Trade, Tariffs & (M&A) Transactions

Posted by | Nilesh Sharma

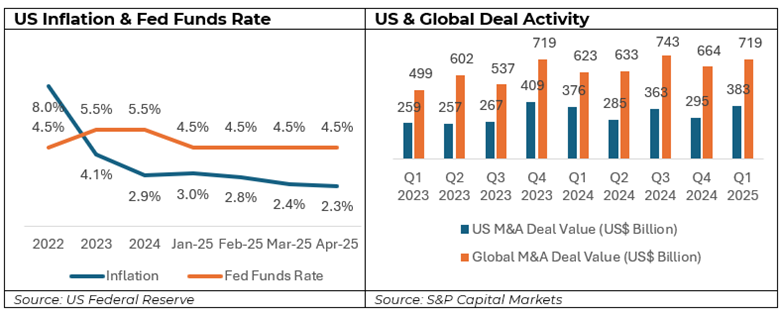

After a muted couple of years in 2023 and 2024, the global mergers and acquisitions (M&A) space seemed poised for a rebound in activity this year. In the US, inflationary pressures were easing with the headline consumer price index (CPI) inflation numbers falling from the highs of 8%+ in 2022 to more manageable levels in 2023 and 2024, prompting the US Federal Reserve to adopt a more accommodating monetary stance. The benchmark Fed funds rate were reduced three times, from 5.5% in September 2024 to 4.25-4.5% range in December 2024. As a result, US M&A deal activity improved, growing to US$340 billion in Q1 2025, up 30% from the previous quarter, according to S&P Global. Internationally, the M&A markets did well, with deal activity trending upward to US$719 billion in Q1 2025 from US$664 billion in Q4 2024.

However, the new administration’s recent imposition of tariffs on its global trading partners has resulted in an abrupt slowdown in dealmaking and hurt the capital markets. The range of tariffs varies from country to country: 10% tariffs on all imports; tariffs in the 10%-50% range for some specific countries; and even higher tariff rates on imports from Canada, China and Mexico, but all of these have contributed to increased trade uncertainty, and higher market volatility globally. In fact, the benchmark S&P500 index had its worst trading day in five years once the tariffs came into effect, losing 5% of its value on April 3, 2025. Market volatility, as measured by The Chicago Board of Exchange (CBOE) Volatility Index (VIX) also surged by more than a third to 52.3 on April 7, 2025, its highest level since August 6, 2024 when it reached 38.5.

Although the markets have since recovered most of their losses after the new administration paused the tariffs and announced a 90-day extension to the tariff deadline, sentiment in the M&A markets has remained subdued.

Historically, economic tariffs have influenced global M&A by disrupting trade dynamics and increasing uncertainty – impacting corporate strategy, valuations, and cross-border transactions. The 2018-2019 US-China trade dispute is a key example: tariffs and retaliatory measures dampened deal-making, especially for large cross-border transactions. Global consultants EY reported a 35% drop in transaction value in Q3 2018 compared to Q2, with deal volume at its lowest since 2013. Chinese acquisitions of US companies fell sharply, from US$55 billion in 2016 to just US$3 billion in 2018, amid tighter regulations and heightened national security concerns that blocked several major deals.

Heightened uncertainty

Businesses hate uncertainty as it affects both short- and medium-term planning. Market or policy ambiguity limits decision-making around resources, investments and growth, particularly when it comes to mergers and/or acquisitions. The prospect of retaliatory tariffs is likely to add to this instability.

Supply chain disruption

Supply chain disruption, prevalent during the COVID era, is expected to reemerge as US businesses pursue new domestic and international suppliers to circumvent the costs from increased tariff activity. It may also lead to shortages, potential price increases and other unforeseen business disruptions if demand outpaces supply.

Business Valuations

A gap between buyers’ and sellers’ valuation expectations has already negatively impacted the M&A market. With businesses facing pricing pressures from high inflation, investors need time to gauge how tariffs will affect product pricing and operations. This added uncertainty could depress valuations and lead to delays in deal-making.

Prolonged due diligence process

Tariffs can complicate due diligence in M&A particularly where material costs and sourcing are affected. Higher tariffs increase input costs – such as aluminum, copper, and steel – disrupting supply chains and squeezing margins. As a result, businesses need to reassess pricing strategies, supplier relationships, and competitive positioning. This added complexity is extending diligence timelines and slowing deal progression.

Outlook: Signs of recovery despite uncertainty

Despite ongoing uncertainty, we expect the M&A market to pick up later this year, driven by increased demand for deals. To avoid tariffs, international firms may acquire US-based assets—particularly in manufacturing—leading to a rise in foreign acquisitions of US companies. This trend reflects growing interest in localizing production to manage costs and minimize risk.

There are also signs of progress on the policy front. The Trump administration has indicated openness to trade negotiations, including an extension of tariff deadlines with China. Meanwhile, the US-UK trade agreement is giving market participants greater confidence that we are heading toward a ‘business as usual’ scenario.

With more certainty and enough dry powder at private equity firms, it’s possible that the environment for deal-making will become more favorable in the months ahead.