Jab n Slim – How a Pen is Revolutionizing the Weight Loss Industry

Posted by | Michael Ratcliffe

Weight loss industry stakeholders brace for a revolution as Wegovy, Ozempic and other semaglutides pick up steam

A new market is emerging thanks to the introduction of a highly effective weight loss solution in the form of a handy injectable pen. Online pharmacies and weight loss websites are jumping on the sales bandwagon. Traditional weight loss services such as Weight Watchers are also responding by acquiring their own online channels to compete in this growing market.

However, the competition goes beyond just owning the sales channel. With a massive market at stake, valued anywhere from $80 billion to $224 billion, questions are arising, questions are arising about which segments of the market will be impacted the most. As a result, different players in the weight loss industry are becoming increasingly concerned about the potential impact.

What are the answers to the major competitive questions in this emerging market?

The background of semaglutide

Nearly 20 years ago the first glucagon-like peptide 1 (GLP-1), a class of Type 2 diabetes drug that improves blood sugar, was launched, creating what is today a market worth nearly $30B. In 2005, Amylin and Lilly received approval for GLP-1 Exenatide as a twice-daily injection for Type 2 diabetes under the brand name Byetta.

The approval was soon followed by multiple other GLP-1 launches, creating a hugely successful class of drugs. With the likelihood of diabetics also having cardiovascular and kidney complications, trials were run to see whether some GLP-1s were less likely to cause these serious secondary effects than others, resulting in some of them being withdrawn.

A significant issue for the early version of GLP-1 drugs was their short half-life, which meant daily or twice-daily injections. In 2017, when semaglutide, the first long-acting GLP-1, was approved, it was a significant breakthrough. Developed by the Danish biotech, Novo Nordisk (Novo), semaglutide only needed to be injected weekly and was launched in 2018 under the brand Ozempic.

Novo quickly followed in 2019 with a highly convenient daily oral approval, which was marketed under the brand Rybelsus. This pill version of semaglutide was accompanied by a highly aggressive TV marketing campaign including the jingle, “A1C, Down with Rybelsus” (A1C is a common measurement of blood sugar levels in diabetics). However, not only did Novo promote the convenience factor of Rybelsus for diabetics, but also the added benefit of its ability to help users lose weight and live their lives “to the fullest.”

The potential revolution of an easy solution to weight loss “in a pill” had arrived.

History repeats itself

This is not the first time a drug was launched initially to address a medical issue, only to discover side effects that were highly desirable during trials, creating an entirely new market. When Pfizer first developed sildenafil to treat hypertension and angina pectoris, their trial participants reported increased erections. Pfizer took quick action to patent and launch the drug, not for cardiovascular conditions, but as Viagra to treat erectile dysfunction (ED). In fact, it was not until seven years later, in 2005, that Pfizer backtracked and received approval to launch sildenafil for its original cardiovascular purpose, under the brand Revatio.

Similarly, Novo, upon discovering the weight loss side effect of their new diabetes drug, recognized its potential applicability to the massive weight loss market. This market was estimated to be worth over $80 billion, in addition to the $30 billion diabetes market.

With this one molecule, Novo Nordisk had the opportunity to target two huge markets with a combined value of over $100 billion.

Wegovy goes mainstream

By December 2020, Novo had further developed its move into the weight loss market when it received approval for its recombinant GLP-1, Saxenda, approved for chronic weight management, but this only provided marginal weight loss in trial. The real milestone was a year later in 2021 when Novo launched Wegovy, a rebranded version of Ozempic specifically designed, approved, and marketed for weight loss with double the weight loss potential of Saxenda.

The only difference between Wegovy and Ozempic is the approved maintenance dose. Wegovy’s weekly maintenance dose is 2.4 mg, while Ozempic’s is only 0.5 to 2 mg depending on its ability to provide glycemic control. Both, however, are semaglutides and injectable.

