EV market dynamics

Posted by | Michael Ratcliffe

The dynamics of disruption… and the passenger car market

Are there dynamics in the passenger car market that could cause a massive, near overnight switch to EV (electric vehicles) from traditional ICE (internal combustion engine) technologies? If so, traditional passenger car manufacturers need to acknowledge that this is a scenario they cannot ignore otherwise their whole existence is under imminent threat.

The Innovator’s Dilemma

Prof. Clay Christensen set out the basic dynamics of disruption nearly 40 years ago in his groundbreaking book “The Innovator’s Dilemma”. He explained that, all too often, businesses continue to develop products and services beyond what customers ideally want, making incremental improvements to justify price increases with the goal of increasing revenues and keeping shareholders happy. However, they can easily overlook that consumers might not want these enhancements but would instead prefer a cheaper, simpler and alternative solution.

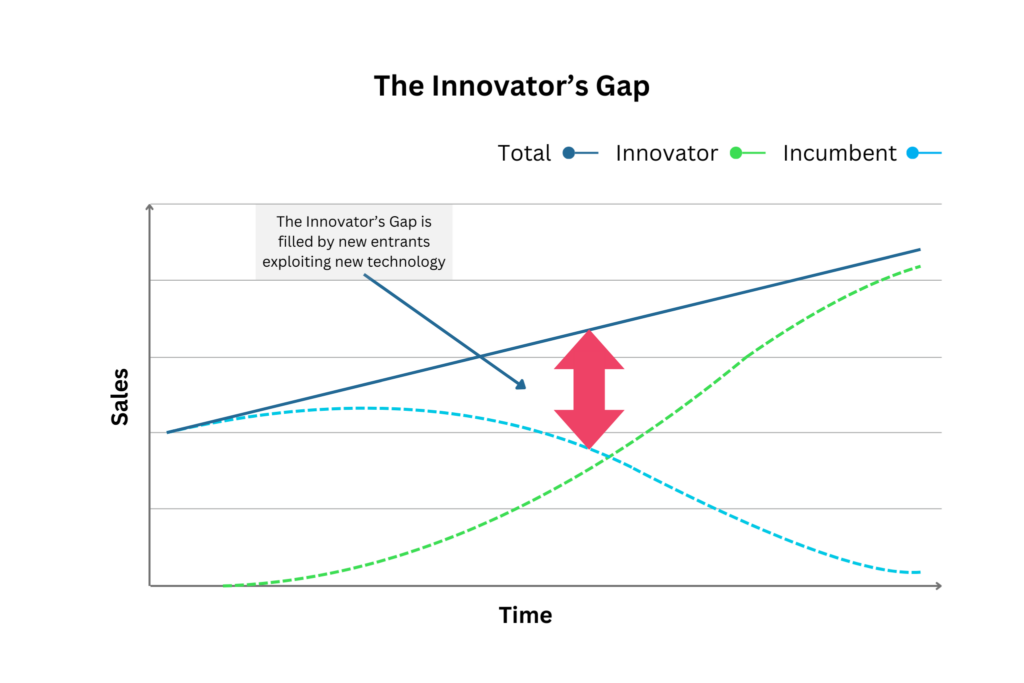

This disconnect between suppliers and customers creates a gap that innovators can and do take advantage of. This can radically change the market, causing the rapid demise of incumbents and the rise of new suppliers. Often this change is driven by new technology. Great examples are the mass ship-building production technologies introduced by the Japanese after World War II which destroyed much of the European shipbuilding market in the following decade, and the PC which destroyed the mini-computing market in the 1980s, radically changing the computing market forever.

The Innovator’s Gap

Today, we’re seeing exactly these dynamics working their way through the passenger car market. Incumbents are still focusing on the hundred-year-old ICE technology, while the innovators are attacking with EVs. Many of the incumbents, like Toyota, see hybrids based on traditional ICE technology as the near-term solution, and don’t consider EVs a serious threat to their core business over the next few years. In contrast, at the same time we are seeing disrupters like Tesla in the US and BYD in China entering the “Innovator’s Gap” with EVs.

It is important to understand that these attacks on the traditional ICE market do not fit in with the classic Christensen model. Today, EV technologies have key disadvantages over ICE – price and the limited number of charging stations in most parts of the world. As a result, the Christensen tsunami-like rush into the disrupter’s technology is not happening. But be careful, as there is another dynamic which could quickly change this overnight.

