Corporate Venture Capital News and Trends – March 2022

Posted by | Fuld & Company

Every month we publish the latest news and developments relating to Corporate Venture Capital (CVC).

If you would like a PDF version of this news please download here.

Corporate Venture Capital Market Summary

The following chart illustrates the number of deals that took place, how many Corporate Venture Capitalists took part, and the largest deal this past month.

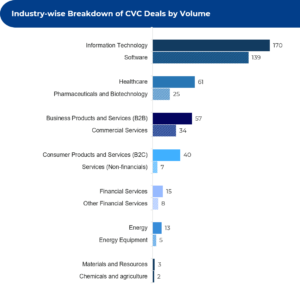

The number of deals that took place by industry is illustrated below.

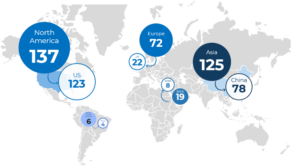

A breakdown of the number of deals by region shows that the highest number took place in North America (137) followed by Asia (125) and Europe (72). The US and China account for the most deals per country with 123 and 78 deals respectively.

The leading Corporate Venture Capitalists and the recipients of the funding are listed below.

Key Corporate Venture Capital News

A summary of the key Corporate Venture Capital news that has occurred over the past month is listed below.

18-FEB-2022

Hong Kong Asia Medical Group bags $400 million in Series D funding round (CVC involved: Country Garden Venture Capital)

- Hong Kong Asia Medical Group, one of China’s biggest cardiovascular medical service providers, has secured around $400 million in Series D funding round

- New investors including Country Garden venture capital, Primavera Capital Group, Taikang Life Insurance, ICBC International, ABC International, BOCOM International, Hudson Bay Capital and Sherpa Venture Capital participated in the round and existing investors including Legend Capital and General Atlantic also increased their holdings

- The funding round is being considered a major valuation booster for the company’s expected IPO launch in 2022

- Hong Kong Asia Medical Group has its three main facilities in mainland China, including two in the central city of Wuhan and one in the Western Xinjiang region. It manages close to 3,000 hospital beds and has partnerships with multiple top cardio hospitals in China

15-FEB-2022

Paper Education Company secures $270 million in Series D round (CVC involved: Salesforce Ventures, SoftBank Vision Fund 2)

- Montréal-based EdTech start-up Paper has secured $270 million in Series D capital, which brings its total funding raised to date to around $390 million

- The investment round was led by two new investors, Sapphire Ventures and SoftBank Vision Fund 2. Existing investors who participated in this round include Institutional Venture Partners, Salesforce Ventures, Framework Venture Partners, Bullpen Capital, Reach Capital, Red House Education, and BDC Capital

- The company intends to use the funds to accelerate growth and expand its operations

- The company partners with K-12 schools throughout the US and Canada to provide an educational support system that includes unlimited 24/7 homework help, writing feedback, study support, etc.

09-FEB-2022

Compute North obtains $385 million in Series C Funding Round (CVC involved: National Grid Partners)

- Eden Prairie-based Compute North has received $385 million in the latest funding round, which includes $300 million in debt financing and $85 million in equity

- The fundraising round was co-led by Mercuria and Generate Capital with additional investors including National Grid Partners

- The company will leverage this fund for continued development of the new US-based data centres and opening of hosting facilities in the US, including at Nebraska, North Carolina, and Texas

- Compute North delivers the most sustainable, cost-effective computing in the world. The company provides efficient, highly scalable infrastructure for clients in the blockchain, cryptocurrency mining and distributed computing space

27-JAN-2022

Fireblocks raises $550 million in Series E funding (CVC involved: CapitalG)

- Digital asset infrastructure start-up Fireblocks has raised $550 million in Series E funding round, which brings the company’s total funding till date to over $1 billion and puts it at a valuation of $8 billion. With this, Fireblocks has become the highest valued digital asset infrastructure provider to date

