Corporate Venture Capital News and Trends – October 2022

Posted by | Fuld & Company

Every month we publish the latest news and developments relating to Corporate Venture Capital (CVC).

If you would like a PDF version of this news please download here.

Corporate Venture Capital Market Summary

The following chart illustrates the number of deals that took place, how many Corporate Venture Capitalists took part, and the largest deal this past month.

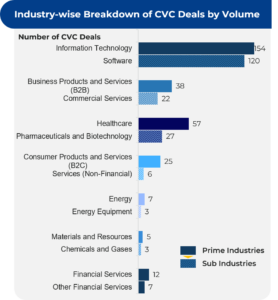

The number of deals that took place by industry is illustrated below.

A breakdown of the number of deals by region shows that the highest number took place in North America (111) followed by Asia (100) and Europe (65). The US and China account for the most deals per country with 104 and 57 deals respectively.

The leading Corporate Venture Capitalists and the recipients of the funding are listed below.

Key Corporate Venture Capital News

A summary of the key Corporate Venture Capital news that has occurred over the past month is listed below.

14 September 2022

California-based Verkada raises $205 million in a Series D funding round (CVC involved: Next47)

- Verkada, a provider of a cloud-managed enterprise building security and management platform, has raised $205 million in a Series D funding round. Since its founding in 2016, Verkada has raised more than $360 million in funding and has reached a $3.2 billion valuation after the latest funding round.

- Linse Capital led the funding round, with participation from MSD Partners, L.P., Felicis Ventures, Next47, Sequoia Capital, Meritech Capital and First Round Capital.

- The company intends to use the funds to enhance its existing offerings, develop new product lines, hire across all functions and continue its geographic expansion.

- Since its last funding in January 2020, Verkada has quadrupled both its customer count and team size and set up six new offices. In the last twelve months, it has expanded its team by 68%, set up three new offices and nearly doubled its total revenue year over year.

08 September 2022

Cryptocurrency start-up Mysten Labs raises $300 million to onboard users to Web3 (CVC involved: FTX Ventures, Dentsu Ventures)

- Mysten Labs, a Web3 infrastructure company and developer of the Sui Layer 1 blockchain, has raised $300 million in a Series B funding round and reached a valuation of over $2 billion.

- FTX Ventures led the funding round with contributions from Binance Labs, Coinbase Ventures, Circle Ventures, Lightspeed Venture Partners, Jump Crypto, Sino Global, Dentsu Ventures, Greenoaks Capital, O’Leary Ventures and the crypto wing of Andreessen Horowitz. Mysten Labs also raised $36 million in a Series A funding round led by the crypto wing of Andreessen Horowitz in December 2021.

- The company plans to use the funds to develop the infrastructure needed to support Web3’s upcoming apps and accelerate the uptake of the Sui ecosystem, with a key focus on the Asia-Pacific region.

- Sui is regarded as one of the newest generation of Layer 1 blockchains and gives significant competition to earlier blockchains such as Ethereum, Solana and Avalanche.

06 September 2022

Arsenal Biosciences bags $220 million in a Series B financing round to advance programmable cell therapy programmes into clinical development (CVC involved: Hitachi Ventures)

- Arsenal Biosciences, Inc. (ArsenalBio), a privately held programmable cell therapy company that engineers advanced chimeric antigen receptor (CAR)-T cell therapies for solid tumours, has raised $220 million in a Series B financing round.

- Softbank Vision Fund 2, the Bristol-Myers Squibb Company, Byers Capital, Emerson Collective Investments, Green Sands, Hitachi Ventures, Sixth Street, the Parker Institute for Cancer Immunotherapy (PICI), Westlake Village BioPartners, the University of California, San Francisco (UCSF) Foundation Investment Company, Euclidean Capital, Waycross Ventures and Kleiner Perkins participated in the funding round.

- The company will use the proceeds to expand its programmable cell therapy research activities and grow its pipeline of therapies and drugs for solid tumour malignancies across a range of cancer indications.

