Tesla’s success on the renewable energy front lines

Posted by | Michael Ratcliffe

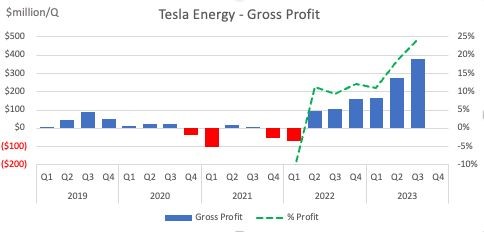

Tesla does it again! Although battery revenues only grew by 3% from Q2 to Q3, gross profit from battery sales rose to 24% in Q3, from 18% in Q2 2023 and 10% in 2022! This means Tesla Energy has now become more profitable than Tesla Auto percentage-wise and made nearly $400 million in gross profit in just Q3.

Its Lathrop, CA battery Megafactory continues to ramp up allowing unit costs to decline and profit margins to continue to grow.

Who said the green energy market is less profitable than the old hydrocarbon market!

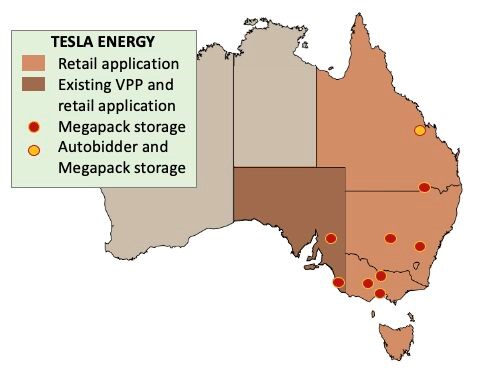

Tesla plugs into Australia

Meanwhile, in Australia, Tesla Energy Ventures Australia Pty Ltd (TEVA) has applied to become an official electrical retailer in 6 regions of Australia. After my recent LinkedIn post about the exploding strength of the Australian roof-top solar market, I was not surprised to see this announcement. Tesla already has its Megapack technology in half of Australia’s 18 operating large-scale storage systems and, as of May 2023, a reported 4,100 homes in its South Australian Virtual Power Plant (VPPs) linking their rooftop solar through Powerwalls together. Tesla also has a revenue-sharing agreement to deploy its trading platform, Autobidder, at Genex’s Queensland storage system. With the continued successful growth of solar across Australia’s 9 million rooftops and its strength in both domestic and grid-level storage systems, Tesla is ideally placed to become a major integrated electricity utility across Australia.

Where next?

Well, it already has VPPs up and running in Puerto Rico, California, Texas and Florida plus having a license to be a public utility in Texas!

Oil majors retreat as Tesla thrives in grid storage profitability

Meanwhile, we are seeing all the oil majors backing out of the green market as they can’t find the double-digit returns they are used to from Oil & Gas, and here’s Tesla making 25% returns out of grid storage on which it will layer electricity trading.

And finally…

Tesla outshines competitors in range and charging efficiency

It has been reported that Semi, Tesla’s heavy truck drive unit, is significantly more efficient than the competition, and might therefore halt moves to transition this market segment to hydrogen rather than electricity. If true, this is big news, as heavy trucking is huge polluter, and warrants keeping a close eye on.

This is such a classic picture of a disruptive innovator exploding into a new market from left field while the incumbents, their supply chains, and their customers are locked into old technology.

Tesla, the Classic Disrupter

Today, traditional oil and gas companies are grappling with the challenge of satisfying their shareholders while transitioning from hydrocarbons to green energy. As if to mock them, the upstart Tesla is making billions of dollars out of the green market by being nimble, ruthless in its cost-cutting, and highly creative in its innovation and strategic thinking.

This is a great example of the classic disrupter that Prof Clay Christenson wrote about in The Innovator’s Solution two decades ago in 2003. The solution is for the major oil companies to break away from century-old thinking and practices. They should establish and fund independent spin-offs, and give them the freedom to compete directly against Tesla. IBM did exactly this 20 years ago when it go hit by the dot-com-bust. The computer giant launched IBM PC out of Florida – as far away from its North-East corporate HQ as possible.

As Yogi Berra said “It is difficult to make predictions, especially about the future,” but its easy to look at history and try to learn from past crises.

Tags: Energy, Renewables, Sustainability