Corporate Venture Capital News and Trends – January 2022

Posted by | Fuld & Company

A roundup of the latest news and developments relating to Corporate Venture Capital (CVC).

If you would like a PDF version of this news please download here.

Corporate Venture Capital Market Summary

The following chart illustrates the number of deals that took place, how many Corporate Venture Capitalists took part, and the largest deal this past month.

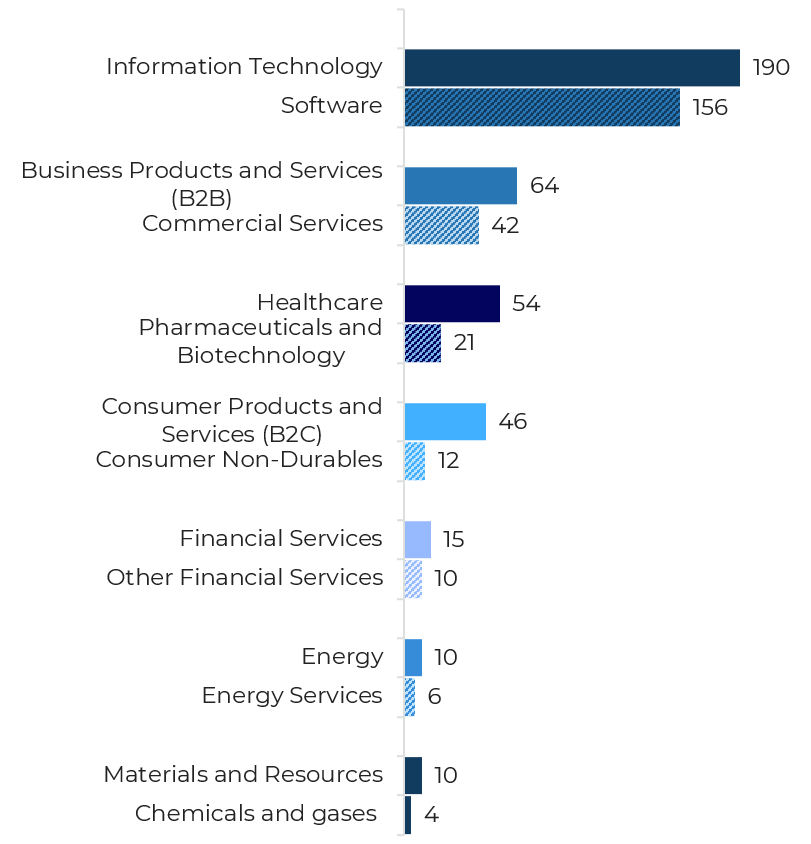

The number of deals that took place by industry is illustrated below.

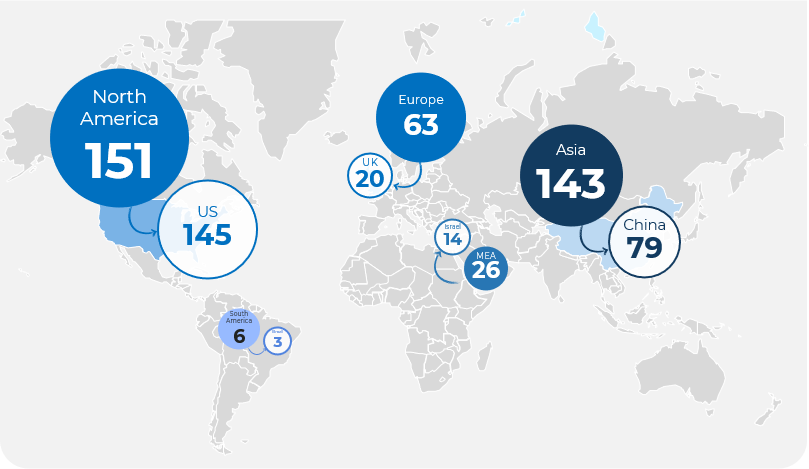

A breakdown of the number of deals by region shows that the highest number took place in North America (178) followed by Asia (126) and Europe (58). The US and China account for the most deals per country with 170 and 77 deals respectively.

