Is shell taking revenge after 115 long years?

Posted by | Fuld & Company

SHELL LNG BUNKERING

In 1910, the British Lords of the Admiralty made the momentous decision to whom they would award a major global contract for bunkers as they started to fit out their battleships to sail on fuel oil rather than coal. Shell’s founder, Marcus Samuel, was hoping to win this lucrative contract, but it went to the emerging Anglo-Persian Oil Company (now BP), much to his chagrin (see my book Liquid Gold Ships). Over a century later, Shell is now leading the marine world in building a new global bunkering network, but this time for LNG and without the help of any friendly naval power.

Only about 8% of the world’s current gross tonnage is fueled by LNG, but the order book tells a different story—35% of new ships are designed to run on LNG. Other low emissions fuels are far less important; 10% of new ships can run on methanol, 2% on electricity, and the remaining 3% on ammonia or hydrogen. However, nearly all of these alternative power systems have the flexibility to switch to fuel oil.

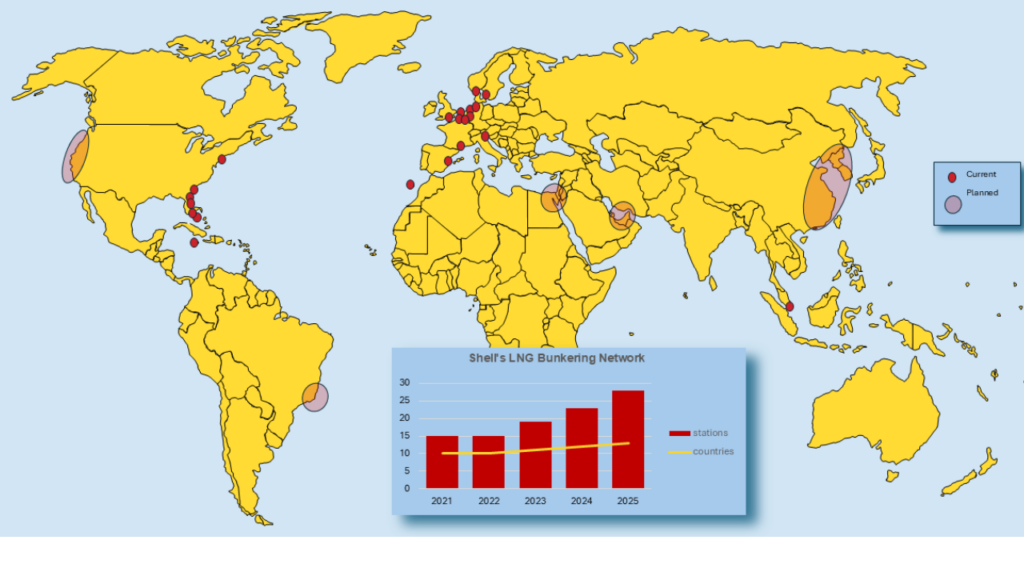

LNG tankers can use cargo boil-off as fuel, but other types of ships rely on LNG bunkers. To meet this exploding growth of LNG in both deep-sea and short-sea shipping, Shell has been expanding its bunkering network to accommodate a wide range of vessels, including containers and cruise ships and, with plans to serve tankers and bulk carriers in the future. Today, Shell operates the world’s largest LNG bunkering network, with 14 specialized barges – either owned or chartered – ranging in capacity from 3,000 m3 to 18,000 m3. These barges cover approximately 28 deep-sea ports, primarily along the US East Coast and in Europe. Singapore is the only station east of Suez, while two of these barges are designed specifically for inland bunkering. As Shell continues to strengthen its position in LNG, it is also exploring hydrogen and other alternative fuels, shaping the future of marine energy.

If your company is involved in powering the global shipping fleet, this development demands your attention. The transport market is increasingly recognizing LNG as an important bridge fuel in the transition from traditional diesel and fuel oil to a carbon-free world. With one of the four remaining major oil companies establishing what appears to be a dominant position, its essential to consider the potential competitive impact on your share of the marine market. Given Shell’s approach, it could become a key gatekeeper in this market.

Tags: alternative-fuels, maritime-energy-transition, Shell, shell bioLNG