The impact of renewable energy on natural gas demand

Posted by | Michael Ratcliffe

Is California’s decline in natural gas usage signaling a nationwide trend?

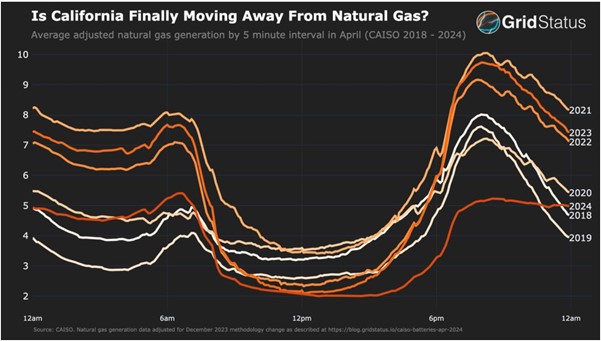

California power consumption data for April 2024 shows a stunning downward trend in US liquefied natural gas (LNG) usage during both the morning and evening hours compared to a year ago. CAISO, the overseer of California’s bulk electric power system, has reported average hourly data for April over the past six years.

The Impact of solar power on natural gas demand has been significant with peak solar power generation across the state increasing from 9 GW in 2018-20 to 12 GW in 2021-23, and surging to 15 GW in 2024. This rise halved the usage of LNG in high-demand times in April 2024. Today, solar accounts for about 50% of power generation in California for approximately six hours during the day. Excess electricity that is generated is increasingly being stored in battery systems, supplying power to consumers in the evening and further reducing the demand for LNG.

Source: GridStatus

Could this be the start of a downward trend in US natural gas usage, potentially leading to lower prices, which are already lower than a year ago?

A complex battle is evolving between green energies such as hydrogen (H2) and electricity, and traditional hydrocarbon energies, as markets and individual companies strive to implement plans to meet net zero emissions (NZE) targets. LNG has been viewed as a “bridge” solution due to its lower emissions compared to fuel oil and coal, though it is not completely green. It offers a valuable partial solution in areas where there are currently no viable green solutions, like deep-sea shipping. However, LNG can be easily replaced in regions where green energy alternatives like solar power in California, are available.

To get a glimpse of the dynamics of the evolving green energy market, read my blog on Shell, H2 and LNG – Shell pushes hydrogen into the “possible future.

Tags: Energy, Oil and Gas