M&A Activity Hits All Time High in 2021; 2022 Off to An Impressive Start!

Posted by | Nilesh Sharma

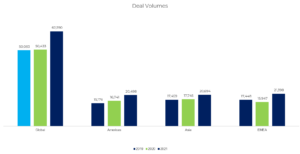

Global M&A activity reached an all-time high in 2021 – the number of deals topped over 62,000 while transaction volumes were an impressive US$5.1 trillion, according to data from service providers Dealogic and Refinitiv. The US market accounted for most of this activity with a transaction value of over US$2.9 trillion. While a large part of this elevated deal activity was driven by the pent-up demand from 2020 when deal activity hit historic low, favorable macroeconomic conditions such as low-interest rates, concerns over a potential increase in capital gains tax and a higher demand for technology and data-driven solutions contributed to increased transaction value and volumes. The number of large deals (deal value of US$5 billion or more) also increased as corporate, private equity and special purpose acquisition companies (SPACs) remained active.

Chart : Global & US deal value and volumes

Chart : Bubble Chart (Global, US, EMEA and Asia) 2021 deal values

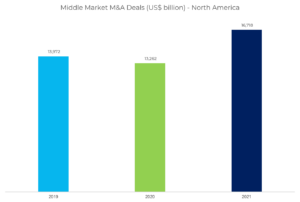

The US middle market too followed suit with private equity transaction value of over US$1.2 trillion through a record 8,600+ deals! Indeed, the ‘dry powder’ or unallocated capital available for deployment stood at US$2.3 trillion at the end of 2021, 14% higher than the previous year. The venture capital deal making activity more than doubled to over US$621 billion in 2021 from around US$290+ billion in the previous year, according to data from Pitchbook.

Chart : US middle market deal value and volumes

2022 has already started on a high note with over US$120 billion worth of large transactions announced in January 2022 alone! Microsoft’s US$69 billion acquisition of Activision Blizzard accounts for over half of this. The middle market space too remains active with companies actively looking to take advantage of elevated valuation levels.

At Fuld & Co, we work with bankers, M&A advisors and private equity firms helping them with market intelligence and transaction support. Talk to us to better understand emerging trends, sector and market updates and other deal and non-deal related marketing documentation support.

Tags: Equity and M&A Research, Financial Equity and M&A Research, M&A