Tesla Energy: The Green Energy Storage Giga-Disrupter

Posted by | Michael Ratcliffe

Whenever a market undergoes significant restructuring, such as the current changes in the global energy and energy storage sectors, it is essential to search for disruptors—companies that unexpectedly enter from adjacent fields and present radical or incremental new technologies or ideas. These disruptors successfully challenge incumbents and turn the market upside down. A prime example of this is Tesla Energy!

The Demand for Green Energy Storage

Except for major oil companies, the global energy market is highly fragmented and primarily regional, if not national or municipal. It has always been segmented by technology, and sources such as the IEA’s World Energy Outlook 2022 predict the expected mix of technologies as we move towards a Net Zero world, hopefully by 2050.

One of the most significant global energy challenges being addressed is the market for green energy. Energy storage is a standout technology that requires massive investment to make the new green energy market a reality.

It’s not just the transportation sector seeking a solution – consumers also need battery storage systems to better manage their home energy usage if they have solar roofs or houses run on the Internet of Things, or if they drive electric vehicles. Industry and municipalities also require energy storage systems to better manage demand and replace fossil fuel systems for peak shaving power plants, as well as to manage the inevitable swings in supply from solar and wind.

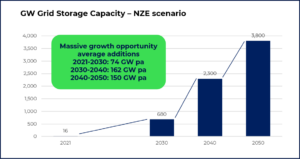

As a result, the IEA forecasts a massive increase in demand for grid-based energy storage, or nearly a 30% CAGR to 2040 from today’s level for their Net Zero scenario, as illustrated in the diagram below.

IEA Net Zero scenario: Total installed battery energy storage capacity

Source: IEA – World Energy Outlook, 2022

This represents a significant opportunity for both incumbent energy companies and startups alike. A growing number of innovative startups are hoping to become the next mass green energy storage solution. However, the IEA makes it clear that chemical batteries are the most favored technology today and tomorrow, and other storage technologies are only likely to find a place in niche corners of the market.

With this immense growth opportunity, many companies are targeting the battery storage market, manufacturing them in the Far East and assembling them into systems with sophisticated software management systems in the US and Europe.

One might expect international oil companies (IOCs) to be targeting this opportunity as it could potentially be a key strategic node in the new green energy market, replacing their central role in controlling the international oil and gas markets.

However, that is not the case.

The leading IOC in the new electricity market is BP, which, through its subsidiary Lightsource bp, is projecting the sale of 25 GW of green electricity projects by 2025, but with only 4 GW of associated storage, or just 3% of the IEA’s projected 2025 demand of 148 GW. The leading green energy company, Iberdrola of Spain, plans for 52 GW of green electricity by 2025, but only 2 GW of storage.

The picture for the major US utilities is very similar, with PG&E planning to install only 3.3 GW of grid storage and 0.4 GW of residential storage.

If we are looking for a disruptor in this exploding market, we have to look elsewhere, and Tesla is a clear candidate.

Tesla and Batteries

Tesla has a 15-year history of developing the most cost-efficient commercial battery technology and is now making batteries itself instead of relying on external suppliers.

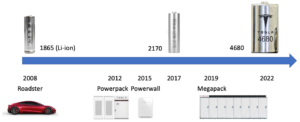

To launch its first all-electric car in 2008, Tesla needed batteries and turned to Panasonic. Over the next 15 years, it made major improvements in battery design, manufacturing, and deployment. It increased the battery size twice, replacing Panasonic’s original 18650 battery with the larger 2170 model in 2017 and introducing the even larger 4680 design in 2022.

It also improved the technology inside these batteries, starting with lithium-ion and then trying nickel-cobalt-aluminum, nickel-cobalt-manganese, and most recently, lithium iron phosphate (LFP). In addition to these developments, Tesla used a mix of suppliers, starting with Panasonic, then bringing in LG, CATL, and BYD, and is now designing and building batteries itself.

Tesla has an impressive 15-year history in developing and deploying the most cost-efficient commercial battery technology and is now at the leading edge of battery design and manufacturing.

While the company was capturing all the headlines with its EVs in the transportation market, in 2012, it made a major strategic move into a different but adjacent market – the static battery market. It started making stand-alone battery packs for businesses under the brand Powerpack.

In 2015, it took this a step further by launching Tesla Energy and its residential 3.3 kW Powerwall battery system designed for single-family homes to manage power usage and provide emergency backup, using the same 18650 batteries in its EVs. This was supposed to coincide with Tesla’s launch of its innovative Solar Roof shingles in 2016 following its acquisition of SolarCity, but these were not rolled out until 2018.

By the end of the decade, Tesla had a foothold as a utility supplier with solar power coming from Tesla’s high-tech Solar Roofs and Solar Panels sold through Tesla Electric, and a Powerwall storage system for both homes and homeowners’ EVs, which could all be managed through Tesla’s Wi-Fi app. Today, in 2023, Tesla is reported to have installed 430,000 solar systems across the US.

Tesla’s Battery Milestones

In 2019, Tesla Energy expanded from the residential market to the grid itself. Elon Musk proudly introduced the Megapack, a container-sized battery unit with 1.5 MW of capacity, and its lithium-ion 18650 batteries. In 2022, it upgraded the design to 1.9 MW and switched to its cheaper LFP technology, exploiting the knowledge it had gained in the EV market.

What is important to understand about the Powerpack, Powerwall, and Megapack is that Tesla uses the same batteries and management software that it puts into its EVs. This means that it can switch manufacturing at will in its Nevada Gigafactory between its different uses of its batteries, providing valuable competitive flexibility and manufacturing efficiency.

