Corporate Venture Capital News and Trends – January 2023

Posted by | Fuld & Company

Every month we publish the latest news and developments relating to Corporate Venture Capital (CVC).

If you would like a PDF version of this news please download here.

Corporate Venture Capital Market Summary

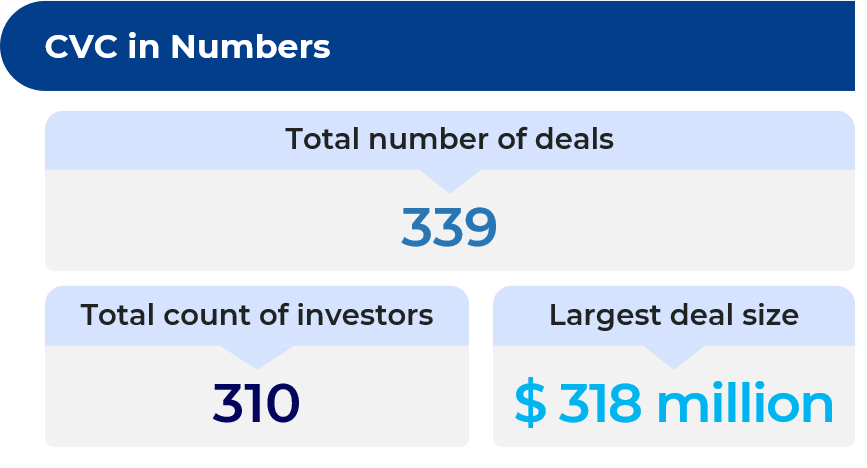

The following chart illustrates the number of deals that took place, how many Corporate Venture Capitalists took part, and the largest deal this past month.

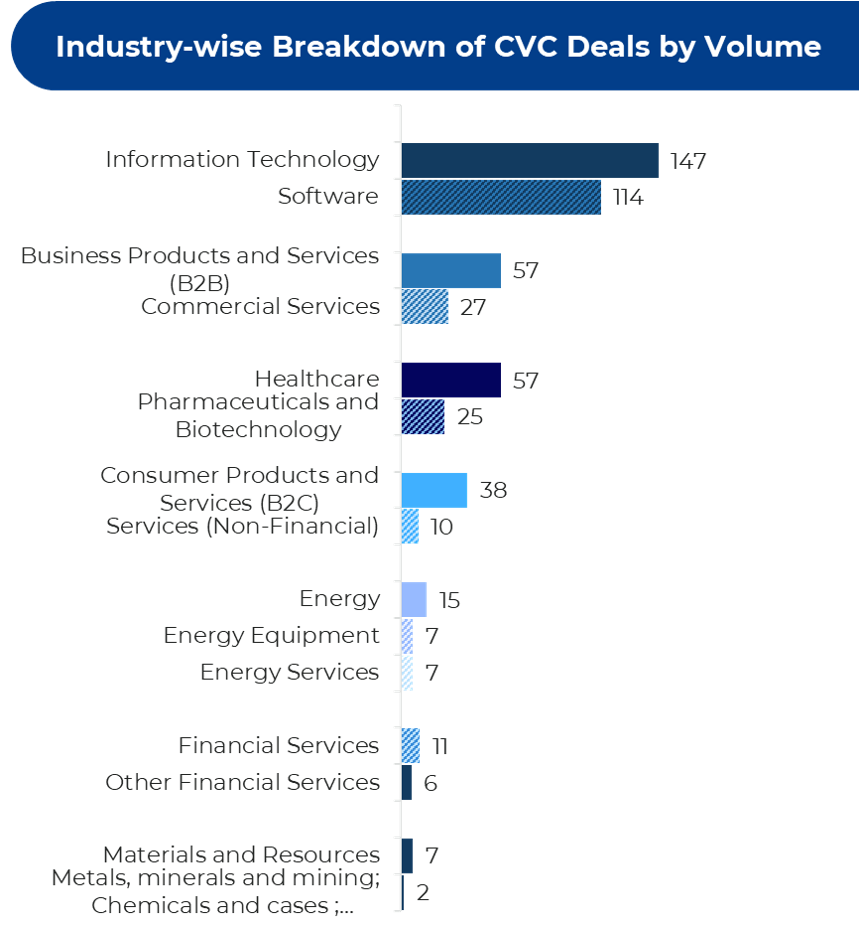

The number of deals that took place by industry is illustrated below.

