Customer Behavior, Risk, and Association Analytics for a Bank’s Credit Card Offerings

Posted by | Fuld & Company

A US-based bank expands its credit card customer base using data analytics to identify potential new customers with low default risk.

Objective

To identify potential customers to whom the bank could offer its credit cards while minimizing the default risk.

Approach

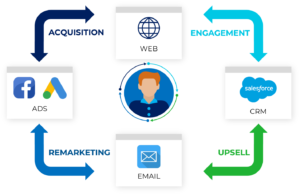

- Analyzed industry and competitor data through credit card consumer surveys to identify the target customer profile and

customers’ product usage behavior.

customers’ product usage behavior. - Identified association rules through market basket analysis and identified the financial products commonly used by credit card users.

- Leveraged rules (identified in previous step) and customer leads data (demographics such as education, income, and credit bureau score) to model potential lending risk for each lead.

Outcome

- The conversion rate for identified prospects exceeded 30%, with average spend of more than $500/month.

- The bank’s credit card penetration rate increased by 2.8 percentage points in the target region (Northeastern US).

Algorithms Used: Apriori algorithm, ensemble classification, and neural network

Tools

Tags: Banking, case study, Data analytics, Financial Services