The leading Corporate Venture Capitalists and the recipients of the funding are listed below.

Key Corporate Venture Capital News

A summary of the key Corporate Venture Capital news that has occurred over the past month is listed below.

14 DECEMBER 2021

Bitcoin servicer NYDIG raises $1 billion in its latest funding round (CVC involved: MassMutual Ventures)

- NYDIG, the New York-based cryptocurrency technology firm, has raised $1 billion in its latest round of funding that has taken the company’s valuation to $7 billion. The funding round represents the second-largest crypto VC deal of 2021.

- The investment round was led by WestCap with participation from prior leads Bessemer Venture Partners and FinTech Collective, as well as strategic partners and existing investors Affirm, FIS, Fiserv, MassMutual, Morgan Stanley, and New York Life.

- The firm plans to use the funds to develop its Bitcoin platform and accelerate onboarding new clients

- The company runs a bitcoin trading, brokerage, custody and asset-management business that caters to institutional investors.

13 DECEMBER 2021

Cloud software tech start-up Airtable raises $735 million in Series F funding (CVC involved: Salesforce Ventures)

- Airtable, a San Francisco-based cloud software tech start-up has secured $735 million in Series F funding round, nearly doubling its valuation from a year ago to $11 billion.

- The round was led by New York City-based XN with participation from new investors including Franklin Templeton, Salesforce Ventures, and Michael Dell’s MSD Capital, among others. Existing investors including Benchmark, Coatue, D1 Capital Partners, and Thrive Capital also participated in the round.

- The company intends to leverage the funds to attract large corporate customers and develop new products.

- Airtable offers an easy-to-use online platform for creating and sharing relational databases. Airtable cloud software is used by more than 300,000 companies, including a significant number of Fortune 500.

02 DECEMBER 2021

AviadoBio bags $80 million to advance its neurodegenerative gene therapy platform (CVC involved: Johnson & Johnson Innovation (JJDC))

- AviadoBio Ltd, a pioneering gene therapy company, has completed a $80-million Series A financing round.

- The financing was led by New Enterprise Associates (NEA) and co-led by Monograph Capital, with participation from Advent Life Sciences, Dementia Discovery Fund (DDF), F-Prime Capital, JJDC and LifeArc

- The company plans to use the funds to advance its lead program in frontotemporal dementia (FTD) into the clinic, progress its preclinical assets, including for amyotrophic lateral sclerosis (ALS), whilst continuing to expand its industry-leading team

- AviadoBio’s platform combines next-generation gene therapy design with neuroscience expertise and a novel neuroanatomy-led approach to drug delivery.

01 DECEMBER 2021

Commonwealth Fusion Systems raises $1.8 billion in funding to commercialize fusion energy (CVC involved: Google Ventures, Eni Next, and Equinor Ventures)

- Commonwealth Fusion Systems has raised $1.8 billion in Series B funding. It has raised more than $2 billion since it was founded in 2018

- The financing round was led by Tiger Global Management with participation from new investors, including Bill Gates, Coatue, DFJ Growth, Emerson Collective, Footprint Coalition, Google, JIMCO Technology Fund, John Doerr, JS Capital, Marc Benioff’s TIME Ventures, Senator Investment Group, as well as current investors, including Breakthrough Energy Ventures, The Engine, Eni Next, Equinor Ventures, Fine Structure Ventures, Future Ventures, Hostplus, Khosla Ventures, Lowercarbon, Moore Strategic Ventures, Safar Partners, Schooner Capital, Soros Fund Management LLC, Starlight Ventures, Temasek, and others committed to the commercialization of fusion energy to mitigate climate change.

