The Silver Tsunami: Aging entrepreneurs to fuel M&A growth

Posted by | Prakhar Baghmar

Grey matter: Demographic behind M&A growth

Prakhar Baghmar, VP and Head of Business & Strategy Research at Fuld, shares his insights into the forces shaping M&A growth.

While most recent business discussions around M&A tend to focus on factors such as technological disruptors, AI impact, economic uncertainties, regulatory changes, and Fed interest rates announcements. While these factors certainly influence M&A growth patterns, there’s another significant driver of M&A activity which is often overlooked – demographics – specifically, the growing number of ageing business owners.

The US is currently witnessing a significant demographic shift, both in the general population and in the business community. From July 2020 to July 2023, the average annual population growth in the US was about 1%, but the number of individuals aged 65 and older grew at a CAGR of nearly 9%. This rapid aging trend is also reflected in business ownership, where 2020 census data suggested that over half of all US companies are owned by people aged 55 and older. This highlights the growing number of business owners approaching or exceeding the traditional retirement age.

This trend is particularly evident in small and mid-market businesses, especially in sectors like logistics, manufacturing, construction, professional services, and healthcare private practices. These industries have long been dominated by older entrepreneurs who have built their companies over decades. However, these business owners now face multiple challenges such as increasing administrative and regulatory burdens, disruptive technologies, and the advent of newer business models. Keeping pace with these changes has become increasingly difficult, leading many aging entrepreneurs to consider exiting the market while their businesses still hold value.

One potential transition strategy is to pass the business on to the next generation, but this option often presents several challenges, most notably the need for a viable succession plan.

Understanding how these aging business owners approach succession, and whether they even have a plan in place, will provide strong insights into how this demographic change might reshape the M&A landscape.

Succession planning: A missing piece

Despite owners’ strong emotional attachment to their businesses and their desire to pass them on to the next generation, the lack of robust succession plans may pose a key challenge. Multiple recent business surveys suggest that a significant number of private business owners are not prepared for this critical phase:

Another challenging factor is that the prospect of taking over the family business is less appealing than the prospect of liquidity for many potential heirs. A recent survey of family businesses by Fuld indicated that more than 1/3 of heirs prefer liquidating businesses over continuing ownership. Key drivers for this preference included lack of interest and/or expertise, a greater interest in tech-driven businesses, legacy business issues, and family dynamics or conflicts. While owners may hope for a legacy of continued family ownership, their heirs may have different financial goals, creating increased pressure to sell the business.

Together, these factors—ageing owners, lack of succession plans, and decreased interest among inheritors—could trigger a significant rise in transactions by private sellers. Experts have dubbed this trend the ‘Silver Tsunami,’ as aging entrepreneurs exit their businesses in large numbers.

