Insights » How Consumers View the Autonomous Vehicle

How Consumers View the Autonomous Vehicle

Posted by | Fuld & Company

Autonomous or self-driving vehicles are on the radar of both consumers and businesses, with the latter in an aggressive race to dominate the industry, expected to be worth $560 billion by 2030. While manufacturers and relatively new ventures such as the ride hailing company Lyft, are investing money and talent to gain competitive advantage.

Fuld & Company conducted a national survey to capture consumers’ attitudes regarding autonomous vehicles. We outline the most significant perspectives and demonstrate the criticality of knowing your consumer, as well as competitors, technologies, regulation, and investment.

How Safe Are Autonomous Cars Going To Be?

The single most common perspective raised was the concern about safety. One-third of respondents cited concerns about the artificial intelligence (AI) control system and its ability to consistently, reliably operate safely. Admittedly, this survey was conducted early in 2018, upon the heels of fatalities during test drives by Uber and Tesla in Arizona and California. News coverage of those incidents may have skewed the response rate, although it is noted that safety concerns are also high on the minds of consumers regarding purchases and operation of traditional vehicles, so consumers are demonstrating consistency.

The question of liability is the second most prominent concern raised by respondents. Obviously tied closely to safety, and to consumers’ current spending on automobile insurance, this question regards who is liable should the AI system fail or operate incorrectly and result in an accident. Autonomous vehicle production and operation involve a number of players from the vehicle manufacturer to the Artificial Intelligence system programmer to, of course, the consumer as owner or rider. Who is at fault should accidents occur is a murky matter. The fact that traditional vehicles and autonomous vehicles will exist simultaneously factors heavily into this question, as cars driven under traditional human control are currently involved in nearly two fatalities for every 100,000,000 miles driven. Marta Tellado, president and CEO of Consumer Reports, has publicly stated that automakers, not consumers, must shoulder self-driving car risks. Consumers participating in our study tended to agree, expressing skepticism about business and regulatory interpretations of liability. In relation to safety and liability, respondents did note that autonomous vehicles remove some dangers, most notably the prevalence of accidents from alcohol impairment.

The Eno Centre for Transportation supported this claim and went further, speculating that if 90% of cars on American roads were autonomous, the number of accidents would fall from 6 million a year to 1.3 million and the number of deaths would decrease from 33,000 to 11,300. Studies of safety are naturally theoretical at this stage given the small number of autonomous vehicles on the road, so automobile executives would be wise to publicly reinforce the safety message. Property and casualty insurance executives and insurance regulators would be similarly prudent to begin thoroughly explaining their interpretations of expected shifts in costs and public policy.

Will I Be Completely Free Of My Driver Duty In An Autonomous Vehicle?

