Corporate Venture Capital News and Trends – July 2022

Posted by | Fuld & Company

Every month we publish the latest news and developments relating to Corporate Venture Capital (CVC).

If you would like a PDF version of this news please download here.

Corporate Venture Capital Market Summary

The following chart illustrates the number of deals that took place, how many Corporate Venture Capitalists took part, and the largest deal this past month.

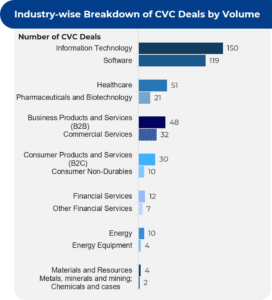

The number of deals that took place by industry is illustrated below.

A breakdown of the number of deals by region shows that the highest number took place in North America (114) followed by Asia (113) and Europe (58). The US and China account for the most deals per country with 114 and 53 deals respectively.

The leading Corporate Venture Capitalists and the recipients of the funding are listed below.

Key Corporate Venture Capital News

A summary of the key Corporate Venture Capital news that has occurred over the past month is listed below.

14 Jun 2022

New York-based food delivery start-up Wonder raises $350 million in a Series B funding round (CVC involved: Google Ventures and Amex Ventures)

- Wonder, a mobile restaurant delivery service, has secured $350 million in Series B funding. The funding places the company’s valuation at $3.5 billion

- The funding was led by Bain Capital Ventures, with participation from Forerunner, Amex Ventures, Yieldstreet, Harmony Partners and Watar Partners. The company’s existing investors, including GV, NEA, Accel, General Catalyst and Alpine Group, also participated in the round

- The company plans to use the funding for expanding into new areas across the United States. It is also planning to launch 11 more restaurants, which will take its total number of restaurants to 30

09 Jun 2022

Value-based care start-up CareBridge bags $140 million in fresh capital to expand its home- and community-based services to more states (CVC involved: Optum Ventures and CVS Ventures)

- Nashville-based start-up CareBridge has obtained $140 million in its latest funding round, which has taken its total funding raised to date to $180 million and valuation to more than $1 billion

- The round was led by existing investor Oak HC/FT, with participation from Optum Ventures, CVS Ventures, Anthem Inc. and HLM Venture Partners

- CareBridge will use the financing to expand geographically, continue building its home- and community-based care database and add services for people with intellectual and developmental disabilities

- Over the past 12 months, the company has grown more than 17x, expanding from serving approximately 1,100 full-risk patients in June 2021 to serving approximately 19,000 full-risk patients now

08 Jun 2022

Multiverse obtains $220 million to expand professional apprenticeships (CVC involved: Google Ventures)

- Multiverse, a London, UK-based apprenticeship company, has closed a $220-million Series D funding round at a post-money valuation of $1.7 billion, doubling its valuation from October 2021

- The round was co-led by StepStone Group, and returning investors Lightspeed Venture Partners and General Catalyst. Founders Circle Capital and existing investors Audacious Ventures, BOND, D1 Capital Partners, GV and Index Ventures also participated in the round

- The company plans to use the funding to accelerate its expansion in the US and broaden the range of learning programs, creating more routes to career progression for apprentices and helping organizations close digital skills gaps across their workforce

- The Multiverse community has reached over 8,000 apprentices globally. Of the professional apprentices that Multiverse places globally, 56% are people of colour, more than half are women and 34% come from economically under-served communities

06 Jun 2022

Imaging sensor start-up Vayyar raises $108 million for fuel expansion (CVC involved: Koch Disruptive Technologies and GLy Capital Management)

- Vayyar, a company that develops radar-imaging sensor technologies, has raised $108 million in a Series E round, which brings the company’s total raised value to over $300 million

- The funding was led by Koch Disruptive Technologies, with participation from GLy Capital Management, Atreides Management LP, Koch Disruptive Technologies, Battery Ventures, Bessemer Ventures, Regal Four and Claltech

- The new funding will allow Vayyar to enhance its machine and deep learning capabilities, accelerate growth across verticals and introduce a “family” of machine learning-powered sensor solutions for public safety, robotics and retail, and extend its reach to additional geographies

- The company develops 4D imaging radar solutions for the automotive and senior care sectors that provide detection and tracking in all conditions

01 Jun 2022

Rimac Group grabs $536 million in Series D investment round (CVC involved: SoftBank Vision Fund 2)

- Croatian electric supercar maker Rimac Group has secured $536 million in a Series D funding round, taking its valuation to $2.2 billion

- The round was led by SoftBank Vision Fund 2 and Goldman Sachs Asset Management, with participation from Rimac’s existing shareholders, including Porsche and Invest Industrial

- The company plans to utilize the funding to hire talent, build a $200-million campus for Rimac’s Zagreb, Croatia headquarters and develop and produce batteries, software and other components for electric cars

25 May 2022

Mexico-based digital freight forwarder Nowports raises $150 million (CVC involved: SoftBank Latin America Fund)

- Nowports, a Latin America-based automated digital freight forwarder, has raised $150 million in a Series C funding round, taking its valuation to $1.1 billion

- The round was led by SoftBank Latin America Fund, with participation from Tiger Global, Foundation Capital, Monashees, Broadhaven Ventures, Mouro Capital and Base10 Partners

- The company plans to use the new capital to conduct more hiring with an emphasis on engineering for technological development. It also plans to expand its presence in countries where it already operates and open offices in more cities. It plans to set up the first few new offices in Brazil, Mexico and Chile

- The company has witnessed a revenue increase of more than 12x year-over-year, along with 10x growth year-over-year in containers shipped and customers served

24 May 2022

Monte Carlo raises $135 million in Series D funding to accelerate the rapid growth of the data observability category (CVC involved: Salesforce Ventures)

- Data observability vendor Monte Carlo has secured a funding of $135 million in a Series D round, reaching a valuation of $1.6 billion

- The round was led by IVP, with participation from Accel, GGV Capital, Redpoint Ventures, ICONIQ Growth, Salesforce Ventures, and GIC Singapore

- The company intends to use the capital infusion to continue improving the experiences it provides to its customers, accelerate product development, and grow its U.S. and EMEA go-to-market and engineering teams

- Monte Carlo has more than doubled its revenue every single quarter. It achieved 100% customer retention in 2021. The total amount raised by the company is $236 million

17 May 2022

India’s fashion supply-chain start-up Fashinza raises $100 million (CVC involved: Prosus Ventures)

- Fashinza, an Indian business-to-business marketplace for fashion brands and retailers, has raised $100 million in a Series B funding round. The latest round takes the total institutional capital raised by the company across debt and equity to nearly $122 million

- The funding was led by Prosus Ventures and Westbridge Capital in a combination of equity and debt. The round also witnessed participation from existing investors Accel, Elevation and ADQ, and angel investors Naval Ravikant, Jeff Fagnan, Jake Zeller, Nivi and Nitesh Banta

- The company intends to use the funds to create a sustainable supply chain for the fashion industry and fuel its global expansion

- t has grown its business by 10x in the past 12 months, crossing the Gross Merchandise Value (GMV) run rate of $150 million

For a PDF copy please download: Corporate Venture Capital News – July 2022.