Corporate Venture Capital News and Trends – September 2022

Posted by | Fuld & Company

Every month we publish the latest news and developments relating to Corporate Venture Capital (CVC).

If you would like a PDF version of this news please download here.

Corporate Venture Capital Market Summary

The following chart illustrates the number of deals that took place, how many Corporate Venture Capitalists took part, and the largest deal this past month.

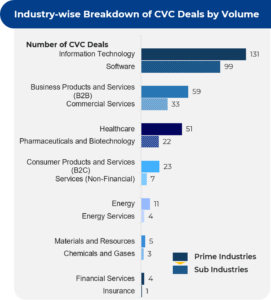

The number of deals that took place by industry is illustrated below.

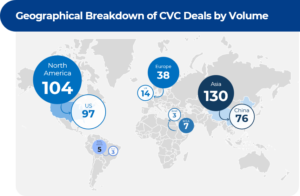

A breakdown of the number of deals by region shows that the highest number took place in North America (104) followed by Asia (130) and Europe (38). The US and China account for the most deals per country with 97 and 76 deals respectively.

The leading Corporate Venture Capitalists and the recipients of the funding are listed below.

Key Corporate Venture Capital News

A summary of the key Corporate Venture Capital news that has occurred over the past month is listed below.

09 August 2022

Frankfurt-based Gunzilla Games secures $46 million (CVC involved: Huobi Capital)

- Gunzilla Games, a AAA game studio, raises a total of $46 million in its latest investment round

- This investment round was led by Republic Capital. Other major participants included Griffin Gaming Partners, Animoca Brands, Jump Crypto, Raptor Group, CoinFund, Shima Capital, Dominance Ventures, GSR, Kucoin Labs, Spartan Investment Group, AlphaCrypto Capital, Blizzard, Digital Strategies, Morningstar Ventures, Gamegroove Capital, NGG, and Huobi Capital, which will also assist in maintaining the technical infrastructure of the project

- This new round of investment will allow the studio to build its new platform, GunZ, to empower players by granting them complete ownership over their in-game possessions

04 August 2022

Afresh secures $115 million in Series B funding and rolls out its fresh food technology to thousands of stores across the US (CVC involved: Maersk Growth)

- Afresh, a leading AI-powered fresh food technology provider raises $115 million in a Series B funding round

- Spark Capital led the round, and Insight Partners, VMG Partners, and Bright Pixel Capital also participated. Walter Robb, a senior executive partner at S2G Ventures and the former co-CEO of Whole Foods Market, also joined the round. All previous investors, including Maersk Growth, High Sage, and Innovation Endeavors, also participated, bringing the company’s total funding raised to date to $148 million

- Afresh will use the investment to set up more stores and expand the footprint of its Fresh Operating System, an AI-powered solution for unifying processes like forecasting, inventory management, ordering, and store operations. The company will also use the funding to grow its team and expand its operations in Europe

02 August 2022

Skyports closes its Series B funding round with a $3.13 million investment (CVC involved: ST Engineering Ventures)

- Leading drone services and advanced air mobility (AAM) vertiport developer Skyports receives over $3 million in additional capital from Singapore-based ST Engineering, increasing the total funds raised in its now-closed Series B funding round to $26.13 million

- Skyports closed the funding round with fresh investment from ST Engineering through its CVC unit, ST Engineering Ventures

- Skysports aims to generate sufficient funding to establish itself as a leading drone services provider, aerial consultancy, and builder of vertiports that will be used in AAM services such as air taxis, which are expected to begin operations as early as 2024

02 August 2022

Indian EV startup River raises $11 million to launch electric scooter by 2023 (CVC involved: Toyota Ventures)

- River, a Bengaluru-based electric scooter startup, raises $11 million in a Series A funding round

- The funding round was led by Chris Sacca’s Lowercarbon Capital, with participation from Toyota Ventures

- With this funding, River plans to expand its team, invest in R&D, set up a manufacturing facility, and get its first product ready for sale by early 2023

25 July 2022

Cleerly raises $192 million in a funding round led by T. Rowe Price and Fidelity (CVC involved: Cigna Ventures)

- Cleerly, a New York-based health tech start-up, raises $192 million in a Series C financing round

- Investment firms T. Rowe Price (TROW.O) and Fidelity Management & Research Company LLC led the funding round. Mirae Asset Capital, Cigna Ventures, Piper Sandler’s Merchant Banking, Sands Capital, and venture capitalist Peter Thiel also participated

- This funding round will enable Cleerly to expand its team and commercial reach to increase patients’ and physicians’ access to its comprehensive technology-enabled care pathway

25 July 2022

Everside Health bags $164 million in growth equity funding (CVC involved: Endeavor Catalyst)

- Everside Health, LLC, a leading direct primary care provider, raises $164 million in growth equity funding

- Everside’s longstanding investor New Enterprise Associates, Inc. (NEA), a global venture capital firm that invests in transformational healthcare and technology companies, its previous investors (including Oak HC/FT and Alta Partners), and nine new investors (including Endeavor Catalyst) joined the funding round

- The company intends to use the funds to explore potential M&A opportunities and enhance its technology stack. The investment will enable Everside Health to embed additional mental health professionals into its health centers as well as advance its technology capabilities to drive improved clinical outcomes

20 July 2022

TAE Technologies raises $250 million in Series G-2 financing round (CVC involved: Chevron Technology Ventures)

- California-based Tae Technologies raises $250 million in a Series G-2 financing round to build the next fusion machine

- The investment round saw the participation of a new investor, Chevron Technology Ventures, along with existing investors Google, Reimagined Ventures, Sumitomo Corporation of Americas, and TIFF Investment Management

- TAE Technologies intends to use the funds for the construction of its next research reactor, Copernicus, which is designed to demonstrate the viability of achieving net energy generation with the company’s advanced beam-driven field-reversed configuration (FRC)

20 July 2022

China-based car chip start-up SiEngine obtains $148 million in Series A round (CVC involved: Boyuan Capital)

- SiEngine Technology Co, a start-up focused on advanced automotive system-on-a-chip designs, has raised nearly $148.2 million (1 billion yuan) in a Series A funding round

- Sequoia Capital led the investment round, and other participating investors included Shanghai Guosheng Capital, Hundreds Capital, Cedarlake Capital, YUE XIU Industrial Investment Fund Management, ICBC International, and Neusoft Capital

- The fresh capital will allow SiEngine to focus on research and development of powerful vehicle-grade computer chips

For a PDF copy please download: Corporate Venture Capital News – September 2022.