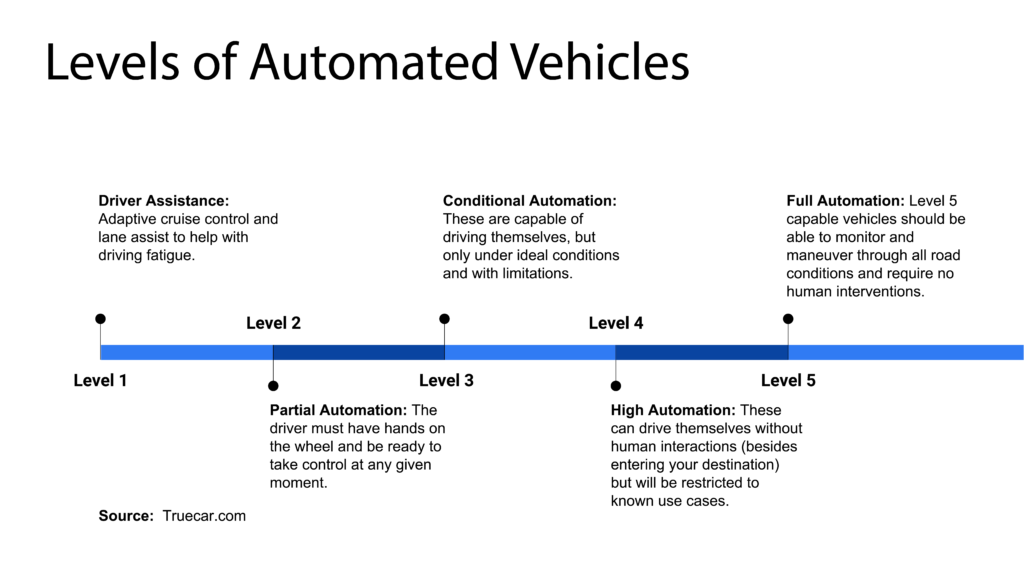

The definition of autonomous vehicles is a question that became evident in this study. Nearly three-quarters of respondents, 72%, indicated that they spend more than thirty minutes in their car commuting to work, and the ability to multi-task during this time was a primary stated desire for 26% of the study participants. Currently, there are five recognized levels [Refer to graphic below] of automated vehicles, each offering a varied level of self-sufficiency, a fact that appears confusing to a multitude of consumers. The level of autonomy, the rider’s scope of responsibility, and his or her subsequent ability to attend to non-transportation matters is a question that businesses need to clarify.

If Given A Choice, I Would Rather Ride-Share Than Own One.

When asked if they would buy an autonomous vehicle regardless of price constraint, 42% of consumers characterized themselves as “Least likely.” Yet, 30% said they would readily use autonomous vehicles for ride sharing purposes, such as with ride sharing company Lyft. Taking advantage of this angle, Drive.ai recently announced the launch of an autonomous vehicle pilot program aimed at delivering short-distance rides in bright orange automated cars. Given consumer attitudes, ride sharing may be first in line for this market, ahead of automobile manufacturers developing AI-driven cars for personal or fleet purchase.

What About The Infrastructure Requirements That Come With Such A Technological Change?

Some respondents, 15%, touched upon a significant point beyond the automobiles themselves. The condition of current U.S. infrastructure is varied and, in many locations, insufficient to satisfy the driving requirements of artificial intelligence. Investment in a refresh of infrastructure, that is, revamping highways, roads, recharging stations, and the like, may be incompatible with state and local funding capabilities, and even where feasible, would necessarily involve considerable time.

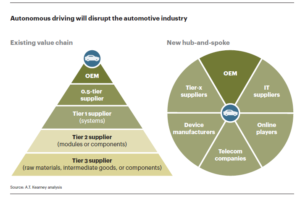

The second component relating to infrastructure is impacting the nation’s industrial ecosystem, reshuffling industry dynamics. The phrase for this dynamism is mobile-connectivity, in which traditional players are partnering with new players to create novel business models. For example, Google joined forces with Daimler AG to research the application of quantum computers for autonomous mobility, and Daimler AG is launching a self-driving service in partnership with Bosch Automotive. According to a 2016 study by A.T. Kearney, industry dynamics will neither be a value-chain nor a value-pyramid but a hub and spoke model, a radical shift for operations, suppliers, distributors, and, of course, for executives. Such a new paradigm will compound the competitive landscape for all.

Bolstering Potential Success

In our study, consumers raised attitudes, questions, and concerns that point to complicated answers that all stakeholders must consider and address before they will realize success. At this time, amid the race to the pole position, none of the players, either individually or in partnership, can respond comprehensively or cohesively to the full array of consumer feedback. That inability could be a constraint to the comprehensive adoption of this innovation.

This dynamic, this limitation, seen in proper perspective, is an opportunity. The company that appreciates the new paradigm, understands consumer attitudes and concerns, and develops a holistic view of the marketplace can gain considerable competitive advantage. After all, leadership in a $500 billion market translates to substantial revenue and market power.

Assessing the new business models that are arising, analyzing the intricate partnerships being created, comprehending the strategies and actions of competitors, and grasping consumer, societal, and regulatory attitudes are investments that businesses must make just as much as investing in product development and technology. And due to the evolving nature of this product and market, companies need rigorous, enduring frameworks that allow continuous monitoring of early warning indicators. Consumers point to critical issues in the external environment that will drive success or failure of companies currently, and often without full insight, investing hundreds of millions of dollars.

Tags: Automotive, Competitive Intelligence, Competitive Strategy, Information Technology, New Entrant Strategy, Rideshare