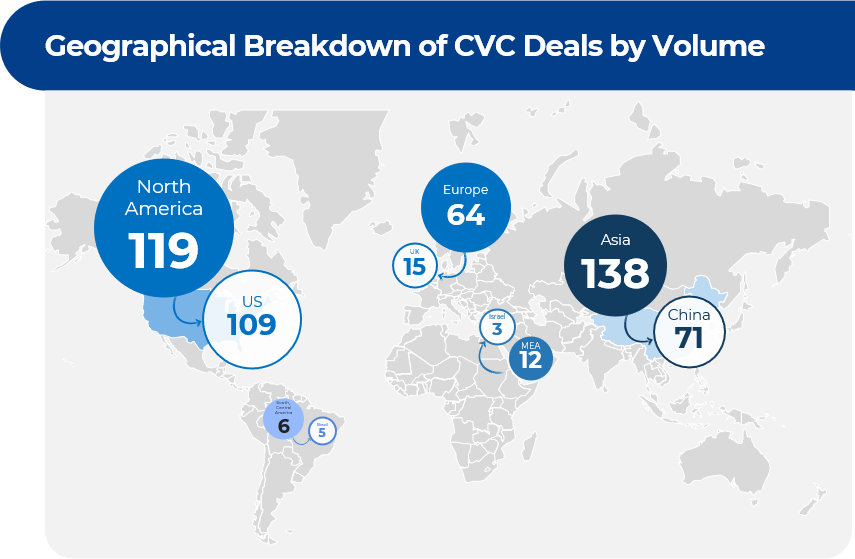

A breakdown of the number of deals by region shows that the highest number took place in Asia (138) followed by North America (119) and Europe (64). The US and China account for the most deals per country with 104 and 62 deals respectively.

The leading Corporate Venture Capitalists and the recipients of the funding are listed below.

Key Corporate Venture Capital News

A summary of the key Corporate Venture Capital news that has occurred over the past month is listed below.

15 December 2022

Vancouver-based climate tech company Svante bags $318 million in a Series E funding round (CVC Involved: 3M Ventures, Samsung Ventures, TechEnergy Ventures and United Airlines Ventures)

- Svante, a Canada-based company that offers a commercially viable way to capture large-scale CO2 emissions from existing infrastructure, has raised $318 million in Series E funding

- Chevron New Energies led the round, with participation from Temasek, OGCI Climate Investments, Delek US, Hesta AG, 3M Ventures, Full Circle Capital, GE Vernova, Japan Energy Fund, Liberty Media, M&G Catalyst, Samsung Ventures, TechEnergy Ventures and United Airlines Ventures

- The company intends to use the funds to accelerate the manufacturing of its carbon capture technology

15 December 2022

Hotel tech start-up Mews raises $185 million for its SaaS-based hotel management platform (CVC Involved: Salesforce Ventures)

- Prague-based hotel management software provider Mews has raised $185 million in a Series C funding round

- Kinnevik and the Growth Equity business within Goldman Sachs Asset Management co-led the funding round. The round also included new backers Revaia, Derive Ventures and Orbit Capital, as well as previous investors Battery Ventures, Notion Capital, Salesforce Ventures, Thayer Ventures and henQ

- The funding will be used to accelerate product innovation, global expansion and M&A

- The company serves over 1,700 properties in more than 60 countries. In 2022, it has grown its revenue 174% year-over-year, with a goal double its revenue each year through organic growth

13 December 2022

France-based Everyday AI platform Dataiku raises $200 million in a Series F funding round (CVC Involved: CapitalG and Snowflake Ventures)

- Dataiku has raised $200 million in a Series F funding round, which brings its total funding raised to date to approximately $850 million

