Stressed / Distressed Investment Banking – A Bright Spot?

Posted by | Nilesh Sharma

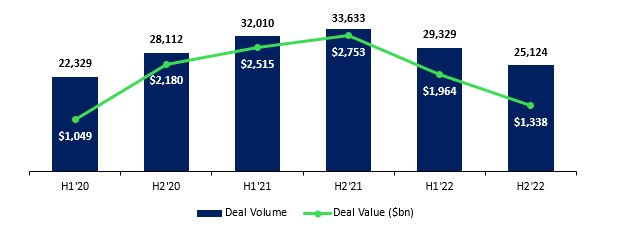

Investment Banking Trends: Interest Rate Cycle Reversal

Investment banking has experienced a decline in deal activity and volume, following a record-breaking 2021. The US Federal Reserve raised its benchmark interest rates, and other central banks followed suit, resulting in a fall in global M&A activity from over 60,000 transactions with a total deal value of over US$5.3t in 2021, to 10,000 fewer transactions in 2022 with a total deal value of just under US$3.3t. However, some large transactions in Q4 2022, including Kroger & Co.’s acquisition of Albertsons Co., Inc for over US$30b and Johnson & Johnson’s US$18b acquisition of Abiomed Inc., mitigated the situation.

Global M&A Deal Volumes and Values

Source: PwC

Source: S&P Capital IQ

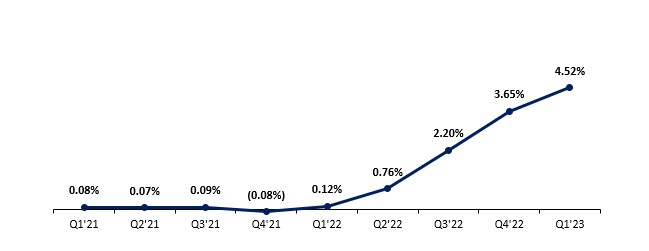

Quarterly Fed Fund Rate

Source: Federal Reserve Bank

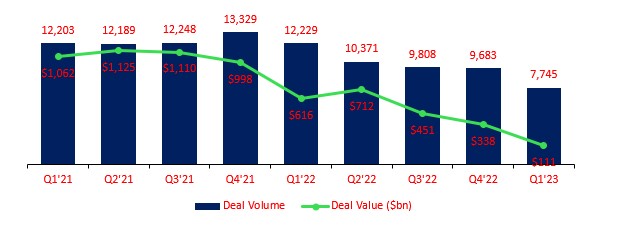

Q1 numbers reflect a similar trend, with the US Federal Reserve raising the Fed Funds Rate further to 4.8% in March 2023, resulting in a decline of M&A deal volume by 36.7% to under 10,000 compared to the same period last year. Moreover, there has been a monthly decline of investment bank M&A activity in the first quarter of 2023, with a deal count in March 23 of 2,318 according to S&P Capital IQ. Investment bankers and advisors remain cautious as both buyers and sellers of businesses grapple with market volatility and uncertain valuations.

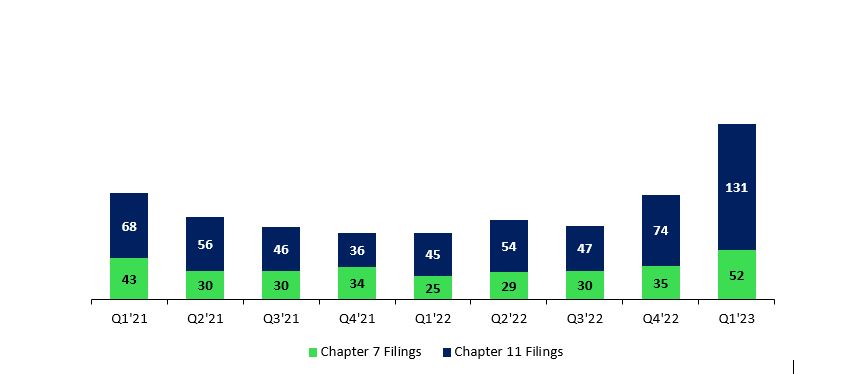

Increasing Bankruptcies and Corporate Restructuring

Bankruptcy filings have increased across sectors due to the scaling back of government support, higher interest rates, and increasingly expensive sources of funding. Sectors that have seen a particular increase in bankruptcies include real estate, retail and consumer, industrials, healthcare, and energy. New bankruptcy filings in these sectors increased 18% to 105,433 in Q1 2023 compared to 89,289 in Q1 2022, according to Epiq Bankruptcy, whilst total commercial bankruptcies shot up 19% to 5,733 versus 4,808. The general trend in bankruptcies was upward, but the situation seems to have escalated since the 2023 collapse of Silicon Valley Bank (SVB) and Signature Bank in the US. This was highlighted in a recent note by Swiss-based investment bank UBS, which described the rise in bankruptcies in small and mid-sized businesses as a sign of “growing distress in the US corporate credit markets”.

Bankruptcy Filings in US

Source: S&P Capital IQ

Corporate restructuring advisory on the rise

As a result, demand for bankruptcy and corporate restructuring services has increased, with stressed and distressed deal making experiencing a surge.

In the US. total restructuring filings in Q1’23 increased by 191%, and liquidation filings by 108% compared to Q1’22 with the majority falling within the range of $10M – $100M total liabilities, and accounting for over 75% of filings in 2021-2022. According to PwC the sectors most likely to be amongst the worst affected by this crunch include automotive, consumer and retail, crypto, health services, industrials, life sciences, pharmaceuticals and real estate.

Firms operating in this space are likely to witness increased activity as they assist small and mid-sized businesses in navigating market volatility, uncertain valuations, and higher borrowing costs. As the economic landscape continues to evolve, the growth in stressed and distressed investment banking services stands out as a crucial aspect of the industry’s adaptation to changing conditions.

About Fuld & Co

Fuld & Co. is a leading research and intelligence agency that provides comprehensive solutions for middle-market focused firms globally. Their team of experts helps clients navigate the most complex market conditions, providing actionable insights for more informed decision-making, whether it is to acquire a new business, conduct due diligence, or assess exit opportunities. Contact us at Fuld & Co. at www.fuld.com to discuss how we can help you with your next transaction.

Tags: Financial Services, Investment Banking, Market Analysis