Adjusting to the EV shift: challenges in the auto industry

Posted by | Rauf Mammadov

Over the past decade, the push for electric vehicles (EVs) has reshaped the automotive industry. By the end of 2023, there were approximately 40 million electric cars on the road worldwide. Nearly 14 million of these were newly registered in 2023, marking a 35% increase from 2022. This growth is striking when compared to 2018, when only around 2 million electric cars were sold1, 2.

But in 2024, some of the big carmakers have been rethinking their EV strategies. While the goal of reaching net-zero emissions remains unchanged, challenges such as reduced subsidies and uncertain demand have led some companies to slow down or adjust their electrification plans. Making EVs affordable for everyone has proven particularly difficult, driven by the high cost of batteries and other supply chain issues, while transitioning to EV production also requires costly factory retooling. The removal and reduction of EV subsidies in key markets like Germany3 and Sweden has added to the pressure, while in the US there’s speculation that subsidies could also be scaled back under Trump4.

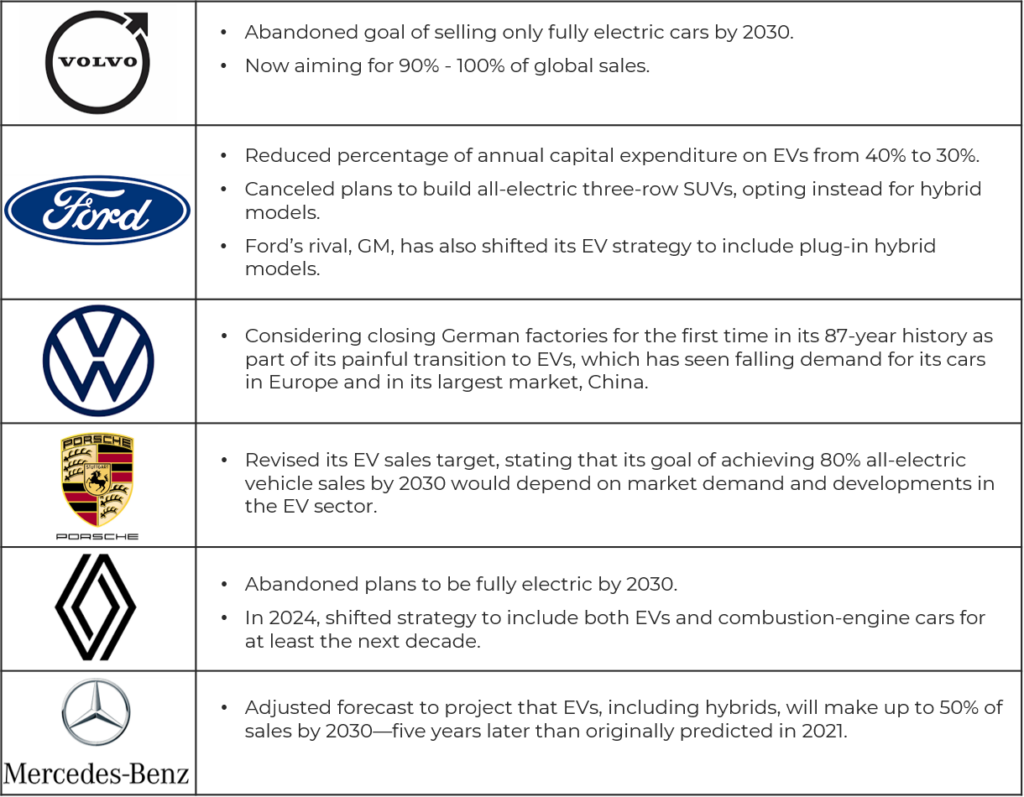

This has led some automakers to revise their plans5. Volvo, for example, moved from a strict EV-only target by 2030 to a more flexible 90-100% electrification. Ford has also dialed back its EV investments to focus more on hybrids, while Volkswagen is grappling with the possibility of closing factories as demand slows in Europe and China.