- New investor Wellington Management led the round, and existing investors such as Tiger Global, ICONIQ Growth, CapitalG, FirstMark Capital, Battery Ventures, Snowflake Ventures and Dawn Capital also participated. Other new investors included Insight Partners, Eurazeo, Lightrock and Datadog CEO Olivier Pomel

- The new round is expected to help the company further expand its product offerings

- In 2022, the company has augmented its customer base to over 500 clients, including over 150 of the world’s largest enterprises, and achieved an annual recurring revenue (ARR) of over $150 million

08 December 2022

Customcells raises $63 million in a Series A financing round (CVC Involved: Porsche Ventures)

- Germany-based battery cell manufacturer Customcells has raised nearly $60 million (€60 million) in Series A funding

- World Fund and Abacon Capital led the round, and existing investors Vsquared Ventures and Porsche Ventures also participated

- The company plans to use the funds to expand its activities in the electrification of air traffic, intensify its research and development work

07 December 2022

Security start-up Drata raises $200 million (CVC Involved: Salesforce Ventures)

- Drata, a security and compliance automation platform, has secured $200 million in a Series C funding round, which has doubled the company’s valuation to $2 billion since its Series B funding in November 2021

- ICONIQ Growth and GGV Capital co-led the investment round, with participation from Alkeon Capital, Salesforce Ventures, Cowboy Ventures, S Ventures, Silicon Valley CISO Investments, FOG Ventures, Jeff Weiner, Frank Slootman, Jennifer Tejada, Amit Agarwal, Olivier Pomel, Jonathan Rubinstein and Satya Nadella

- The company aims to accelerate its growth and expand its operations by leveraging the freshly raised funds for research and development

- Drata has expanded its workforce from 70 to 300 employees and its customer base from a few hundred customers to over 2,000 in the past 12 months

28 November 2022

Chinese biotech firm, Trinomab Biotech, raises $104 million in a pre-IPO round (CVC Involved: Gree Financial Investment)

- Trinomab Biotech, a China-based clinical-stage biopharmaceutical firm with global operations, has completed its pre-IPO financing at about $104.4 million (¥750 million)

- Private equity (PE) investment firms Kingray Capital and Gree Financial Investment co-led the funding round, with participation from Efung Capital, Shenyin & Wanguo Investment, Zhuhai Shenhonggejin Medical and Health Industry Investment Fund, Jiaxing Weilong Equity Investment, and other investors. Existing shareholders China Medical System, Wuxi Guolian Capital and Jinhang Group also participated

- The company will primarily use the funds to advance its product pipeline

27 November 2022

China-based Freetech secures $100 million in a Series B funding round (CVC Involved: BAIC Capital)

- FreeTech, a developer of assisted driving solutions, has raised nearly $100 million in Series B funding

- Chaos Investment led the funding round, and other investors included BAIC Capital, TCL, Shaanxi Automobile Group, Sun Life-Everbright, Aopeng Investment and SAIC Motor-backed Hengxu Capital

- The firm plans to use the proceeds to strengthen its leading market position, ramp up its R&D efforts and accelerate the commercialisation of autonomous driving solutions

21 November 2022

FogPharma obtains $178 million to target cancer (CVC Involved: Google Ventures)

- FogPharma, a biopharmaceutical company, has raised $178 million in Series D financing

- The financing round includes new investors ARCH Venture Partners, Milky Way Investments and Fidelity Management & Research Company, as well as existing investors VenBio Partners, Deerfield Management, Google Ventures, Cormorant Asset Management, funds and accounts advised by T. Rowe Price Associates, Inc., Invus, Farallon Capital Management, HBM Healthcare Investments, Casdin Capital and PagsGroup

- The company intends to use the funds to advance and expand its pipeline of hyperstabilized α-helical polypeptide therapeutics, targeting major cancer drivers

- FogPharma’s lead Helicon polypeptide development candidate, FOG-001, a first-and-only-in-class direct TCF-blocking β-catenin inhibitor with potential applicability to significant cancer patient populations, is expected to enter clinical development in mid-2023

For a PDF copy please download: Corporate Venture Capital News.