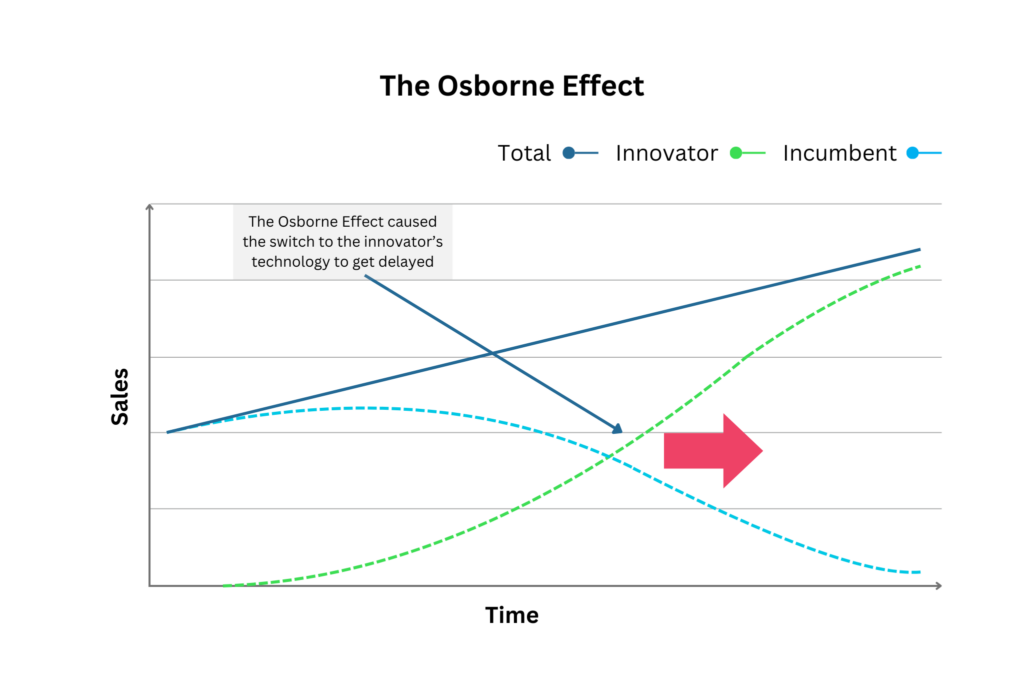

The Osborne Effect

The Osborne 1 was a PC launched in the 1980s, which Adam Osborne, the company founder, destroyed by pre-announcing a next-generation far better model. Rather than buying the Osborne 1, consumers waited for the launch of the new model, causing the whole company to fail. In other words, the Osborne Effect creates delays in the adoption of new innovations due to driving consumer’s expectations that it is better to wait than buy now.

The Osborne Effect is very evident today in the “range concerns” impacting the current EV passenger car market. In some markets, especially the US, the availability of charging stations in certain geographies is limited. This is causing concern among consumers that they will run out of power miles away from a charging station. In addition, most EVs are significantly more expensive than their ICE equivalents. As a result, consumers are delaying their EV purchases, waiting for more charging stations to be built and prices of EVs to fall. This hesitation has led to two observable effects and consumers are either:

-

-

- keeping their ICE vehicles longer, or

- buying hybrids to overcome range concern but still feeling they are going green

-

When we look at statistics on the US auto market, we see both effects.

