Inside the deal making mindset: Lessons from 40+ investment banks

Posted by | Alok Tayal

I recently visited 12 US cities, meeting with more than 40 lower-middle and middle-market investment banking firms—both clients and prospects—as part of Fuld’s ongoing effort to understand the challenges and priorities shaping the sector. My trip also included the DealMAX conference in Las Vegas, which offered a dynamic platform to connect with professionals and leverage first-hand insights into how firms are responding to competitive and operational pressures in today’s complex deal landscape.

During these conversations some common challenges emerged, providing a window into how teams are adapting in a demanding environment. Firms are focused on how to differentiate themselves in investment banking, using technology more effectively, and expanding their networks amid heightened competition and uncertain timelines.

This article outlines the primary concerns raised and offers actionable insights for investment banking leaders.

1. Brand differentiation: Standing out in a crowded market

Bankers frequently asked, “How do I differentiate my firm in a sea of advisors?”

Winning mandates requires a compelling, cohesive investment banking brand positioning strategy that resonates with clients, which firms are addressing by:

- Crafting targeted content

Developing sector-specific insights or investment theses to highlight unique expertise, such as short founder videos, thought leadership, or newsletters.

- Embracing visual storytelling

Moving beyond text-heavy teasers and CIMs to engage clients with animated teasers, infographics, and short videos.

- Standardizing branding

Using consistent brand templates for pitch decks, websites, and newsletters to project a polished, unified identity.

–> Differentiation hinges on delivering consistent, value-driven messaging that sets a firm apart in a competitive landscape.

2. Efficient execution: Harnessing technology with purpose

The hype around artificial intelligence (AI) has shifted to practical applications, with firms asking, “Which use cases deliver real value?”

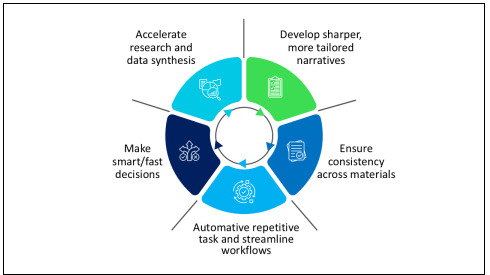

To modernize their M&A process, firms are exploring AI tools for M&A and looking at practical AI use cases in investment banking to:

When AI is integrated into well-defined processes, it is yielding 30–40% efficiency gains across the deal lifecycle.

| Stage | AI Use Cases |

| Deal Sourcing | Smart list building, automated market scans |

| Marketing/Outreach | Drafting teaser content, building initial buyer maps |

| Execution – Research | Summarizing industry reports, benchmarking peers |

| Execution – Modeling | Troubleshooting Excel errors, stress-testing assumptions |

| Data Room Management | Automating document indexing, contract review, generating summaries |

| Client Communication | Summarizing meeting notes, drafting presentation slides |

–> AI delivers the greatest impact when applied to specific, repeatable tasks, freeing up time for teams to focus on high-value activities.

3. Buyer/seller expansion: Refreshing networks

Bankers expressed frustration with stale buyer lists, noting, “We keep going back to the same buyers.”

Expanding networks is essential to uncover new opportunities, particularly in niche sectors. Firms are tackling this by:

- Re-mapping buyer universes

Using data platforms to build targeted buyer lists for M&A based on deal activity, fund strategies, and sector relevance.

- Enhancing outreach

Personalizing communication to reach decision-makers and tracking responsiveness to refine strategies.

- Tapping emerging sponsors

Identifying new players through analysis of market trends and investment patterns.

–> A dynamic, data-driven approach to buyer coverage strengthens deal pipelines and unlocks untapped opportunities.

Looking ahead

Investment banks are navigating a competitive landscape with creativity and resilience. By focusing on differentiation, purposeful technology adoption, and network expansion, firms can position themselves for success.

At Fuld, we partner with IB firms to turn these strategies into reality, significantly enhancing brand impact and bringing 30-40% deal efficiency and over 50% cost efficiencies.

Tags: Brand Strategy, Financial Services, Investment Banking Research, Mergers & Acquisition