How Private Equity is Faring During Tumultuous Times

Posted by | Nilesh Sharma

2022 PE performance amid market volatility

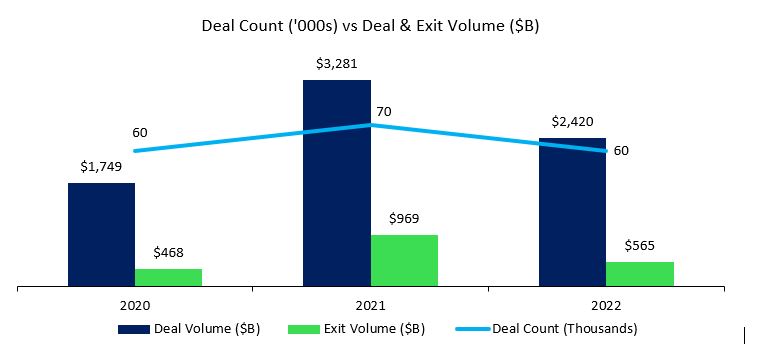

After a record-breaking 2021, in 2022 private equity (PE) deal volume fell to US$2.4tn while total deal count declined to just below 60,000. Despite this, 2022 emerged as the second best year on record for the private equity industry as buyout deal value stood at US$654bn versus US$1,012bn in 2021, exits were US$56bn in 2022 versus US$969bn in 2021, and fund raising at a respectable US$347bn in 2022 compared to US$413bn in 2021, according to global consulting firm Bain & Co.

Deal activity experienced a significant decline in the latter part of 2022 due to the aggressive interest rate hikes by central banks in response to mounting inflationary pressures. Consequently, public markets underwent a correction in valuations, leading to a reduction in lending by banks and investors. This pullback in lending, in turn, contributed to the decrease in both deal activity and transaction volumes.

Source: Bain & Co., Prequin, S&P Capital IQ, McKinsey, Global Private Equity Report 2023 | Bain & Company

Financial and equity markets follow suit

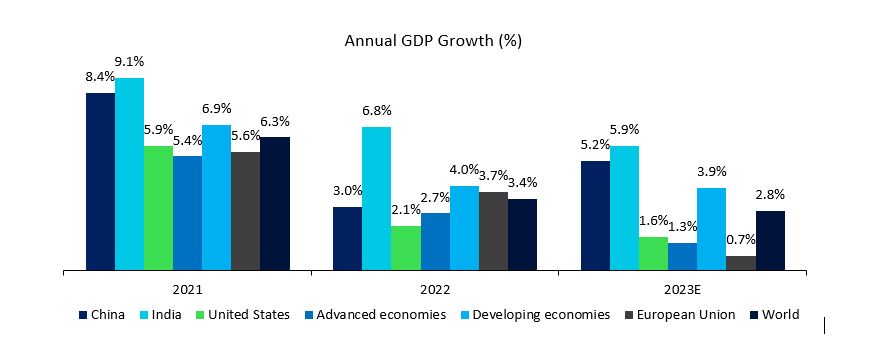

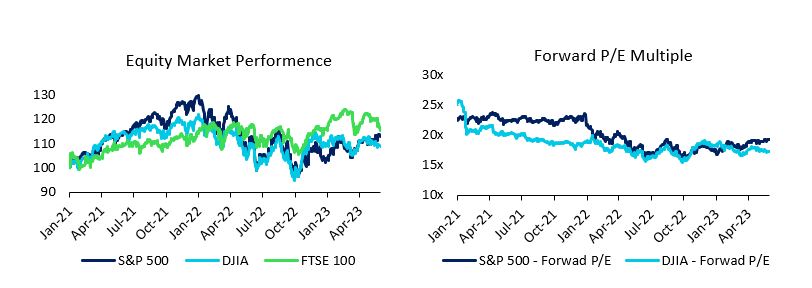

The global macroeconomic environment remains uncertain with headwinds emanating from the ongoing Russia-Ukraine conflict, financial market instability with a spate of bank failures in the US and a slowdown in the real economy. According to the IMF World Economic Outlook, the EU is projected to grow a dismal 1.3% in 2023 compared to 2.7% in 2022. Mirroring this trend, equity markets also fell from their historic highs. The benchmark Dow Jones Industrial Average (DJIA) index fell 11.4% and the S&P500 index fell 19.4% in 2022.

In Europe equity indices also fell, reflecting growing concerns over macroeconomic stability and falling corporate earnings. According to the US Bureau of Economic Analysis (BEA), corporate earnings fell 5.1% QoQ in Q1 2023 after falling 2.0% QoQ in Q4 2022.

Source: IMF World Economic Outlook, April 2023 World Economic Outlook (imf.org)

Source: S&P CapIQ

Reduced exit paths for PE firms

Against this backdrop, it appears that the available avenues for private equity firms and sponsors to exit their investments profitably have diminished. In fact, public company privatizations, a trend that was picking up during the period of easy liquidity, have come to a halt as banks hold back on financing some of these large transactions. Furthermore, the decline in Initial Public Offerings (IPOs) and Follow-On Public Offerings (FPO) has forced many private equity firms to hold on to investments they would otherwise have exited. In addition to retaining these investments, many PE firms have opted to mark down some of them and sell at a significant discount compared to their IPO prices.

Investment markdowns and discounted sales

On March 8, 2023 Blackstone Group, one of the world’s largest private equity firms, sold a 10% stake in the dating app Bumble Inc. (BMBL) for US$300m at US$22.80 per share, significantly lower than the gains it made during the IPO in 2021. Other large private equity firms such as Apollo Global and General Atlantic have also sold stakes in some of their portfolio companies at a discount, according to the Financial Times. Private equity groups sell stakes at discount on expectations valuations will stay low | Financial Times (ft.com)

Source: S&P CapIQ

While curtailing of the IPO and FPO window is one of the reasons private equity firms are finding it difficult to exit from some of their investments, sellers’ expectations is another key factor lowering deal activity. In the current market environment where multiples have come down significantly, sellers particularly in the middle market space (companies with market value of less than US$1bn) are less motivated to sell at lower valuations. Furthermore, corporate buyers or strategics (as they are known in the private investment market) are less willing to buy private equity owned assets and companies as they gear up for a period of slow economic growth and focus on preserving capital.

Dry powder and an FPO market revival?

Nonetheless, not everything is as dreary in the private investment world with many private equity firms raising funds and amassing a significant amount of undeployed capital, also known as “dry powder.” – A recent estimate (High PE Dry Powder Sustains Amid New Market Outlook | Allvue (allvuesystems.com) suggests that globally private equity firms held a formidable US$3.7tn in dry powder in 2022, which would need to be deployed opportunistically. Additionally, there are encouraging signs of the follow-on public offering (FPO) market picking up with PE investors raising over US$6.7bn year to date in 2023, as against US$6.3bn raised in all of 2022, according to the Financial Times. Private equity groups sell stakes at discount on expectations valuations will stay low | Financial Times (ft.com)

About Fuld & Co

Fuld & Co. is a leading research and intelligence agency that provides comprehensive solutions for middle-market focused firms globally. Our team of experts helps clients navigate the most complex market conditions, providing actionable insights for more informed decision-making, whether it is to acquire a new business, conduct due diligence, or assess exit opportunities. Contact us to discuss how we can help you with your next transaction.

Tags: Financial Equity and M&A Research, Financial Services, private equity