Corporate Venture Capital News and Trends – December 2022

Posted by | Fuld & Company

Every month we publish the latest news and developments relating to Corporate Venture Capital (CVC).

If you would like a PDF version of this news, please download here.

Corporate Venture Capital Market Summary

The following chart illustrates the number of deals that took place, how many Corporate Venture Capitalists took part, and the largest deal this past month.

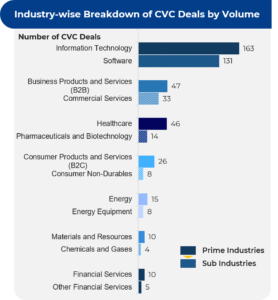

The number of deals that took place by industry is illustrated below.

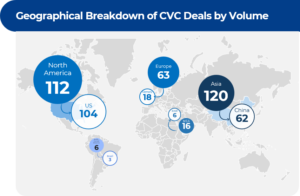

A breakdown of the number of deals by region shows that the highest number took place in North America (112) followed by Asia (120) and Europe (63). The US and China account for the most deals per country with 104 and 62 deals respectively.

The leading Corporate Venture Capitalists and the recipients of the funding are listed below.

Key Corporate Venture Capital News

A summary of the key Corporate Venture Capital news that has occurred over the past month is listed below.

15 November 2022

Home healthcare company DispatchHealth raises $330 million (CVC involved: Optum Ventures)

- Denver-based DispatchHealth has raised $330 million in its latest funding round, which has brought its total funding to date to over $700 million

- Optum Ventures led the equity raise, with support from current investors such as Humana, Oak HC/FT, Echo Health Ventures and Questa Capital. New investors included Adams Street Partners, the Olayan Group, Silicon Valley Bank, Pegasus Tech Ventures and Blue Shield. The debt raise was led by Silicon Valley Bank and K2 HealthVentures

- With the help of the capital raised, the company will focus on building a proprietary technology platform and will add more services to its existing platform

- DispatchHealth offers on-demand at-home acute care delivered by emergency and internal medicine teams

02 November 2022

Data intelligence tech provider Alation raises $123 million in Series E financing round (CVC involved: Databricks Ventures, Dell Technologies Capital and Salesforce Ventures)

- Data intelligence software developer Alation has raised $123 million in a Series E funding round

- Thoma Bravo, Sanabil Investments and Costanoa Ventures co-led the funding round. Other participants included Databricks Ventures, Dell Technologies Capital, Hewlett Packard Enterprise, Icon Ventures, Queensland Investment Corporation, Riverwood Capital, Salesforce Ventures, Sapphire Ventures and Union Grove

- Alation will utilise the capital to accelerate its global expansion, continue its strategic product development efforts, increase product-focused research and development, and make acquisitions to expand its technology portfolio

- The company also plans to expand its employee base, which has grown by 75% in less than 12 months and currently includes more than 700 employees across the globe

31 October 2022

Lithium battery developer Kuntian New Energy raises over $137.4 million (CVC involved: Sinopec Capital)

- Kuntian New Energy, a company specialising in the research and development of lithium-ion battery anode materials, has raised over $137.4 million (CNY 1 billion) from its strategic investors

- Sinopec Capital, SK China and CICC Capital jointly led the funding round, and investors such as Fosun Capital, SANY Group and Guangfa Qianhe Investment also participated

- The company will use the funds for the research and development, production and sales of synthetic graphite products

- Kuntian became the first domestic company in China to perform the graphitization of lithium-ion battery anode materials, applying its self-developed box furnace technology

27 October 2022

Emerging Markets Property Group (EMPG) raises $200 million (CVC involved: Prosus Ventures)

- EMPG, the Dubai-based unicorn that owns and operates Bayut and dubizzle in the UAE and Zameen.com in Pakistan, has closed a $200 million investment round

- Affinity Partners led the funding round, along with new funding from OLX, Acacia Partners, KCK Group, Prosus Ventures and several other undisclosed investors

- EMPG will use the funds to solidify its position in the markets it operates in and prepare for an IPO in the near future

25 October 2022

Bilt Rewards raises $150 million at a $1.5 billion valuation (CVC involved: Prosus Ventures)

- New York-based Bilt Rewards has raised $150 million, bringing its total valuation to $1.5 billion

- Left Lane Capital led the funding round, and other participants included Smash Capital, Wells Fargo, Greystar, Invitation Homes, Camber Creek, Fifth Wall and Prosus Ventures

- The company plans to use the new funding to expand its offerings and strengthen its relationships with existing loyalty and real estate partners

- Bilt Rewards offers a rewards program and a credit card that converts rent into reward points. The company’s platform allows tenants to earn miles and points and increase their credit scores while paying rent. The company has processed over $3 billion in annualised rent payments and over $1.6 billion in annualised card spending since its launch in 2021

19 October 2022

Celestia raises $55 million for new modular blockchain network (CVC involved: FTX Ventures and Coinbase Ventures)

- Celestia Labs has raised $55 million in a combined Series A and B round. The company achieved unicorn status with a $1 billion valuation and was four times oversubscribed

- Bain Capital Crypto and Polychain Capital led the round, and other participants included Coinbase Ventures, Jump Crypto, FTX Ventures, Placeholder, Galaxy, Delphi Digital and several other venture capital and angel investors

- The company plans to use its newly raised funds to create a modular blockchain network. The modular blockchain network is aimed at solving the challenge of deploying and scaling blockchains

18 October 2022

Austin-based Jasper bags $125 million in Series A funding round (CVC involved: HubSpot Ventures)

- Jasper, an AI-powered content platform, has raised $125 million in a Series A funding round at a $1.5 billion valuation

- Insight Partners led the round and was joined by other leading firms such as Coatue, Bessemer Venture Partners, IVP, Foundation Capital, Founders Circle Capital and HubSpot Ventures

- The company intends to use the funds to further develop its products and improve its overall customer experience

- Since its launch in Jan 2021, Jasper has gained more than 70,000 paying users, ranging from individuals to teams at large enterprises

17 October 2022

Privately-held Swiss ophthalmology company Oculis raises $80 million in a PIPE deal (CVC involved: Novartis Venture Fund)

- Oculis and European Biotech Acquisition Corp, a special purpose acquisition company (SPAC), have signed a definitive business combination agreement

- The business combination is expected to deliver gross proceeds to Oculis in excess of $200 million. This includes approximately $127.5 million held in EBAC’s trust and commitments to an upsized PIPE and private investment of approximately $80 million

- LSP 7 led the funding round, with the participation of leading institutional investors such as Earlybird, Novartis Venture Fund, Pivotal bio venture Partners, VI Partners and funds managed by Tekla Capital Management, among others

For a PDF copy please download: Corporate Venture Capital News – December 2022.