The AI revolution: Transforming private investments

Posted by | Nilesh Sharma

In recent years, the surge of Artificial Intelligence (AI) has brought about a significant change in the world of private investment. This advanced technology is not just a trendy term but a powerful force reshaping traditional investment methods and redefining the strategies of private investment firms. From spotting promising opportunities to optimizing portfolio performance, AI is revolutionizing the way investments are made.

The year of Artificial Intelligence

According to the Organization for Economic Cooperation and Development (OECD), AI startups have become the focus of private investments since 2018, with over 15,400 deals worth a staggering US$240 billion being closed in the AI sector since 2022. (Top Venture Capital Firms Investing in Artificial Intelligence (AI) (linqto.com)

In 2023, the AI sector’s value surpassed US$100 billion, as reported by Statista. Forecasts suggest a rapid rise, with the sector expected to grow to over US$2 trillion by the end of the decade. This significant growth is driven by a combination of public and private investments, highlighting the essential role of AI in shaping the future of investments.

Harnessing AI for insightful decision making

AI’s capabilities go beyond financial metrics; it extends to understanding customer behavior and market trends. Investment firms use AI-driven analytics to extract insights from vast amounts of data, news reports, and social media activity, enabling a deeper understanding of market dynamics and consumer preferences. This informed decision-making leads to strategic investments aligned with evolving market demands.

Sectors leading in AI investment

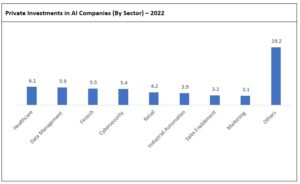

In 2022, the healthcare, data management, and fintech sectors emerged as focal points for AI investment. Healthcare AI companies alone received over US$6 billion in private investments, highlighting the sector’s potential to revolutionize patient care and diagnostics. Data management and cloud computing entities followed closely, with investments exceeding US$5.8 billion, emphasizing the critical role of data in driving business insights. Fintech also attracted significant investment, surpassing US$5.5 billion, signaling a shift in financial services.

Source: Statista (Private investment in global AI by focus area worldwide 2022 | Statista) Note: Others include 16 industry segments

Looking ahead, the outlook for private AI investments remains strong, albeit with a gradual pace of growth. Sectors such as life sciences, healthcare, fintech, and data management are expected to continue attracting sustained investment interest, driven by ongoing innovation and strategic acquisitions. As AI evolves, private investment firms must adapt quickly to capitalize on emerging opportunities and navigate the ever-changing investment landscape.