Resurgence in Middle Market M&A: Insights from DealMAX

Posted by | Nilesh Sharma

The 2024 DealMAX conference, held in Las Vegas and organized by the Association for Corporate Growth (ACG) brought together over 3,000 private equity professionals and investment bankers within the middle market community. The event was an opportunity for exchanging ideas, fostering dealmaking opportunities, and networking. The conference also included a program featuring high-level speakers from leading investment firms and consultancies including JP Morgan, Oaktree Capital, Churchill Asset Management and Paladin, who shared invaluable industry insights. Here are some of the key insights from the event.

Recovery after a slow 2023?

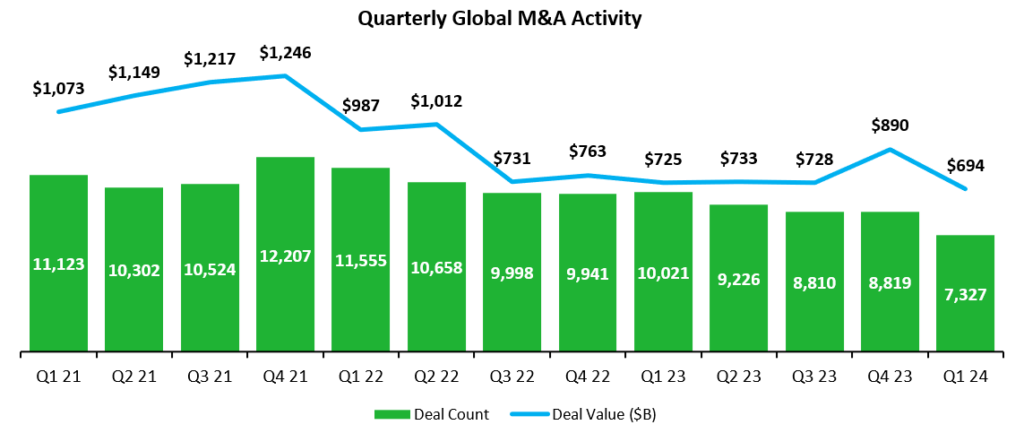

After a disappointing 2023, the global mergers and acquisitions (M&A) market seems to be reviving in 2024.

In 2023, the value of global M&A deals fell 16% on the previous year to US$3.1 trillion, according to McKinsey1. This decline in M&A activity was attributed to a combination of factors: the tightening of US monetary policy, marked by a series of interest rate increases by the US Federal Reserve aimed at curbing inflationary pressures; heightened geopolitical tensions arising from the ongoing conflicts in Eastern Europe and the Middle East; and widespread concerns of an impending recession.

Despite the slowdown in M&A activity, the Americas remained resilient, accounting for over half of the global deal value in 2023 at US$1.6 trillion, down 7% from 2022. In contrast, M&A activity experienced sharper declines in other regions, with a 30% drop in Europe and the Middle East (EMEA) and a 19% decrease in the Asia-Pacific (APAC) region.

Source: Pitchbook, Global M&A Report2

Source: Pitchbook, Global M&A Report 2

Source: Pitchbook, Global M&A Report 2

Rebound in Private Equity activity

2024 has seen an uptick in deal activity, particularly within private equity and private credit markets, as the M&A market factors in higher interest rates and a growing consensus around an improving economic environment. An additional reason for a lackluster 2023 was lower private equity and M&A activity, with deals falling 37% to US$560 billion, just 18% of total deal activity in 2023. This decline occurred despite 2023’s exceptionally high fundraising by middle-market private equity funds. Many sponsors are now warming up to equity participation with private equity firms sitting on over US$3 trillion worth of ‘dry powder’ that needs to be deployed. As a result, deal volumes are already improving, and this trend is likely to continue in the remaining quarters of 2024.

Challenge of higher valuations and extended deal timelines

Higher valuations and longer deal closure timelines are contributing further to lower deal activity. Misalignment between buyers and sellers regarding company valuations has been evident, prompting concerns about the sustainability of inflated valuations and sellers’ expectations. The time required to close a transaction has increased significantly compared to both the pre-pandemic and pandemic periods. This has been driven in part by increased regulatory requirements leading to more extensive due diligence processes, characterized by increased buyer involvement, and the greater participation of specialized firms.

Source: Pitchbook, Global M&A Report 2

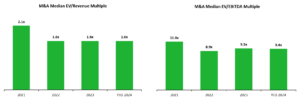

Private Credit – filling the gap

Increased activity in the private credit markets has been one of the silver linings in the global M&A space since 2022. As of the end of 2023, private credit has become a US$1.7 trillion market, including venture debt, special situations, and mezzanine, distressed and direct lending. After a brief lull in the preceding years, deal activity is returning to healthy levels. Private credit markets have absorbed interest rate increases more effectively, while leverage levels are returning to what can be considered ‘business as usual’ in Q1 2024.

Outlook for M&A in 2024 and beyond

In conclusion, the landscape of global mergers and acquisitions (M&A) is undergoing a transformative resurgence in 2024, as evidenced by the revitalized activity witnessed at DealMAX. Despite the setbacks of 2023, including lower private equity involvement and concerns over valuation alignment and closure timelines, there is an unmistakable upward trend in deal activity, particularly within the private equity and private credit sectors. With private credit markets robustly absorbing interest rate increases and leverage levels normalizing, the M&A landscape looks promising for the remainder of 2024 and onwards.

Source: Prequin 3

References

1. McKinsey: Top M&A trends in 2024: A blueprint for success

2. Pitchbook: Q1 2024 Global MA Report

3. Prequin Rate hikes bolster private credit’s allure in 2023 but weigh on most other private assets

Tags: private equity