Auto OEM scalebacks in 2024

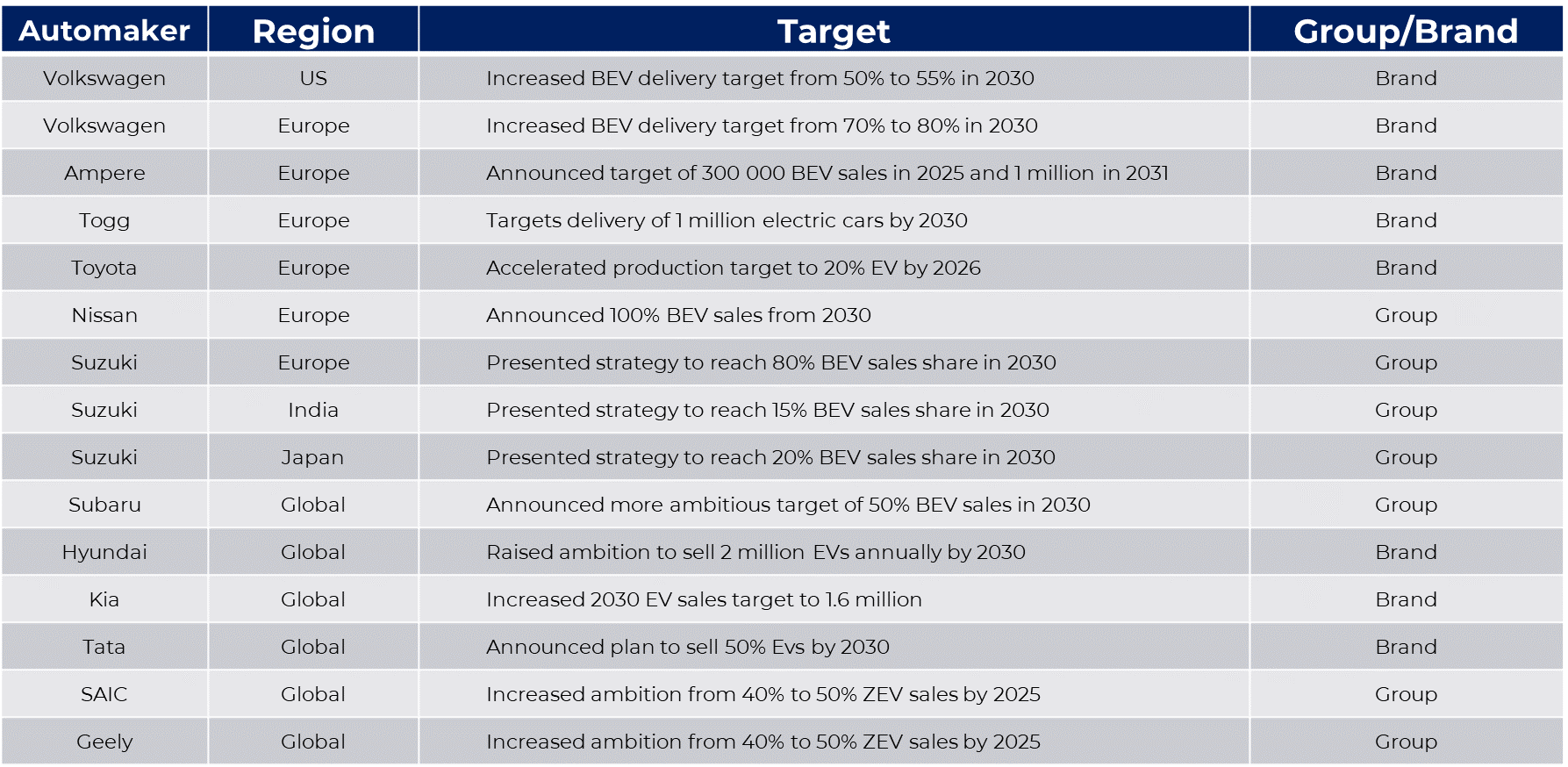

Despite these headwinds, the industry has not abandoned its long-term vision. Top automakers, accounting for 55% of global sales in 2023, still aim to deliver over 20 million EVs by 2030. Companies like BMW and Stellantis continue to set ambitious goals, although some, like Toyota, have tempered short-term production targets6.

