Corporate Venture Capital News and Trends – February 2022

Posted by | Fuld & Company

A roundup of the latest news and developments relating to Corporate Venture Capital (CVC).

If you would like a PDF version of this news please get in touch.

Corporate Venture Capital Market Summary

The following chart illustrates the number of deals that took place, how many Corporate Venture Capitalists took part, and the largest deal this past month.

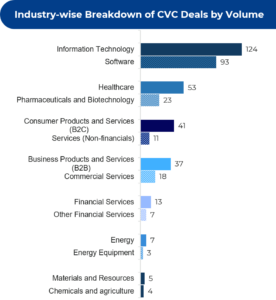

The number of deals that took place by industry is illustrated below.

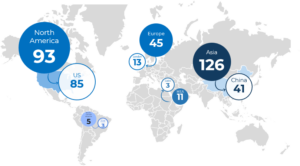

A breakdown of the number of deals by region shows that the highest number took place in North America (93) followed by Asia (126) and Europe (45). The US and China account for the most deals per country with 85 and 41 deals respectively.

The leading Corporate Venture Capitalists and the recipients of the funding are listed below.

Key Corporate Venture Capital News

A summary of the key Corporate Venture Capital news that has occurred over the past month is listed below.

13 JANUARY 2022

Highspot raises $248 million to bolster sales enablement by leveraging AI (CVC involved: Salesforce Venture)

- Seattle-based software enterprise Highspot has raised $248 million as a part of its Series F round, which brings its total valuation to $3.5 billion

- The financing round was led by B Capital Group and D1 Capital Partners, both new investors, Other participants include ICONIQ Growth, Madrona Venture Group, Salesforce Ventures, Sapphire Ventures, and Tiger Global Management

- The company plans to leverage this fund to help its customers increase individual performance and retain top talent across the team

- The company has witnessed a growth of 935% in its revenue over the last three years. The network of its salespeople, channel partners, services reps, and customers grew by 150% in 2021

11 JANUARY 2022

GoStudent raises $340 million to bring online tutoring to the US (CVC involved: SoftBank Vision Fund 2, Prosus ventures)

- Vienna-based education start-up GoStudent has obtained $340 million in Series D funding round. With this funding, the valuation of the company has reached $3.4 billion. GoStudent has raiseda total of $669 million since its foundation in 2016

- The financing round was led by Prosus, along with participation from Deutsche Telekom, SoftBank Vision Fund 2, Tencent, Dragoneer, Left Lane Capital, and Coatue

- The company plans to leverage the fund to support international expansion, particularly in Mexico and Canada, enhance its product portfolio and increase its market share in existing geographies

- GoStudent provides paid, one-to-one, video-based tuition to primary, secondary, and college-aged students in 30+ subjects via its platform, using a membership model in 22 countries. It has recorded a growth of 800% in its revenue and 70x in terms of value since 2020

04 JANUARY 2022

ShopUp obtains a total of $109 million after extended Series B funding round (CVC: Prosus Ventures)

- Dhaka-based B2B commerce start-up ShopUp has secured $34 million in Series B extension round. The extension takes ShopUp’s total series B investment to $109 million. In late 2022, ShopUp raised $75 million in the first series B funding

- The investment round was led by Tiger Global and Valar Ventures, with participation from VEON Ventures, Omidyar, Prosus Ventures, Flourish Ventures, and Lonsdale Capital

- ShopUp offers varied B2B commerce services, including wholesale, logistics, and working capital assistance through partnerships with banks and other partners and business management solution

27 JANUARY 2021

Recruiting software company Paradox receives $200 million in Series C funding (CVC involved: Workday ventures

- Paradox, a Scottsdale, Arizona-based conversational recruiting platform, has secured $200 million in Series C funding. The investment has taken the company’s value to $1.5 billion

- The round was co-led by Stripes, Sapphire & Thoma Bravo, and included participation from Workday Ventures, Willoughby Capital, Twilio Venture, Blue Cloud Ventures, Geodesic, Principia Growth, DLA Piper Venture Fund, and current investor Brighton Park Capital

- The company intends to leverage the fund for building its team, strengthening its client base, and exploring the potential of AI in recruiting and HR software

- Paradox is serving its global clients with their hiring needs across high-volume hourly and high-skilled professional roles

22 DECEMBER 2021

Chinese autonomous driving start-up Haomo completes $157 million financings (CVC involved: Qualcomm ventures)

- Haomo, an autonomous driving start-up, has raised nearly $157 million (1 billion yuan) in a Series A funding round

- The investment round was backed by Hillhouse Capital’s early-stage investment unit GL Ventures, Meituan, Hong Kong-listed Shoucheng Holdings Limited, Qualcomm Ventures, and JZ Capital

- The company will leverage this fund to build its talent pool and enhance its R&D capabilities

- Haomo produces Level 4 autonomous driving logistics vehicles that can handle all the aspects of driving in most circumstances with no human intervention

16 DECEMBER 2021

Cockroach Labs attains $278 million in Series F funding (CVC involved: GV (Google Venture))

- SQL database company Cockroach Labs has netted funding of $278 million in a Series F round. With this investment, the company has attained a total value of about $5 billion

- The investment round was led by Greenoaks with participation from Altimeter, BOND, Benchmark, Coatue, FirstMark, GV, Index Ventures, J.P. Morgan, Lone Pine Capital, Redpoint Ventures, and Tiger Global

- Cockroach Labs is a highly evolved, cloud-native, distributed SQL database. The company plans to use this investment to support the ongoing investments in the development of innovative and fast-growing cloud databases, as well as to propel its continued customer growth and expansion into new markets

16 DECEMBER 2021

Vertical farming start-up Infarm raises $200 million for international expansion (CVC involved: Bonnier)

- Infarm, a Europe-based vertical farming firm has raised $200 million in Series D funding round, bringing the total funding to date to $600 million. It has earned its place as Europe’s first vertical farming unicorn, with a valuation of $1 billion

- The investment round was led by existing and new investors, including the Qatar Investment Authority (QIA), Equity, Hanaco, Atomico, Lightrock, and Bonnier

- The company plans to leverage the fund to expand the deployment of its vertical farms in the U.S., Canada, Japan, and Europe, with a particular emphasis on new market entries in the Asia-Pacific and the Middle East regions. The company will open its first Growing center in Qatar in 2023

- Infarm offers smart modular farming systems that enable urban farms to grow fresh food. Currently, the company operates more than 17 growing centers and over 1,400 in-store farms for 30 retailers worldwide. It plans to have 100 growing centers in 20 countries by 2030

16 DECEMBER 2021

Cloud analytics startup Sigma Computing bags $300 million in Series C funding round (CVC involved: Snowflake Ventures)

- No-code cloud analytics and business intelligence firm Sigma Computing has secured a Series C funding of $300 million. The round brings Sigma’s total amount raised to date to $381.3 million

- The investment round was co-led by D1 Capital Partners and hedge fund XN, with participation from existing investors Altimeter Capital, Sutter Hill Ventures, and Snowflake Ventures

- Sigma Computing offers no-code business intelligence and analytics solution designed for use with cloud data warehouses. It is one of the latest start-ups that are garnering a growing amount of interest from investors in the cloud analytics sector

For a PDF copy please get in touch