How a life insurer’s competitors leverage their marketing channels to achieve steady growth

Posted by |

Background:

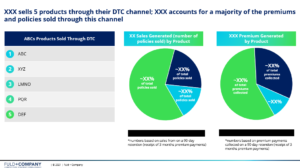

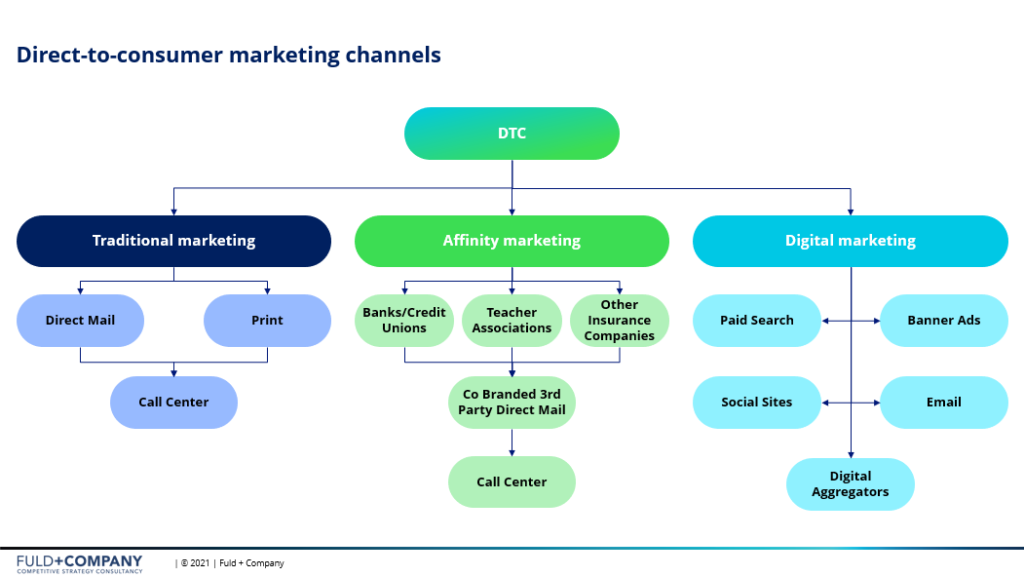

A major life insurance company wanted to better understand how a direct competitor leverages their sales channels within their direct-to-consumer business segment. Their competitor has seen their market share for products within their direct-to-consumer business increase each year and wanted to identify how they are able to achieve such steady growth. Specifically, our client wanted to assess what were the main growth drivers for this business segment and the key marketing channels the competitor was using to drive growth for their products sold through their direct-to-consumer channel. Working with Fuld & Company, the client was able to determine what marketing strategies are heavily utilized, which products generated the most sales in their direct-to-consumer channel, what are their cross selling and upselling strategies, and how their competitor plans on leveraging certain tactics to attract new policyholders.

Challenge:

Our client faces pressure from their competitor’s increasing their market share of products within their direct-to-consumer channel. Our client wants to know how they are achieving such growth and what tactics are successful in selling their various products. Learning about which sales channels their competitor relied on, and the challenges they come across, provides insight to our client on what marketing tools they should invest more of their efforts into for their own direct-to-consumer product. This helps better optimize our client’s marketing strategy on how they can better reach potential consumers and better compete with their competitor’s insurance offerings.

Approach:

Fuld & Company engaged with a wide variety of sources at peer companies to learn more about the growth drivers and marketing strategies competitors used for their direct-to-consumer products. Connecting with industry sources by leveraging our network, Fuld & Company was able to identify what was driving growth for their products, percent breakdown of sales generated by each marketing channel, what marketing channel was their top priority, and how they upsell and cross sell their insurance products within their direct-to-consumer channel.

Result + Benefits

Through our analysis, the client gained a better understanding of how their competitors leverage their marketing channels to achieve steady growth of their various products. Their competitor prioritized a specific channel that is highly responsive for an aging demographic; however, this strategy may become outdated for the next generation of potential policyholders. This gives our client insight on the type of other marketing channels they can invest in that will be potentially more responsive to this younger generation. Our client will be better positioned to build on other marketing tactics their competitor is not prioritizing, which will help them better compete with their competitor and help draw in a larger pool of prospects. Furthermore, our client was able to identify additional strategies for upselling and cross selling their products, which can help increase their market share of their various insurance products. Fuld & Company is now discussing additional research support, which covers customer experience, additional competitor analysis, and brand positioning to help the client capitalize on learnings from this phase.

Download Case Study