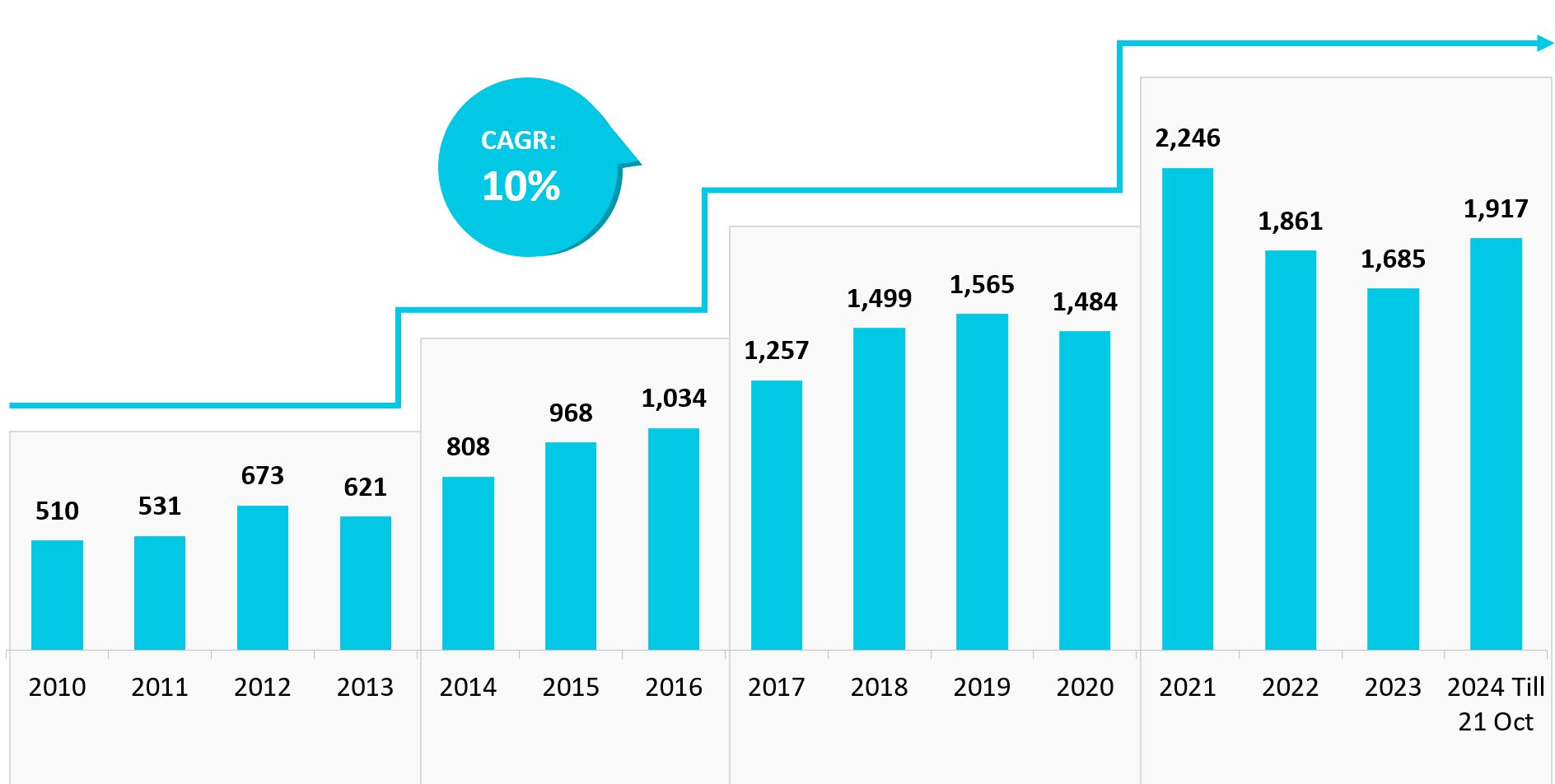

A closer look at M&A deal volumes for privately held companies already reveals the growing impact of aging entrepreneurs on transactional activity, particularly in the post-pandemic environment.

US – M&A deals volume for privately held companies

Source: Pitchbook³

The post-pandemic shifts in the business environment, consumer expectations, and technology landscape have forced many aging business owners to reassess their long-term strategies, with one prominent option being to liquidate the business.

The future of the M&A ecosystem

While the increase in aging entrepreneurs could contribute to M&A deal growth, the immediate impact has been less noticeable than anticipated. Several factors contribute to this disconnect, including emotional attachments to businesses, unfavorable economic conditions, and a general lack of exit readiness. While some of these factors are behavioral and therefore resistant to a rapid change, others present valuable opportunities for M&A advisors and investors on both the sell-side and buy-side.

This lack of exit preparedness presents a significant opportunity for investment banks to step in and facilitate M&A transactions. Many of these business owners may be unfamiliar with the complexities of selling their company or feel overwhelmed by the process of due diligence in M&A transactions. In addition to their transactional role, investment banks must act as consultants and guides, offering critical support in preparing businesses for sale, developing effective exit strategies, determining accurate valuations, and identifying potential buyers.

For private equity firms, strategically investing in these businesses and building a platform for consolidation could generate substantial returns.

Conclusion

While the aging entrepreneur demographic is expected to shape the M&A landscape, its full impact is uncertain. Emotional attachments, unfavorable market conditions, and unprepared exits could delay the anticipated shift. Despite these uncertainties, demographic trends and the widespread lack of succession planning strongly point to a rise in age-related transactions. For investment banks and private equity firms, preparing to engage with this emerging trend presents a significant opportunity – even if the ‘Silver Tsunami’ doesn’t unfold as predicted.

At Fuld & Company, we’re well-positioned to help private equity and investment banking firms navigate this shifting landscape. Our advisory support team works with investment banks to help prepare them for exits while our diligence support team can assist with identifying potential deals, developing pitch materials, conducting valuations, and performing in-depth due diligence. Additionally, our portfolio consulting services can help PE firms manage transformation and uncover new growth opportunities. For more information about our research services, please contact us.

References:

- https://www.bbh.com/us/en/insights/capital-partners-insights/second-annual-private-business-owner-survey.html

- https://www.pwc.com/us/en/services/audit-assurance/private-company-services/library/family-business-survey.html

- https://pitchbook.com/

Tags: Financial Services, Investment Banking, Mergers & Acquisition