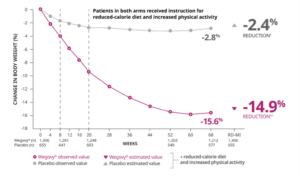

It is important to understand that Wegovy is officially approved for patients who need chronic weight management and have a Body Mass Index (BMI) greater than 30, whereas Ozempic is only approved for patients who have Type 2 Diabetes Mellitus. This means that for people who can get their doctors to prescribe Wegovy for weight loss, many could have the cost covered by their insurance plans. However, there are still plenty of people who are willing to pay out of pocket for semaglutide, despite the high price tag and, hence, could opt to pay for either Wegovy or Ozempic. With trials showing potential weight loss of 10% to 15%, for many, the price tag of $1,500 per month is well worth it.

While semaglutide presents a promising solution for weight loss, there are risks and downsides to consider. Firstly, it requires continuous use, as discontinuing its use can result in weight gain within a few months. Secondly, adverse events may occur. For example, clinical trials have shown that around 45% of patients taking Wegovy, a brand of semaglutide, experienced nausea, while a third experienced diarrhea and a quarter experienced vomiting and constipation. Furthermore, there are indications that GLP-1s may be linked to certain serious conditions, such as thyroid cancer, although this has only been observed in animal studies. However, it is worth noting that most of the side effects are temporary and usually subside within 3-5 weeks.

Change in BMI in Wegovy’s Clinical Trials

A Hollywood fad or here to stay?

Despite the high cost and potential side effects of semaglutide, there seems to be a significant interest among people looking for a quick solution to their weight problems, with weight loss clinics being flooded with patients wanting to try the drug. Many of these patients have learned about the drug through social media platforms such as TikTok. However, it should be noted that this is not a low-cost option, as insurance coverage for the therapy is often limited, leaving patients to pay out of pocket. Buying through online websites like GoodRX will set you back $1,000 per month for one prefilled pen of 2.0 mg if you get the Ozempic version or $1,400 per month for a pack of 4 prefilled pens of 2.4 mg Wegovy. That’s $12,000 to $16,000 a year!

For those desperate to lose weight, it is evident there is a growing number of people who are prepared to pay up. But how will this drug impact other areas of the weight loss industry and how are competitors and investors likely to respond?

Given that someone may already be paying over $10,000 annually for a GLP-1, it seems reasonable to assume they may not want to also pay for another weight loss program, especially if it doesn’t guarantee results. In contrast, a weekly injection of semaglutide using a convenient pen promises to deliver assured results. Additionally, patients can avoid spending several hours a week at the gym or workout club, as all they need to do is self-administer the injection once a week from the comfort of their own home.

In fact, the demand for semaglutide has become so great that Novo already has supply issues. For instance, they recently posted on their website:

- “We acknowledge the growing trend of weight-management telehealth providers, many of whom are advertising Wegovy. Novo Nordisk is not directly supplying Wegovy to any Telehealth providers.”

- “Pharmacies may experience normal delays given the time required to order the product from their local distribution center, and geographical variabilities. We encourage patients to contact their local pharmacy in advance to confirm when they will be able to fill their prescription.”

Where do semaglutides fit into the weight loss industry?

Private Equity investors are both interested and invested in the health and weight loss market, including nutrition supplements, lifestyle (diet) companies such as Weight Watchers, packaged food and beverage products that we see in supermarkets and drug chains, and the fitness industry, including fitness centers and products such as Peloton. Let’s also not forget the plethora of personal devices out there such as smartwatches and fitness trackers that keep track of the steps we take and the calories we’ve burned.

The medical industry also plays a role, with the bariatric weight loss surgery market valued at $668 million and growing, while reality TV shows such as “My 600lb Life” highlight the pain and suffering, both emotionally and physically, experienced by people who are morbidly obese.

Meanwhile, Big Pharma, observing the current success of GLP-1s such as Wegovy and Saxenda, is certainly going to continue to introduce newer, better, and faster products with fewer side effects, in the race to gain market share and fend off the generics. This will be no different than what we’ve already seen with ED drugs such as Viagra, Cialis and Stendra. The only difference here is that the size of the weight loss market is significantly greater since it includes all genders and ages.

Likely new competitors like Eli Lilly are on the cusp of launching a variation of their own diabetes drug, Mounjaro. Lilly’s chief scientific and medical officer, Daniel Skovronsky, readily admits, “Every program we do, we look at what our competitors have done, who’s done it the fastest, and then we set a goal to go even faster. Speed becomes our No. 1 incentive, which is hard because it’s a cultural change.”

