Corporate Venture Capital News and Trends – June 2022

Posted by | Fuld & Company

Every month we publish the latest news and developments relating to Corporate Venture Capital (CVC).

If you would like a PDF version of this news please download here.

Corporate Venture Capital Market Summary

The following chart illustrates the number of deals that took place, how many Corporate Venture Capitalists took part, and the largest deal this past month.

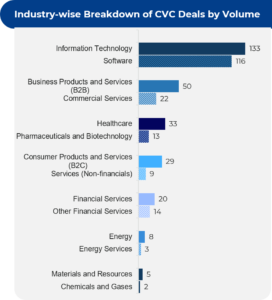

The number of deals that took place by industry is illustrated below.

A breakdown of the number of deals by region shows that the highest number took place in North America (111) followed by Asia (99) and Europe (46). The US and China account for the most deals per country with 102 and 46 deals respectively.

The leading Corporate Venture Capitalists and the recipients of the funding are listed below.

Key Corporate Venture Capital News

A summary of the key Corporate Venture Capital news that has occurred over the past month is listed below.

12 May 2022

UAE-based cloud kitchen Kitopi raises $300 million in a Series C round extension (CVC involved: SoftBank Vision Fund 2)

- Kitopi, a UAE-based cloud kitchen operator, has raised an additional $300 million in its Series C round extension, bringing the capital raised by it in this round to $715 million. The latest funding round has increased Kitopi’s valuation to $1.55 billion after the company became a unicorn

- The company will use the funds to invest in more dine-in restaurants and better serve its customers

- The funding round was led by SoftBank Vision Fund 2 and saw the participation of Chimera, DisruptAD, B. Riley, Dogus Group, Next Play Capital and Nordstar

- Kitopi operates more than 60 cloud kitchens across the UAE, the KSA, Kuwait, and Bahrain.

11 May 2022

Colombia-based PropTech company Habi raises $200 million in Series C funding (CVC involved: SoftBank Latin America Funds)

- Habi, a data-driven residential real estate platform, has obtained $200 million in a Series C funding round, becoming the first property technology (PropTech) LatAm unicorn

- The round was led by Homebrew and SoftBank Latin America Funds, with participation from Banco Mercantil del Norte, S.A., Institución de Banca Múltiple, Grupo Financiero Banorte, Tiger Global, Inspired Capital, Clocktower Ventures, Endeavor Catalyst and Henry Kravis

- Habi plans to use the new capital to expand its suite of offerings, with a focus on embedded financial services

11 May 2022

Open-source software company Aiven raises $200 million in a Series D funding round (CVC involved: Salesforce Ventures)

- Aiven, a software company that combines open-source technologies with cloud infrastructure, has raised $210 million in a Series D funding round, bringing the total amount raised by it to $420 million, at a valuation of more than $3 billion

- The round was led by Eurazeo and involved funds and accounts managed by BlackRock, as well as existing investors IVP, Atomico, Earlybird, World Innovation Lab, and Salesforce Ventures

- Aiven has increased its headcount by more than 65% since October 2021. It aims to use the new funding to continue its international expansion beyond its newest hubs in Japan, Singapore, and New Zealand to other parts of the Asia Pacific and Latin America

10 may 2022

Climate tech start-up Arcadia obtains a $200 million funding (CVC involved: Salesforce Ventures)

- Arcadia, a technology company that empowers energy innovators to fight the climate crisis, has raised $200 million in a funding round

- The round was led by J.P. Morgan Asset Management’s sustainable growth equity team, with participation from new partners Keyframe Capital, Broadscale Group, and Triangle Peak Partners, as well as existing partners Camber Creek, Tiger Global Management, Wellington Management, Salesforce Ventures, Drawdown Fund, MCJ Collective, etc.

- The company will use the funding to strengthen the impact of Arc, its data, and API platform, by expanding data coverage and new product development

09 May 2022

South Korea-based OHouse raises $182 million to add augmented reality (AR) features to its home improvement app (CVC involved: SoftBank Ventures)

- South Korea-based start-up Bucketplace, which operates a home decor and interior design app 0House, has raised $182 million in Series D funding

- The funding round was led by Korea Development Bank. Other investors who participated in the round include SoftBank Ventures, Vertex Growth, Bond Capital, BRV Capital Management, IMM Investment, and Mirae Asset Capital

- The company will use the fresh capital to hire more tech specialists to develop an AR component for its OHouse platform to help consumers visualize products such as furniture or decor items in their own homes. It also plans to accelerate its growth in South Korea and expand into other countries and regions, such as Japan, the US, and Southeast Asia

- OHouse has 10 monthly million users on its app and website. According to Bucketplace, the platform has been downloaded over 20 million times in South Korea

04 may 2022

Washington-based Group14 Technologies raises $400 million in Series C funding (CVC involved: Porsche Ventures)

- Group14 Technologies has raised $400 million in a Series C funding round

- The round was led by Porsche Ventures, with participation from OMERS Capital Markets, Decarbonization Partners, Riverstone, Vsquared Ventures, Moore Strategic Investors, and other institutional investors

- The investment will enable Group14 Technologies to begin the construction of its second plant in the US

28 April 2022

Germany-based AppLike Group raises $106 million (CVC involved: Bertelsmann Investments)

- AdTech company AppLike Group has secured a $106 million (€ 100 million) funding

- The start-up has received the funding from Bertelsmann as a part of the latter’s Boost 2025 strategy

- The company intends to use the newly-infused capital to build new business and platforms and develop new technologies

- The AppLike Group currently comprises four companies – Adjoe, Just Dice, Sunday, and Justtrack. These companies cover the business areas of app marketing, reach expansion, mobile games development, and automation of mobile app growth strategy

26 April 2022

Software delivery platform provider Harness secures $230 million in a Series D funding round (CVC involved: Splunk Ventures, GV, and ServiceNow Ventures)

- San Francisco-based software delivery platform provider Harness has raised $230 million in a Series D funding round at a valuation of $3.7 billion. Of the $230 million in funding, $175 million were received in equity funding and $55 million in debt financing

- The investment round was led by Northwest Venture Partners, with participation from new investors J.P. Morgan, Capital One Ventures, Splunk Ventures, Adage Capital Partners, Balyasny Asset Management, Gaingels, and Harmonic Growth Partners. All the existing investors, including ServiceNow Ventures, Menlo Ventures, IVP, Unusual Ventures, Citi Ventures, Battery Ventures, Alkeon Capital, GV (formerly Google Ventures), Sorenson Capital, Thomvest Ventures, and Silicon Valley Bank, also participated

- Harness plans to use its new funding to hire more team members across the company and expand the Harness software delivery platform

- The company’s headcount has nearly tripled to more than 700 employees since January 2021

For a PDF copy please download: Corporate Venture Capital News – May 2022.