06 September 2022

Finland-based VR-tech company Varjo raises $40 million in a Series D funding round (CVC Involved: Volvo Car Tech Fund)

- Varjo, a provider of professional-grade virtual and extended reality (VR/XR) hardware and software, has raised $40 million in a Series D funding round, which brings its total funding since 2017 to $163 million.

- EQT Ventures, Atomico, Volvo Car Tech Fund, Lifeline Ventures, Mirabaud and Foxconn participated in the round.

- It will use the funds to continue the R&D efforts for its headsets and develop software applications and tools for Varjo Reality Cloud, a streaming platform that it launched earlier this year. It will also scale its software and hardware offerings across new enterprise verticals such as design and manufacturing, engineering, education and healthcare.

- As per its CEO, Varjo is the first and only company in the world to deliver human-eye resolution virtual and mixed reality technology to enterprises.

01 September 2022

Switzerland-based FoodTech start-up Planted raises $70 million in a Series B funding round (CVC involved: Vorwerk Ventures and Tengelmann Ventures)

- Planted, a FoodTech start-up known for its clean-label bio-structured meat has raised $70 million in a Series B financing round.

- L Catterton, the largest global consumer-focused private equity firm, led the round, along with Vorwerk Ventures, re: food, Movendo, Be8 Ventures, ACE, ETH Foundation, Yann Sommer and a new investor, Tengelmann Ventures.

- Planted will use the funds to launch its new whole-cut line of products, including chicken breasts, further its international expansion and increase its production capacity.

- The company raised around $40 million in 2021 and recently announced that it has doubled its production capacity from 500kg to over a tonne per hour.

29 August 2022

Blockchain gaming company Limit Break secures $200 million in a funding round (CVC involved: FTX Ventures)

- Limit Break, a Park City, Utah-based gaming company known for its DigiDaigaku non-fungible tokens (NFT) collection, has raised $200 million in a funding round.

- Buckley Ventures, Standard Crypto and Paradigm Ventures led the funding round, and other investors such as FTX Ventures, Coinbase Ventures, Anthos Capital, SV Angel and Shervin Pishevar also participated.

- The proceeds from the funding will be used to build massive multiplayer online (MMO) web3 video games.

- The company also plans to introduce “Free-to-Own,” a new gaming model that will replace the existing “Play-to-Earn” and “Free-to-Play” models and allow users to mint genesis NFTs that will not require them to pay any fee.

22 August 2022

Saudi Arabia-based buy-now-pay-later (BNPL) fintech start-up Tamara raises $100 million in a Series B equity round (CVC involved: Endeavor Catalyst)

- Tamara, a leading payments start-up focused on driving financial inclusion across the Middle East, has raised $100 million in a Series B equity round, bringing the total funding since its inception to $216 million in equity and debt.

- Sanabil Investments, a wholly owned subsidiary of the Public Investment Fund (PIF), participated in the round, along with Coatue, Shorooq Partners, Endeavor Catalyst and global fintech company Checkout.com.

- Tamara plans to leverage the funding to expand its product offerings across payments and shopping services and expand into new markets.

- The company has acquired more than 3 million customers, witnessed a 10x year-on-year revenue growth and onboarded over 4,000 partner merchants, including leading global and regional brands such as IKEA, SHEIN, Adidas, Namshi and Jarir plus, as well as local SMEs.

19 August 2022

China-based Porton Advanced Solutions obtains $80 million for its gene and cell therapy (GCT) contract development and manufacturing organization (CDMO) operations (CVC involved: Fosun Health Capital and Momentum Venture)

- Porton Advanced Solutions, a Suzhou, China-based provider of GCTs, which has an integrated CDMO platform to help bring new therapies to patients, has raised $80 million in a Series B financing round.

- China Merchants Groups’ healthcare private equity fund Merchant Health and its sister funds China Merchants Capital and China Merchants Securities Investments led the funding round. Venture and private equity firms such as Fosun Health Capital, Gortune Investment, SDICTK, Porton Pharma Solutions, CS Capital, HM Capital, Ruilian Investment and Momentum Venture also participated.

- The company will use the proceeds to continue its business expansion into different markets, with investment in core manufacturing infrastructures and global commercial operations.

For a PDF copy please download: Corporate Venture Capital News – September 2022.