Corporate Venture Capital News and Trends – May 2022

Posted by | Fuld & Company

Every month we publish the latest news and developments relating to Corporate Venture Capital (CVC).

If you would like a PDF version of this news please download here.

Corporate Venture Capital Market Summary

The following chart illustrates the number of deals that took place, how many Corporate Venture Capitalists took part, and the largest deal this past month.

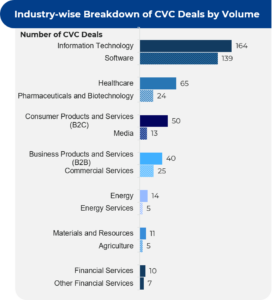

The number of deals that took place by industry is illustrated below.

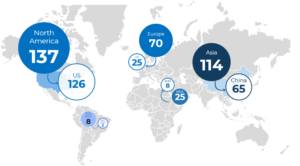

A breakdown of the number of deals by region shows that the highest number took place in North America (137) followed by Asia (114) and Europe (70). The US and China account for the most deals per country with 126 and 65 deals respectively.

The leading Corporate Venture Capitalists and the recipients of the funding are listed below.

Key Corporate Venture Capital News

A summary of the key Corporate Venture Capital news that has occurred over the past month is listed below.

22 April 2022

Yuga Labs, the parent company of Bored Ape Yacht Club, secures $450 million in the seed round (CVC involved: Coinbase Ventures)

- Miami-based NFT firm Yuga Labs, has raised $450 million in funding at a $4 billion valuation

- The funding round was led by the venture capital firm Andreessen Horowitz. Other investors that participated in the round include Animoca Brands, Coinbase, LionTree, Thrive Capital, Sound Ventures, FTX Trading Ltd., and Monday

- The company aims to use the funds to hire new employees in its development team and for joint ventures and partnership

14 April 2022

Pax8 obtains $185 million to accelerate innovation and continue expansion into new markets (CVCs involved: SoftBank Vision Fund 2 and Liberty Global Ventures)

- Cloud commerce marketplace Pax8 has secured $185 million in a funding round, reaching a $1.7 billion valuation

- SoftBank Vision Fund led the funding series, with additional contributions from existing investors such as Catalyst Investors, Sageview Capital, Blue Cloud Ventures, and Liberty Global Ventures

- The new investment will provide capital to the company to accelerate innovation and continue its expansion into new global markets

- Pax8 has more than 200,000 business clients and 20,000 managed services partners. The platform simplifies the IT buying experience for small and medium-sized businesses through the IT channel ecosystem and solves challenges related to billing and provisioning through the automation of processes

12 April 2022

Philippines-based Voyager Innovations raises $210 million (CVCs involved: PLDT Capital and Tencent venture capital)

- Voyager Innovations, the owner of FinTech platform PayMaya and neobank Maya Bank, has achieved a unicorn status after raising $210 million

- The funding round was led by SIG Venture Capital, with participation from EDBI and First Pacific Company, as well as existing shareholders such as PLDT Capital, KKR, Tencent Venture Capital, International Finance Corporation and IFC Emerging Asia Fund, and IFC Financial Institutions Growth Fund (two funds managed by the IFC Asset Management Company)

- The funds will be used to launch Maya Bank services, including savings and credit products, through PayMaya, which has over 47 million registered users

- At the end of March 2022, PayMaya had over 47 million registered users across its consumer platforms (more than two-thirds of the adult population in the Philippines). It is the leading non-bank enterprise payments processor in the Philippines, enabling over 630,000 digital payments from e-wallets and QR to any credit, debit, and prepaid card

11 April 2022

Germany-based start-up 1Komma5 Grad bags $217.2 million in Series A financing (CVC involved: Porsche Ventures)

- 1Komma5 has raised $217.2 million (€200 million) in a Series A funding round to support its plan to equip 1.5 million buildings across Europe with carbon-neutral technology for electricity, heating, and mobility by the end of 2030

- The financing was provided by eCapital, BTOV Ventures, Porsche Ventures, French Eurazeo, Blue Elephant Ventures, and the Haniel and Schuerfeld families