It is no longer just the rich and famous and Hollywood celebrities who are taking semaglutide. It has gone mainstream. The rest of the weight loss industry needs to sit up, take note, and plan for the battle for market share.

Risks and opportunities for investors

According to research conducted by Morgan Stanley, obesity treatment could quickly become a top-12 global therapy—growing from a $2.4 billion category in 2022 to $54 billion by 2030. Equity analyst Mark Purcell from Morgan Stanley also believes the treatment of obesity is on the cusp of moving into mainstream primary care management, and analogized that to, quote, “a clear precedent for investors, is treatment for high blood pressure – going from a nascent category in the 1980s to a $30 billion market in the 1990s.”

A growth equity firm founded by a former Blackstone executive, WestCap, also recently invested $100 million dollars in a weight management startup called Found in early 2022. Found is now valued at $600 million dollars.

GLP-1s are having an impact on the $80 billion weight loss industry, but it’s unlikely that they will completely disrupt the market. The key questions are: which channels and which segments will be most affected? It will be interesting to see how investors, including private equity firms, approach their current portfolios and future acquisitions. Have they identified the right channel players to invest in and answered the segmentation question? Strategic buyers like Weight Watchers (WW) have wasted no time getting into the GLP-1 market by acquiring the digital platform Sequence.

There are critical questions that need to be addressed. Will others follow suit after Weight Watchers (WW) and invest in digital channels, moving away from the traditional weight loss market and hedging their strategies? Will pharmaceutical companies improve their game by getting approval for an oral version of GLP-1?

Stakeholders, including players and investors in the weight loss market, need to think about these questions and set up a monitoring program as we may be at the start of a major revolution. The fight for market share has only just begun, and as we saw during COVID, a percentage of the population distrusts big pharma and is unlikely to become consumers of GLP-1s, whether administered by a tiny needle or taken orally.

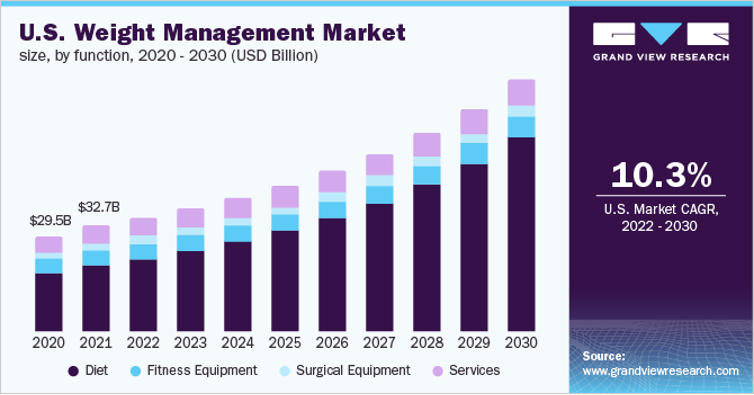

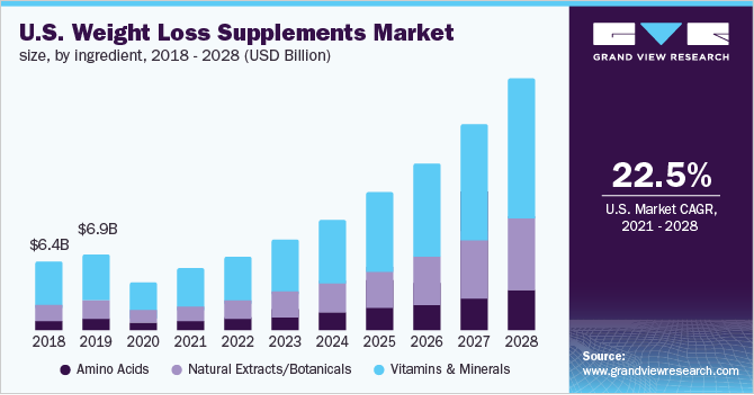

Market data on industry sub-segments:

US Weight Management Market 2018-2028

US Weight Loss Supplements Market

Tags: biomed, investments, Pharma, Pharmaceuticals, private equity