Regional dynamics are also playing a key role in shaping strategies. Scandinavia is leading EV adoption in Europe, with Norway hitting a record 94.3% of new car registrations for all-electric vehicles in August 2024. In contrast, wider European and US markets are seeing more gradual progress, while Chinese automakers are leading EV growth globally7.

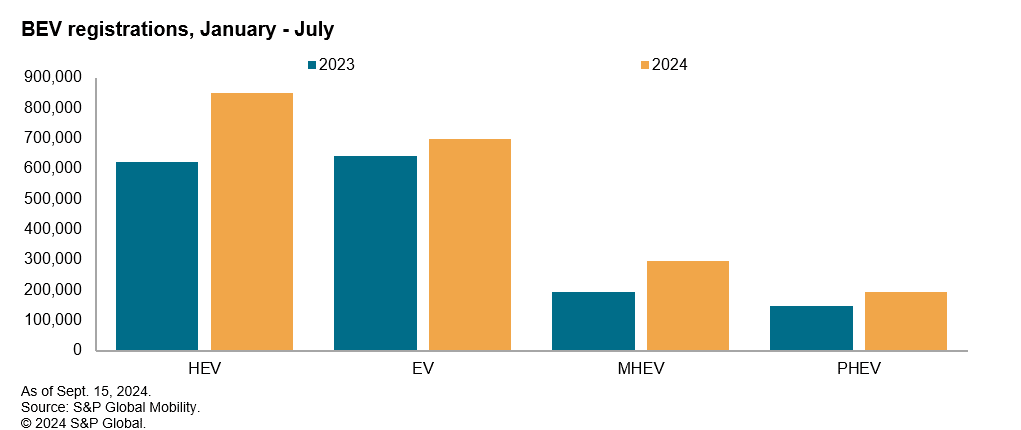

People are choosing hybrids over EVs due to concerns about range anxiety, limited charging infrastructure, and the time it takes to recharge, which hybrids overcome with their gasoline backup. Additionally, hybrids are often more affordable and eliminate worries about long-term battery durability and replacement costs 8.

HEV – Hybrid Electric Vehicles PHEV – Plug-in Hybrid Vehicle MHEV – Mild Hybrid Electric Vehicle

Slower growth in Europe and the US contrasts sharply with the surge in demand in China, which increased by 33% in 2023. Chinese EV manufacturers are also posing a significant challenge for European OEMs. While the European Union deliberates on implementing tariff regulations against Chinese imports, Chinese companies are wasting no time, announcing plans for EV production facilities in Hungary and Turkey.

While these recalibrations may seem like setbacks, they reflect a pragmatic approach to achieving long-term sustainability goals. By balancing electrification ambitions with financial viability and market readiness, OEMs are striving to navigate the complex path toward a zero-emissions future. For the industry, the focus remains clear: making EVs more accessible and ensuring a smoother transition for both automakers and consumers.

This shifting landscape highlights the delicate balance between ambition and realism in the global transition to electric vehicles.

References:

- https://ourworldindata.org/electric-car-sales

- https://www.iea.org/reports/global-ev-outlook-2024/trends-in-electric-cars

- https://www.technologyreview.com/2024/09/23/1104247/ending-ev-subsidies/#:~:text=The%20German%20government%20announced%20in,called%20the%20program%20a%20success

- https://www.reuters.com/business/autos-transportation/trumps-transition-team-aims-kill-biden-ev-tax-credit-2024-11-14/

- https://www.reuters.com/business/autos-transportation/carmakers-adjust-electrification-plans-ev-demand-slows-2024-09-06/

- https://evboosters.com/ev-charging-news/the-electrification-targets-of-light-duty-vehicles-by-2030/#:~:text=Noteworthy%20targets%20include%20BMW%20aiming,million%20per%20year%20by%202025

- https://www.theguardian.com/environment/2024/sep/17/norway-electric-cars-outnumber-petrol-for-first-time-in-historic-milestone

- https://www.spglobal.com/mobility/en/research-analysis/behind-the-headlines-oems-gently-braking-on-ev-investment.html

Read more:

The dynamics of disruption… and the passenger car market

Listen to our podcast:

Navigating the energy transition: Incumbents vs Disruptors

Tags: Emerging Markets, Energy, Innovation, Renewables, Sustainability, Technology & Innovation Research