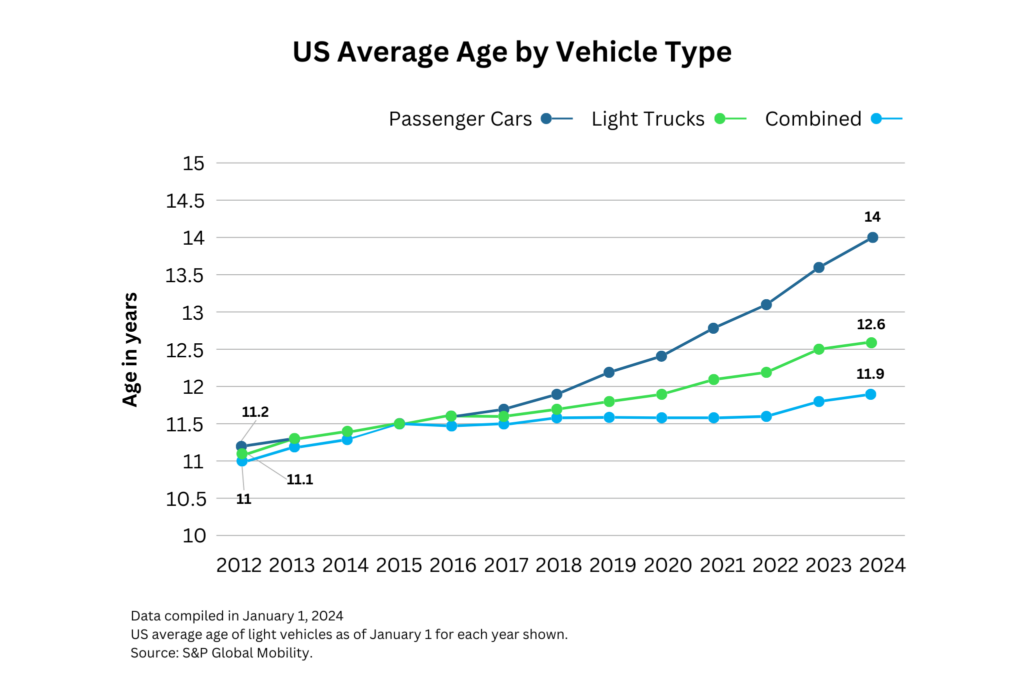

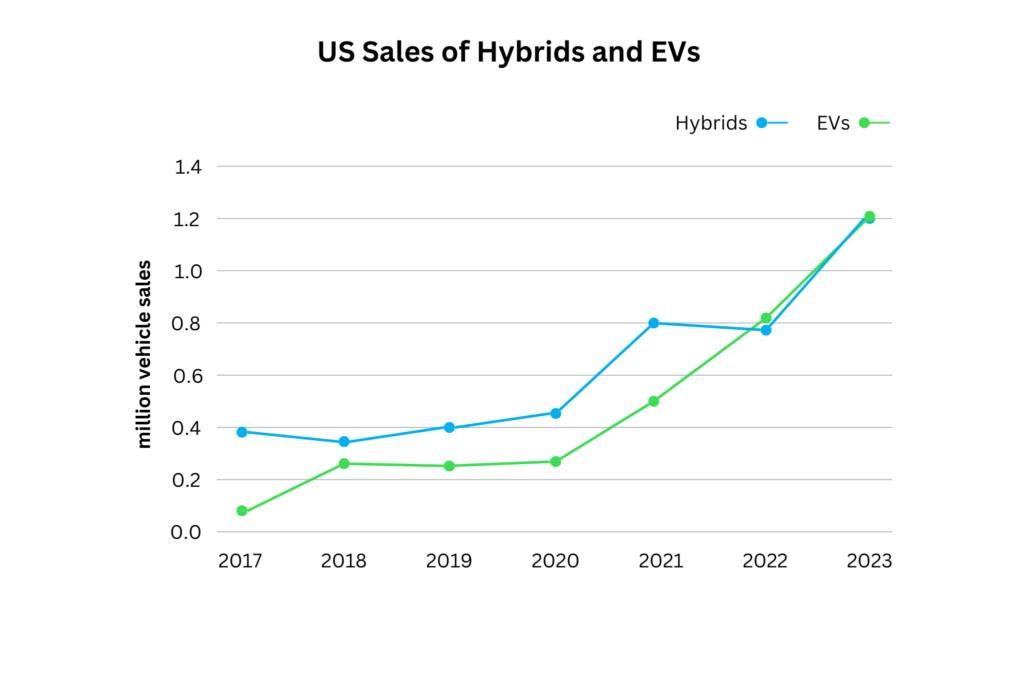

S&P statistics on the average age of US vehicles show a significant increase in the age of passenger cars from just under 12 years to 14 years over the last 7 years. Also, the sales of hybrids have grown faster than that of EVs over the past 3 years, supporting the idea that some consumers see hybrids as a great alternative to going fully green with an EV.

Both effects imply a possibly huge pent-up Christensen-like demand for EVs over hybrids and ICE technology in general.