- The capital will be used for acquisitions, investments in digitalization, and the development of 1Komma5’s energy IoT platform

- The company has sold and installed about 35,000 carbon-neutral energy systems in total. It generated $24.6 million (€23 million) in revenue in the second half of 2021

06 April 2022

Bengaluru-based VerSe Innovation raises $805 million in Series J funding round (CVC involved: Sumeru Ventures)

- VerseSe Innovation, the parent firm of news aggregator app Dailyhunt and short video app Josh, has obtained $805 million as part of a Series J funding round. With this new investment, the company’s valuation has reached $5 billion

- The funding round was led by existing investor Canada Pension Plan Investment Board (CPPIB). New investors such as Ontario Teachers’ Pension Fund, Luxor Capital, and Sumeru Ventures and existing backers such as Sofina Group, Baillie Gifford, etc., also participated in this round

- VerSe Innovation aims to deploy parts of the new capital to strengthen its artificial intelligence, machine learning, and data science capabilities for better user engagement, retention, and monetization. It also plans to invest in new areas, such as live streaming and Web 3.0, to expand its monetization capabilities

- VerSe Innovation has three key consumer technology platforms: Dailyhunt, Josh, and PublicVibe. Dailyhunt has over 350 million users, Josh (its short video platform) has 150 million monthly active users, and PublicVibe (a hyperlocal video platform) has over five million monthly active users

23 March 2022

RapidAPI secures $150 million financing at a $1 billion valuation (CVCs involved: SoftBank Vision Fund 2 and M12)

- California-based RapidAPI has received $150 million in a Series D funding round. With this funding, the company has attained a unicorn status

- The round was led by new investor SoftBank Vision Fund 2, with participation from Qumra and the company’s existing investors, including Andreessen Horowitz, M12 (Microsoft’s Venture Fund), Viola Growth, Green Bay, Grove Ventures, and Stripes

- The funding will help expand the capabilities of the company’s API Hub and support the growing demand for RapidAPI Enterprise Hub deployments

- RapidAPI has become the world’s largest API Hub, where over 4 million developers find, test, connect and collaborate on APIs. It almost tripled the number of enterprise deployments in 2021 and plans to continue growing at that rate in 2022

23 March 2022

Cincinnati-based start-up Astronomer receives $213 million in Series C round (CVC involved: Salesforce Ventures)

- Cincinnati-based tech start-up Astronomer has grabbed $213 million in Series C funding, bringing its total funding to $300 million

- The funding round was led by Insight Ventures. Other investors included Meritech Capital, Salesforce Ventures, J.P. Morgan, K5 Global, Sutter Hill Ventures, Venrock, and Sierra Ventures

- The company plans to use the new funding to grow its engineering and customer success teams and scale its go-to-market operations, as well as for technological development

- Astronomer is the developer of a modern data orchestration platform powered by Apache Airflow, which enables data teams to increase the availability of trusted data. It has increased its headcount 10x since 2020, now exceeding 250 global employees

17 March 2022

Gadget-rental start-up Grover raises $330 million in Series C funding round (CVC involved: Assurant Ventures)

- Berlin-based consumer tech subscription platform Grover has raised $330 million in Series C funding

- Energy Impact Partners led the equity portion of the Series C funding. Other participants included Co-Investor Partners, Korelya Capital, LG, Mirae Asset Group, and previous backers such as Viola Fintech, Assurant, and comparison. Fanara Capital provided the debt

- Grover plans to leverage the funding to expand its device stock as it prepares for increased user growth. It also plans to develop more tools and financial services to personalize the user experience and encourage more business on its platform through schemes such as loyalty programs

- The company rents out electronics such as computers, gaming consoles, and smartphones, which are refurbished and rented again to new users. Its circular economy model aims to reduce e-waste by optimizing the use of electronic devices. It currently has 2 million registered users, 500k active subscribers, and 250k active customers

For a PDF copy please download: Corporate Venture Capital News – April 2022.