- The funding includes capital to construct, commission, and operate SPARC, the world’s first commercially relevant net energy fusion machine. In addition, it will enable the company to begin work on ARC, the first commercial fusion power plant, which includes developing support technologies, advancing the design, identifying the site, and assembling the partners and customers for the future of fusion power.

30 NOVEMBER 2021

GTA Semiconductor bags $1.26 billion in latest financing round (CVC involved: Shang Qi Capital and Xiaomi Changjiang fund)

- Chinese analog-dedicated foundry GTA Semiconductor grabs $1.26 billion in its Series A fundraising.

- This round of strategic financing was led by Huada Semiconductor Co., Ltd. Other investors include CII Fund, Shang QI Capital, Skyworth investment, Xiaomi Changjiang Fund, CITIC Industrial Fund, CICC, China Capital Management Co., Ltd., Guotai Junan Securities, etc.

- The foundry plans to leverage a part of the funds for R&D of automobile power chips, insulated gate bipolar transistor (IGBT), and silicon-carbide (SiC) power devices. The other part will be used to scale up the manufacturing capacity of automotive electronics.

- GTA is a leading dedicated analog foundry focusing on manufacturing analog and power discrete ICs. It possesses 5-inch, 6-inch, and 8-inch wafer production lines. Its products are widely used in high-end applications such as automotive electronics, industrial control, power management, smart terminals, rail transit, and smart grids.

29 NOVEMBER 2021

UK-based second-hand car auction platform Motorway raises $190 million in Series C funding round (CVC involved: BMW i Ventures)

- The Series C investment brings Motorway’s all-time raise to $273 million and its valuation to over $1 billion.

- The funding was co-led by Index Ventures and ICONIQ Growth, along with existing investors including Latitude, Unbound and BMW i Ventures.

- The company plans to use the new investment to hire tech talent and build a world-class team across the business, focusing on improving customer experience and making Motorway the definitive way for people to sell their cars.

18 NOVEMBER 2021

Cybersecurity company Lacework obtains $1.3 billion in Series D funding (CVC involved: Liberty Global Ventures and Snowflake Ventures)

- California-based cloud security vendor Lacework has raised $1.3 billion at a valuation of $8.3 billion in its Series D funding round.

- The investment was led by existing investors Sutter Hill Ventures, Altimeter Capital, D1 Capital Partners, and Tiger Global Management with participation from new investors, including Counterpoint Global (Morgan Stanley), Durable Capital, Franklin Templeton, General Catalyst, and XN. Coatue, Dragoneer, Liberty Global Ventures, and Snowflake Ventures, all its existing investors had also participated.

- Lacework plans to deploy the new capital to carry out select acquisitions, expand in Europe and Asia-Pacific, and work more efficiently with its channel partners.

- It has built a momentum of more than 3x year-on-year revenue growth, a 3.5x year-on-year increase in new customers, and more than 3x year-on-year employee growth worldwide. The company has more than tripled its headcount over the past nine months, with the personnel expansion fairly split between go-to-market and engineering.

16 NOVEMBER 2021

House of D2C brands Mensa secures $135 million (CVC involved: Prosus Ventures)

- Bengaluru-based Mensa has secured $135 million in its Series B funding round. With this, Mensa Brands is now valued at over $1 billion within six months of starting operations, making it the fastest growing start-up to enter the group of Indian unicorns.

- The financing round was led by Alpha Wave Ventures (Falcon Edge Capital). Other existing investors include Accel Partners, Norwest Venture Partners and Tiger Global Management, along with new investor Prosus Ventures.

- Mensa Brands plans to deploy the fresh capital to accelerate growth and ramp up its acquisitions in the market while scaling its team across operations, marketing and technology functions.

- Mensa Brands follows a ‘house of brands’ or brand aggregation strategy wherein it acquires and partners with digital first brands and helps accelerate their growth by providing on-the-ground expertise and tech-led interventions related to marketing and operations.

For a PDF copy please download: Corporate Venture Capital News – January 2022.