Declining ‘range concerns’

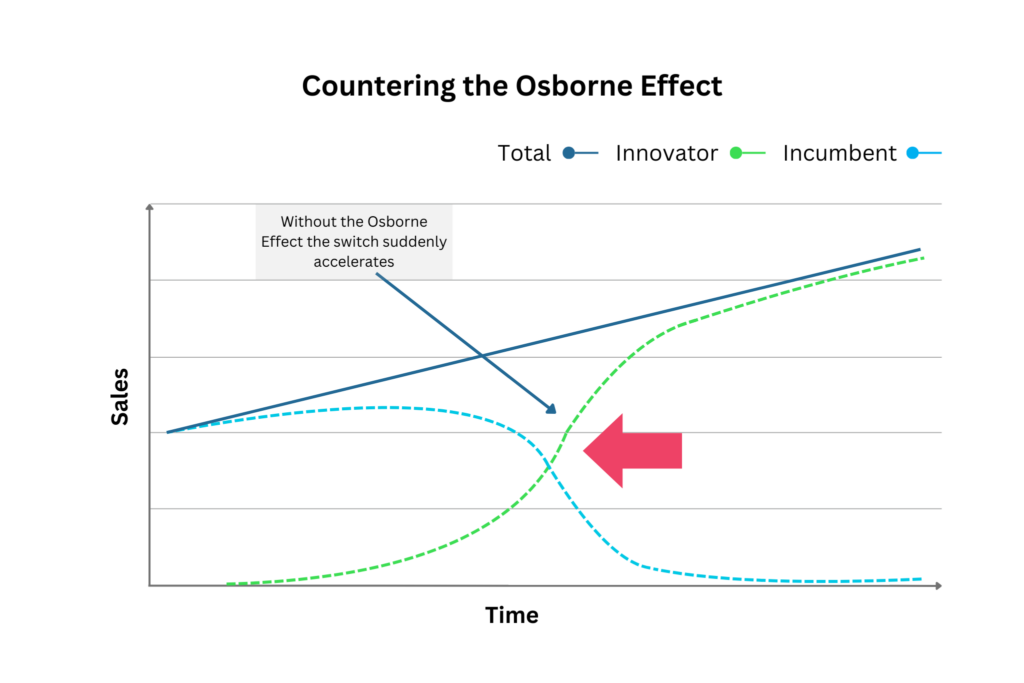

Understanding this is crucial because if EV technology starts to overcome “range concern” and at the same time becomes cheaper, it could significantly disrupt passenger car buying habits. One way this could happen is if battery technology advances to extend range, rather than an increase in charging stations, and becomes cheaper. If this were to happen, the Osborne Effect disappears, and the flood gates open for EVs.

What is very clear is that there is a huge amount of R&D going on around the world to develop better batteries, both with new materials and new technologies like solid state. Many of the leaders in new battery technology are in China and the leading battery company in world, CATL, may have announced just the battery needed to break through the Osborne Effect.

CATL has just announced the Shenxing PLUS, the world’s first LFP battery that achieves a range above 1,000 kilometers with 4C superfast charging. And as we discuss in our podcast on the impact of sodium batteries on transportation, this battery could double the current range and, at the same time, be significantly cheaper than lithium-based batteries. We could see this battery being used in production passenger cars as early as 2025!

The Osborne Effect eliminated

The scenario of eliminating the Osborne Effect on the EV market through a new and revolutionary battery could be huge. The floodgates could open, leading to a sudden shift in consumer behavior from buying ICE vehicles and hybrids to full EVs. In the 1990s, we saw the wholesale near overnight destruction of the mini-computer market by the PC. Might we see the same in the late 2020s with traditional ICE manufacturers that left it too late to switch technologies? They won’t be able to compete with the exploding demand for cheap, sodium battery-powered EV technology from Chinese manufacturers –w ho are already mass-producing high quality EVs, often designed by top western designers.

One key reason the Japanese succeeded in winning over the deep-sea shipbuilding market in the 1960s was European ship unions’ resistance to change. We are seeing similar forces in the ICE market today with Japan, Germany and the US looking to protect jobs from imported disruptive EV technology. Sixty years ago, not only did these protectionist forces not work, but they also actually helped to create the near-total destruction of the European shipbuilding market by blocking change.

The scenario we have painted above is not fiction. It is real. We have seen it many times in recent history and it should be very, very scary for ICE manufacturers and the local economies which are highly dependent on them.

Read more

The Truth About Disruptive Innovation— Seeing Beyond the Buzzwords

How connected and autonomous vehicles support a greener future

Top 4 Market Disruptors Affecting Every Company in the Energy Sector

Tags: Energy, renewable energy