US Middle Market Deal Activity Review – Q2 2025

Posted by | Fuld & Company

M&A – Turning A Corner?

Despite economic uncertainty from tariffs and geopolitical volatility, US middle market M&A deal activity remained resilient in Q2 2025, with both strategic and private buyers continuing to close deals. These Q2 2025 M&A trends highlight resilience despite broader economic pressures. Stabilized interest rates and a recovery in capital markets supported positive sentiment. Activity rose across sectors, driven by consolidation and increased investment in technology and AI. While the impact of tariffs varied, they did not derail the M&A market as feared, confirming our previous outlook. This was evident in the sharp rise in total deal value, from US$143.3 billion in April to US$197.5 billion in May 2025, according to FactSet.

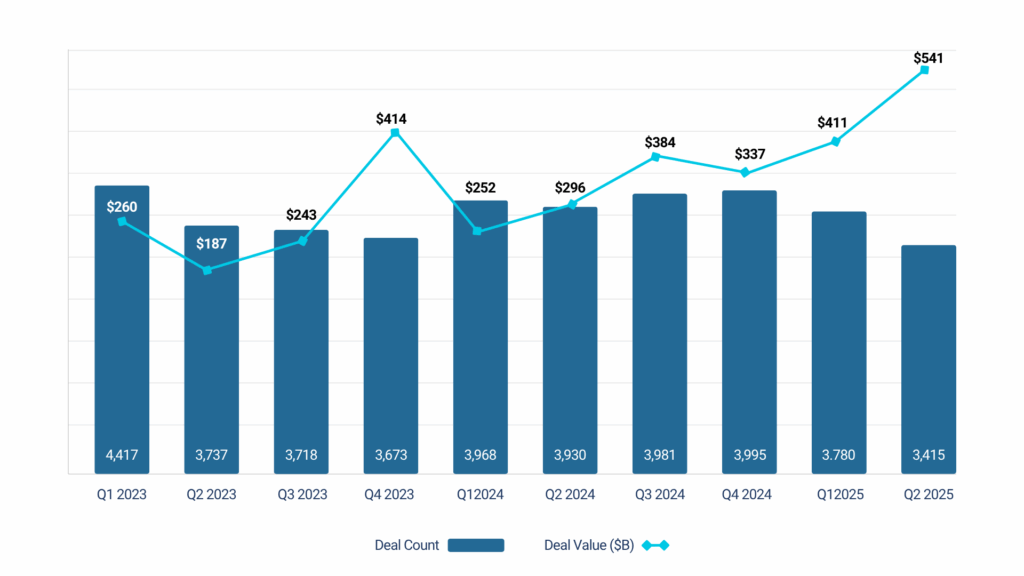

US Quarterly Deal Activity & Volumes (Source: Pitchbook)

Following the disruption of the 2020 pandemic and the interest rate reset in 2022 – which severely impacted the M&A market – firms are becoming more adaptable to changing external conditions, using volatility to their advantage. Corporate earnings have improved as companies prioritize operational efficiency and balance sheet strength. As a result, many are now better positioned to respond to challenges and pursue growth, including M&A. Private equity deal activity remains selective, with firms holding over US$1.5 trillion in dry powder, which could support deal activity in H2 2025.

Challenges Remain

Despite strong fundamentals, several headwinds persist. Uncertain tariff policy continues to complicate planning, while capital is increasingly directed towards emerging technology, particularly AI, at the expense of M&A. Though interest rates have stabilized and the US Federal Reserve maintains an accommodative stance, rates remain relatively high amid renewed inflationary pressure. Ongoing trade uncertainty has raised recession risk, prompting some firms to reassess capital allocation. Rising regulatory scrutiny may also temper the pace of recovery in the M&A market. These factors continue to shape the US M&A market outlook heading into H2 2025.

Drivers for M&A

Nonetheless, companies remain optimistic and are using M&A to supplement organic growth. M&A in the technology sector is rebounding quite sharply, with GenAI acquisitions becoming a strategic priority. Deals are focusing on expanding AI capabilities and infrastructure. Healthcare and pharmaceuticals are also driving M&A activity, especially in health-tech and MedTech. Notable recent transactions include Essilor’s acquisition of the AI-powered platform Optegra.

We also believe that private equity is likely to lead M&A dealmaking in H2 2025. With ample dry powder, PE firms face pressure from LPs to deploy capital. Add-on and bolt-on acquisitions aimed at scaling, diversifying offerings and entering new markets are expected to be major themes.