Corporate Venture Capital News and Trends – November 2022

Posted by | Fuld & Company

Every month we publish the latest news and developments relating to Corporate Venture Capital (CVC).

If you would like a PDF version of this news please download here.

Corporate Venture Capital Market Summary

The following chart illustrates the number of deals that took place, how many Corporate Venture Capitalists took part, and the largest deal this past month.

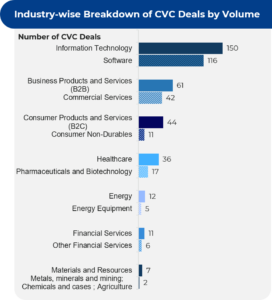

The number of deals that took place by industry is illustrated below.

A breakdown of the number of deals by region shows that the highest number took place in North America (128) followed by Asia (99) and Europe (74). The US and China account for the most deals per country with 123 and 51 deals respectively.

The leading Corporate Venture Capitalists and the recipients of the funding are listed below.

Key Corporate Venture Capital News

A summary of the key Corporate Venture Capital news that has occurred over the past month is listed below.

11-Oct-2022

Global fintech platform Airwallex bags $100 million in a Series E extension (Series E2) round (CVC involved: Salesforce Ventures)

- Airwallex, an Australia-based cross-border payments start-up, has obtained $100 million in a Series E extension round. The funding places the company’s valuation at $5.5 billion

- Existing investors Square Peg, Salesforce Ventures, Sequoia Capital China, Lone Pine Capital, Hermitage Capital, 1835i Ventures and Tencent participated in the round and were joined by Australian superannuation fund HostPlus and an unnamed North American pension fund

- The new funding will allow Airwallex to continue to expand its operations and business reach. The company has planned to launch multiple new products and services as part of its 2022-23 roadmap, which includes making improvements to its expense management platform and launching a credit solution

- The customer base of the company has more than doubled and revenue has increased by 184% year-over-year

06-Oct-2022

Supply chain tech start-up Altana Technologies raises $100 million in Series B round (CVC involved: GV)

- New York-based Altana Technologies has raised $100 million in a Series B investment round

- Activate Capital led the round, and other participants included OMERS Ventures, Prologis Ventures, Reefknot Investments and Four More Capital. Existing investors GV (Google Ventures), Amadeus Capital Partners, Floating Point and Ridgeline Partners also joined the round

- Altana will use the proceeds to develop new software capabilities. It also plans to expand its workforce to 110 employees by the end of 2022 to support its growth initiatives

- The company offers Altana Atlas, a software platform that organizations can use to monitor their supply chains. The platform is powered by an artificial intelligence model that processes billions of data points

06-Oct-2022

Green iron company Electra secures $85 million to electrify steelmaking (CVC involved: BHP Ventures)

- Electra has raised $85 million to produce Low-Temperature Iron (LTI) from commercial and low-grade ores using zero-carbon intermittent electricity

- The company is backed by investors such as Breakthrough Energy Ventures, Amazon, BHP Ventures, Temasek, S2G Ventures, Capricorn Investment Group, Lowercarbon Capital, Valor Equity Partners and Baruch Future Ventures

- The funds raised are primarily aimed at decarbonizing iron and steelmaking

- Electra has created a novel process to electrochemically refine iron ore into pure iron at 60 degrees Celsius using renewable electricity and then convert the iron into steel using the existing infrastructure of electricity-powered arc furnaces. By comparison, 69% of steel today is made at approximately 1,600 degrees Celsius using coal, emitting about two tonnes of carbon dioxide for every tonne of steel produced

29-Sep-2022

Israel-based Ox Security raises $34 million in seed funding (CVC involved: M12)

- Ox Security, an Israel-based software supply chain security solutions provider, has raised $34 million in seed funding

- The seed round was led by Evolution Equity Partners, Team8 and M12 and witnessed participation from Rain Capital

- The company plans to use this capital to double its headcount of 30 by the end of 2023, accelerate its growth and expand its operations and business reach

28-Sep-2022

California-based Moxion Power bags $100 million in Series B Funding (CVC involved: Enterprise Holdings Ventures)

- Moxion Power, a Richmond, California-based manufacturer of clean, mobile energy storage technology, has raised $100 million in Series B funding

- Tamarack Global led the round, which saw participation from Energy Impact Partners, Sunbelt Rentals, Amazon’s Climate Pledge Fund, Microsoft’s Climate Innovation Fund, Enterprise Holdings Ventures, Marubeni Ventures, Suffolk Technologies and Rocketship.

- The company intends to use the funds to scale the production at its first two domestic manufacturing facilities to meet the increasing demand for its mobile energy storage products

26-Sep-2022

Paris-based online food delivery solution Not So Dark raises $80 million in Series B funding round (CVC involved: Conviviality Ventures)

- Not So Dark, a start-up offering restaurants a digitised ordering system, has secured $80 million in Series B funding, which has taken the total funds raised by the company so far to $105 million

- Kharis Capital and Verlinvest led the funding round, with participation from Conviviality Ventures

- The company plans to use the funds to expand its virtual food delivery franchise model across Europe

- Currently, the company operates in 100 cities and has a portfolio of 150 partners

23-Sep-2022

Neuromorphic vision start-up Prophesee raises $48 million in Series C investment round (CVC involved: Prosperity7 Ventures and Robert Bosch Venture Capital)

- Paris-based start-up Prophesee has secured $48 million in a Series C funding round, which takes the total funding raised by the company since 2014 to $127 million

- Prosperity7 Ventures led the round, and existing investors Sinovation Ventures, Xiaomi, Intel Capital, Robert Bosch Venture Capital, 360 Capital, iBionext, and the European Investment Bank also participated

- The company plans to utilize the funding to accelerate the development and commercialisation of AI-enabled neuromorphic vision solutions in the smartphone, industrial and consumer markets

21-Sep-2022

Mainspring closes Series E funding round at $290 million (CVC involved: Shell Ventures)

- Clean power generation company Mainspring Energy Inc. has raised $290 million in a Series E financing round

- Lightrock led the funding round. Other participants included new investors such as Canada Pension Plan Investment Board (CPP Investments), Shell Ventures, Hanwha Power Systems, etc., as well as existing investors such as Khosla Ventures, Bill Gates, Fine Structure Ventures and Princeville Capital

- Mainspring will leverage the funds raised to expand business operations and scale the manufacturing of its innovative clean energy generators for commercial, industrial and grid-side customers

For a PDF copy please download: Corporate Venture Capital News – November 2022.