eliminating the threat of substitutes, the big five have superior understanding of their consumers. Consumer intelligence is two pronged: how many people do you reach and how much do you know about them. On average there are 40,000 users who search on google every second thus Google Trends is the most trusted trend report because it encapsulates what we search (where, when, how). Similarly, Facebook has access to 2.2 billion active users’ data which helps it predict what advertisements suit us best. Now, layer the customer reach of these giants’ advanced technological expertise, Amazon’s recommendation engine for instance, and the result is deep consumer insights.

So how can existing businesses across industry verticals combat the Big Five?

All hope is not lost. There are techniques that help organizations to understand external forces including the big five, and to pinpoint opportunities to evaluate threats and create value. Market sizing and trend analytics, technology landscaping, consumer preferencing and in-depth competitor analyses are critical, especially in the digital age in which the competitive intensity for each new dollar of sales is increasing concurrent with the rapid pace of innovation. Companies can make the most effective decisions by implementing strategies that account for competitors and the totality of the external environment. It is only with this foundational understanding that organizations can obsess over their consumers, know their needs, and develop the differentiating products and solutions and positioning that meet consumer desires.

References

[1] https://www.cnbc.com/2018/04/27/microsoft-gains-cloud-market-share-in-q1-but-aws-still-dominates.html [2] http://uk.businessinsider.com/how-google-apple-facebook-amazon-microsoft-make-money-chart-2017-5?r=US&IR=T [4] Amazon Web Services, Robert S. Huckman Gary P. Pisano and Liz Kind, HBS, 2012 [5] https://www.wired.co.uk/article/google-acquisitions-data-visualisation-infoporn-waze-youtube-android [6] https://www.forbes.com/sites/greatspeculations/2013/01/09/an-overview-why-microsofts-worth-42/#786cadd51c87 [7] https://www.businessinsider.com/amazon-accounts-for-43-of-us-online-retail-sales-2017-2 [8] http://www.internetlivestats.com/google-search-statistics/

Tags: Amazon, Apple, Competitive Intelligence, Competitive Strategy, Consumer Trends, Data, Digital Transformation, Facebook, Google, Information Technology, Microsoft, New Entrant Strategy, Other Industries