These moves by Tesla into static battery storage systems may seem like a natural extension of its success in the EV market, but they are much larger than many people realize relative to the IEA’s projections.

Currently, Tesla makes all of its batteries in its Nevada Gigafactory. In 2022, it announced that it was building a new Gigafactory in Lathrop, California, inland from San Francisco. This will be dedicated to making Megapacks with a planned output of 13,000 per year.

That is around 25 GW of storage capacity per year or five times the total planned by BP or PG&E over the next two years and around a quarter of the total global annual increase in storage demand forecasted by the IEA! In addition, Tesla Energy is the provider that major grid incumbents like PG&E are using to build their grid-sized storage farms with Megapacks.

The latest Megapack sells at a list price of $2.6 million. If Tesla were to sell all of its planned output from the Lathrop Gigafactory, revenues would be $34 billion, which is 50% of its 2022 automotive sales of $67 billion. Total sales of energy generation and storage are already estimated to potentially reach $12 billion in 2023. It’s no wonder that Musk has said that batteries have the potential to generate greater revenue than his car sales.

Tesla and Virtual Power Plants

However, the story doesn’t end there.

We must appreciate that Elon’s aspiration is to become a global “distributed” utility based on “virtual power plants” (VPPs) created through the linking up of individual residential Powerpacks and Tesla’s own grid-sized farms of Megapacks. This is not a pipe dream.

In 2021, Tesla Energy Ventures LLC was launched as a public utility in Texas, allowing Tesla to buy energy from its customers with solar and storage systems and resell it. By becoming a long-term buyer of excess electricity from its Powerpack customers, Tesla can also link all of its residential Powerwalls together to form a “community battery” system for a neighborhood.

Therefore, it can become an emergency utility for an entire community. Admittedly, with only a limited number of households with Powerpacks today, power from a VPP would only be available for a short period of time since the total capacity of Powerwalls is not that great. However, it is a revolutionary concept aiming to replace expensive, polluting natural gas peaker plants that only kick in during short-term peak demand with 100% green electricity.

Continuing its geographical expansion, Tesla launched a beta VPP in California in 2021, which went live with customers of PG&E who have Powerwalls in the summer of 2022 and currently can link together 3,000 homes. In 2019, it jointly launched a VPP pilot in South Australia, joining forces with Neoen SA, France’s largest renewable power company, and launched the “Tesla Big Battery” across other regions of Australia in 2022. In late 2022, Tesla unveiled its VPP pilot on the island of Miyakojima in the Okinawa Prefecture of Japan with 300 homes and has been working with Octopus Energy to develop a VPP in the UK since 2021.

Tesla is also building its own 100+ MW utility-size storage system outside Houston through a new subsidiary, Gambit Energy Storage LLC, and linking it to the Texas grid. This will allow Tesla to trade energy, buying and storing electricity when prices are low and reselling it when prices are high. The unregulated Texas grid offers Tesla a unique opportunity to pilot such a grid-level strategy. Gambit states that the grid services it provides are peak shaving and backup power in the event of a power outage, the same as Tesla residential VPP services.

In addition to its grid-sized battery solutions, Tesla has developed a suite of high-end power management software, allowing them to deliver a power ecosystem for fleet managers, utilities, power plant operators, and traders. This includes trading and microgrid packages. It’s perhaps not surprising to hear that global energy traders have started to take Tesla very seriously.

What is Tesla’s Energy Strategy?

This is all very interesting, but what does it all add to?

Although Tesla has been open about its energy strategy, it has not received as much press coverage as its automotive strategy. Nonetheless, it is worth summarizing what we can see from its current activities.

- Elon Musk has made key statements about wanting to harness the power of the sun to transform the world to green energy, seeing it as a free and abundant resource.

- Tesla has entered the traditional electricity power market from the automotive market through Tesla Energy.

- Tesla has developed a unique technology package consisting of:

- rooftop solar panels

- low-cost panels and installation

- the ability to network them together to create a VPP

- chemical battery storage systems

- both residential and grid-sized options

- using the same technology and software management system as their EV batteries.

- manufacturing of all their batteries on the same production line in their plants.

- rooftop solar panels

- Tesla has created massive production capacity for storage units with their new Gigafactory in Lathrop California, specifically for making Megapacks, and capable of producing 40 GWh of power or 25GW of storage capacity per year. This factory went from groundbreaking to production in 12 months, giving. This factory went from groundbreaking to production in 12 months, giving them a unique ability to ramp up their production capacity with other Gigafactories dedicated to batteries.

- They also have the ability to manage, network, and trade power from both their residential and commercial battery systems.

All of these factors make Tesla a classic disrupter in the energy market, as first described by Clayton Christensen in his theory of “Disruptive Innovation”. Without a doubt, Musk has a grand plan that goes beyond competing in the power-shaving market and supplying batteries and software to end users. The key competitive question should, therefore, be “What is Musk’s next move?

Reports indicate that Tesla is already exploring new technologies for solar panels, like ferroelectric and thin film, and considering a wide range of innovative technologies for power storage. Musk’s Master Energy Plan 3 also talked about heat pumps for homes and commercial buildings, high-temperature heat delivery, and hydrogen for industrial applications. It is clear that his vision does not stop at solar panels and battery systems.

All of this should be a major warning to any company in the power market, not just the incumbents but also startups and their investors looking to jump on the green bandwagon. It is critically important to track what Tesla is doing, not just commercially but also technologically, as well as where Tesla is having success and where it’s having problems.

Tesla Energy has already become a major regional power player, a leader in solar and electricity storage technology, and all the signs are that it’s setting itself up to become the mega-disrupter of the global green power market.

Tags: Energy, Energy and Utilities, investments, Renewables