A Big Business Driver for Middle Market Private Equity & Investment Banks

Posted by | Nilesh Sharma

Twenty-six years ago, Bill Gates, co-founder and former Chief Executive Officer (CEO) of Microsoft Corporation wrote an essay titled ‘Content is King,’ where he described the importance of content in broadcasting and the then-emerging internet space. He wrote, “Content is where I expect much of the real money will be made on the internet, just as it was in broadcasting.” To this day, content and content marketing continues to be driving factor for companies to demonstrate their domain expertise and leadership. The distribution of relevant and timely content, through the appropriate channels and platforms, enables companies to reach wider audiences, increase customer engagement, and drive value creation.

Traditionally, private equity (PE) firms and investment banks (IBs) have relied on conferences, relationships and networks for most business leads and growth. And today, there are still PE firms with websites that include little content that differentiates them as the ‘right’ partners to work with. However, we are seeing now that more private capital markets firms–particularly in the middle-market space–are progressively using content to drive higher stakeholder engagement.

In a time when investment opportunities are abundant but fragmented, it is increasingly imperative for PE firms to tell their ‘story’–their brand, reputation, investment philosophy, sector focus and track record–to win the business of new clients. The emergence of a tech-savvy generation of investors and business owners is compelling PE firms to evolve and relate with stakeholders’ preferred ways of learning and interacting. Private equity firms are becoming more adept at using content and content marketing to communicate their unique value propositions to their target audience. Content is helping these firms to differentiate themselves in the eyes of asset allocators, co-investors, and limited partners (LPs), as well as bankers and business owners.

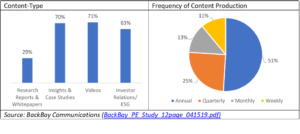

According to BackBay Communications, a UK-based branding and public relations company, there has been a significant increase in the number of private equity firms producing thought leadership. Nearly two-thirds of the top 100 global private equity firms now create and publish some form of content–from newsletters and simple infographics to detailed thematic research reports and thought leadership pieces. Not only are these private equity firms producing content regularly, but also use multiple channels and media–including news and print media, social media, podcasts, and videos–to reach an even wider audience. A case in point is the ‘Peer-to-Peer’ talk show and podcast hosted by David Rubenstein, co-founder & co-Chairman of The Carlyle Group.

Investment banks, on the other hand, have always been excellent marketers. As part of their day-to-day practice, they have long created content in the form of pitch books, confidential information memorandum (CIMs), and teasers when selling companies, raising funds, or buying companies for their clients. However, not all IBs are as savvy as others when it comes to using content to position their firm as the ‘go-to’ partner for businesses and investors. Indeed, the Covid-era disruption has forced a swathe of investment bankers and mergers and acquisitions (M&A) advisors to rethink their approach to marketing, driving the use of the content, and sharing it via social media and other platforms, to showcase their credentials and widen their reach.

At Fuld & Company, we specialize in providing deal and non-deal-related research and content services including whitepapers, thematic research and thought leadership, to middle-market-focused PE and IB firms. We work with a number of investment banks, M&A advisors, and private equity firms to create white-label content designed to showcase their domain expertise and unique value propositions.

Talk to us to learn more about how we can help your firm with your content creation requirements.

Author: Nilesh Sharma | VP – Strategy & Financial Services | Fuld & Company

Tags: Financial Equity and M&A Research, Financial Services, PE, private equity