- The funding round was led by D1 Capital Partners and Spark Capital and witnessed participation from new investors including General Atlantic, Index ventures, Mammoth, CapitalG, Altimeter, ICONIQ Strategic Partners, Canapi Ventures and Parafi Growth Fund. The existing investors who participated are Sequoia Capital, Coatue, Ribbit, Bank of New York Mellon, Paradigm, DRW Venture Capital, Tenaya Capital and SCB10x

- The company plans to use the new funding to support clients globally and invest in innovation in the areas of DeFi, NFTs and payments

- Fireblocks is an enterprise-grade platform that supports over 800 major institutions and delivers a secure infrastructure to users for moving, storing, and issuing digital assets

26-JAN-2022

E-commerce delivery platform Paack raises $225 million for expansion in Europe (CVC involved: SoftBank Vision Fund 2, Endeavor Catalyst)

- Barcelona-based e-commerce delivery start-up Paack has secured Series D funding of $225 million, which brings its total funding raised to date to $307.9 million (€273 million)

- The financing round was led by SoftBank Vision Fund 2. New investors including InfraVia Capital Partners, First Bridge Ventures and Endeavor Catalyst participated in the round. The round also witnessed participation from existing investors including Unbound, Kibo Ventures, Big Sur Ventures, RPS Ventures, Fuse Partners, Rider Global and Castel Capital

- The start-up plans to leverage the fund for launching new technologies, expanding across Europe and implementing targeted practices to achieve its sustainability targets

- Paack uses its proprietary technology stack and operational excellence in servicing time slot deliveries with a strong focus on the end customer

24-JAN-2022

Indian food delivery start-up Swiggy raises $700 million in Series K round (CVC involved: Prosus Ventures, Sumeru Ventures)

- Swiggy, a seven-year-old food delivery start-up of India, has raised $700 million in Series K financing round. The funding places the company’s valuation at $10.7 billion

- The round was led by Invesco, along with participation from new investors Baron Capital Group, Sumeru Ventures, IIFL AMC Late Stake Tech Fund, Kotak, Axis Growth, Sixteenth Street Capital, Ghisallo, Smile Group and Segantii Capital. Existing investors who participated in the round include Prosus Ventures, Alpha Wave Global, Qatar Investment Authority and ARK Impact

- The investment will be deployed heavily for the expansion of its express grocery delivery business ‘Instamart’ and further strengthening of its food-delivery business

- Swiggy is an Indian online food ordering and delivery platform with operations in more than 800 cities. It has also forayed into the quick-commerce vertical with the launch of online grocery delivery service Instamart

19-JAN-2022

Password management platform 1Password raises $620 million in Series C round (CVC involved: Salesforce Ventures)

- 1Password, developed by AgileBits, has closed a $620 million Series C funding round that has taken its total funding raised to date to $920 million and valuation at $6.8 billion, making it one of Canada’s most valuable tech companies

- The investment round was led by ICONIQ Growth and witnessed participation from Tiger Global, Lightspeed Venture Partners, Backbone Angels, Accel, Salesforce Ventures and other individual investors

- 1Password plans to use its newly raised funds to drive continued growth, increase hiring in its engineering and customer support teams, make strategic acquisitions and accelerate its product development initiatives

- 1Password provides users a place to store various passwords, software licenses and other sensitive information in a secure virtual vault

17-JAN-2022

French start-up Exotec raises $335 million in Series D round (CVC involved: Dell Technologies Capital)

- Exotec, a provider of automated warehouse solutions, has secured $335 million in Series D funding, taking its valuation to $2 billion

- The round was led by Goldman Sachs’ Growth Equity and witnessed participation from new investors including 83North and Dell Technologies Capital. The existing Exotec investors who invested in this round are Bpifrance, Iris Capital, Lime Rock Partners and Breega

- The company intends to leverage the fund for hiring about 500 engineers by 2025 and continuing its push in North America

- Exotec provides an end-to-end solution, including hardware and software, to turn a regular warehouse into a partially automated logistics platform that eliminates manual tasks

For a PDF copy please download: Corporate Venture Capital News – March 2022.