Big Tech’s Growing Appetite for Power: The Rise of Off-Grid Data Center Energy

Posted by | Rauf Mammadov

In 2023, the Big Tech sector generated a staggering $1.3 trillion in combined revenue, cementing its presence in nearly every aspect of modern life. However, for all its control over digital platforms, regulations and public discourse, Big Tech’s biggest constraint isn’t policy, but power, often stemming from the limitations of the data centre infrastructure.

The digital economy runs on computing, which needs energy to operate. The rapid growth of artificial intelligence, cloud computing, and digital services is driving demand for electricity to unprecedented levels. This is forcing tech giants such as Meta to rethink their energy strategies to secure a stable, cost-effective power supply for their data centres.

Where Will the Electricity Come From?

To secure reliable and cost-effective electricity, Big Tech companies are either building their own off-grid power plants or forging direct partnerships with energy suppliers—a shift that is reshaping global energy markets. These dedicated power sources are designed specifically for data centers, ensuring a stable power supply, reducing dependence on overburdened public utilities.

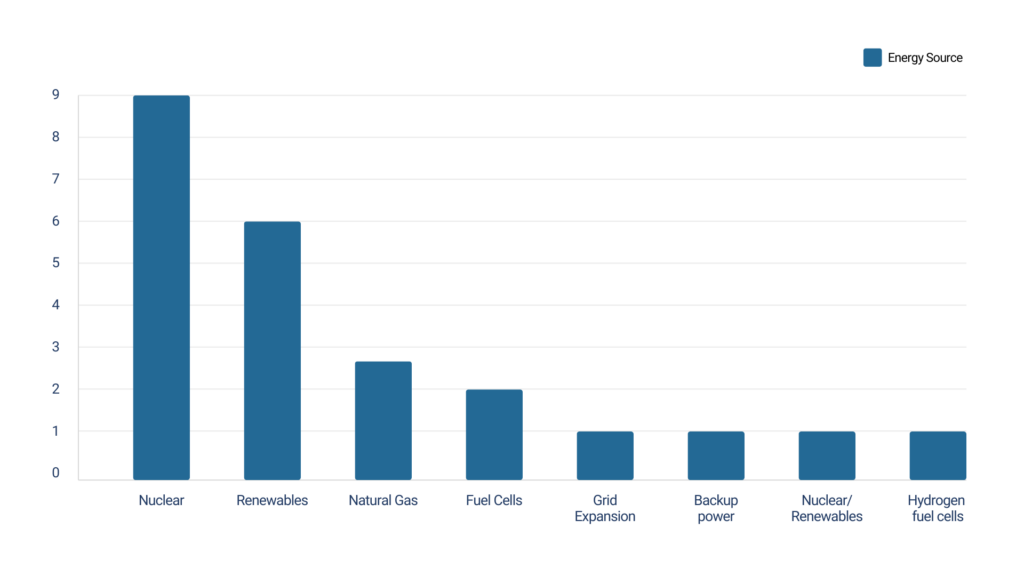

Nuclear energy appears to be the front runner. Of 25 agreements and memorandums of understanding (MoUs) signed with energy providers, nine involve nuclear power—including both traditional reactors and small modular reactors (SMRs). By contrast, just six focus on renewables like solar, wind, and geothermal. Another notable trend is the rise of natural gas-powered data centers, where Big Tech’s interests increasingly align with those of major players like Exxon and Chevron.

Energy as the Next Battleground

This shift toward off-grid energy is not just a technical or business decision—it’s also a political and economic transformation. By generating their own power, tech giants are no longer just customers of the energy sector but are becoming energy companies themselves, thereby influencing data centre operations. This raises crucial questions:

- Will Big Tech’s control over energy sideline public utilities and reshape energy markets?

- How will regulators respond to privately controlled power plants that bypass national energy policies?

- Could off-grid power infrastructure widen the gap between those with access to reliable energy and those without?

The more Big Tech’s appetite for electricity grows, the more it will increase its control over energy resources, leading to a redefining of global power structures, with the future of computing power inseparable from the future of energy. What started as a search for reliable power is evolving into a struggle over who controls the next generation of energy infrastructure, which directly impacts data centre reliance.

A New Digital-Industrial Complex?

What happens when the world’s most powerful technology companies also become its most influential energy providers? The result may be a new kind of digital-industrial complex, where the companies that power the digital economy also control the infrastructure that sustains it. Whether this shift leads to greater efficiency and innovation, or deeper inequality and regulatory conflicts, remains to be seen. One thing is clear: In the coming decade, it won’t be data that dictates Big Tech’s next frontier—it will be energy.

Tags: Big Tech, Data Centers, Energy, Off-Grid Energy