Corporate Venture Capital News and Trends – August 2022

Posted by | Fuld & Company

Every month we publish the latest news and developments relating to Corporate Venture Capital (CVC).

If you would like a PDF version of this news please download here.

Corporate Venture Capital Market Summary

The following chart illustrates the number of deals that took place, how many Corporate Venture Capitalists took part, and the largest deal this past month.

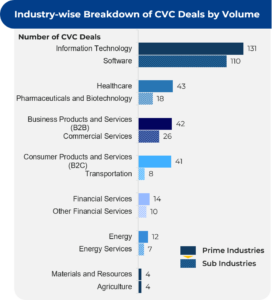

The number of deals that took place by industry is illustrated below.

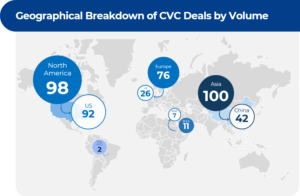

A breakdown of the number of deals by region shows that the highest number took place in North America (98) followed by Asia (100) and Europe (76). The US and China account for the most deals per country with 92 and 42 deals respectively.

The leading Corporate Venture Capitalists and the recipients of the funding are listed below.

Key Corporate Venture Capital News

A summary of the key Corporate Venture Capital news that has occurred over the past month is listed below.

14 July 2022

India-based EV ride-hailing firm BluSmart raises USD 250 million to increase its fleet size (CVC involved: BP Ventures)

- India’s first and leading ride-sharing company for EVs, BluSmart, has raised around USD 250 million in a fresh funding round, which will take the start-up’s total fundraising amount to over USD 300 million.

- The round was led by BP Ventures and saw the participation of Alteria Capital, BlackSoil Group, Centrum Capital, and 9Unicorns. BP Ventures had also led the start-up’s USD 25 million Series A funding round in September 2021.

- BluSmart plans to use the funds to buy more EVs and expand its charging infrastructure. It also plans to invest more in its technology and expand its services to more cities in India.

12 July 2022

Biotechnology start-up Areteia Therapeutics raises USD 350 million to create an oral asthma treatment (CVC involved: Sanofi Ventures and Google Ventures)

- Population Health Partners and Knopp Biosciences have launched a new biotechnology start-up, Areteia Therapeutics, with a USD 350 million Series A venture capital funding.

- The Series A round was led by Bain Capital Life Sciences. Other investors include Google Ventures, Arch Venture Partners, Sanofi Ventures, Maverick Capital, Access Biotechnology, and Population Health.

- The company plans to use the funding to develop new medicines, including an oral drug for severe asthma. The drug is ready for Phase 3 clinical trials.

06 July 2022

Seattle-based start-up Zap Energy raises USD 160 million in a Series C funding round to advance reactor technology (CVC involved: Shell Ventures and Chevron Technology Ventures)

- Zap Energy has raised USD 160 million in a Series C round, increasing the total funding since its launch to approximately USD 200 million.

- Lowercarbon Capital led the round. In addition, the company’s new investors, including Breakthrough Energy Ventures, Shell Ventures, DCVC, and Valor Equity Partners, and existing investors such as Addition, Energy Impact Partners, and Chevron Technology Ventures also participated.

- The company plans to use the funds to build a new supercapacitor bank that can generate pulses of electricity reaching 1,000 kA.

30 Jun 2022

Guangzhou-based chip supplier CanSemi Technology raises USD 671 million (CVC involved: GAC Capital)

- CanSemi, a semiconductor supplier backed by the GAC Group, has completed its latest financing round, raising USD 671.87 million (RMB 4.5 billion).

- The round was led by investors GAC Capital and Guangdong Province Semiconductor and Integrated Circuit Industry Investment Fund. Automakers such as SAIC Motor, BAIC Group, etc., venture capital firms Yuexiu Industrial Fund, Yingke PE, CMB International, Walden International, GF Securities, and Jadestone VC also participated.

- CanSemi plans to use the funds for building new production facilities.

30 Jun 2022

French start-up Electra raises USD 163 million in equity financing (CVC involved: RATP Capital Innovation)

- Electra, a Paris-based company specializing in fast charging for EVs, has raised USD 163 million in equity financing.

- The funding is the largest achieved by a France-based company in the fast-charging setor and was led by global investing group Eurazeo. RGREEN Invest, RIVE Private Investment, Serena, the Chopard Group, the SNCF G, roup, and RATP Capital Innovation also participated in the round.

- Electra will use the funds to increase its presence in France, and also expand in Europe. Electra is the only fast charging specialist in France and will now have the means to compete with leading players in Europe.

30 Jun 2022

France-based Flying Whales raises USD 123 million to create a low-carbon cargo transport solution (CVC involved: Air Liquide Venture Capital)

- Flying Whales, a France-based company designing a new industrial low-carbon cargo transport has raised USD 123 million in funding.

- The funding round was backed by the French government via French Tech Souverainete and the Principality of Monaco via the Societe Nationale de Financement. Flying Whales’ current strategic shareholders ALIAD (Air Liquide’s venture capital fund) and ADP Group participated in the round. Societe Generale Assurances and new private investors also participated.

- The company aims to leverage the funding to create a low-a carbon cargo transport solution.

29 Jun 2022

ReCode Therapeutics raises USD 120 million in a Series B funding round (CVC involved: Leaps by Bayer and Amgen Ventures)

- Genetic medicines company ReCode Therapeutics has raised USD 120 million in an ended financing round, securing a total of USD 200 million in Series B funding with this new financing.

- The company’s new investors, including Leaps by Bayer (an investment unit of Bayer), AyurMaya (an affiliate of investment firm Matrix Capital Management), and, Amgen Ventures (Amgen’s venture capital fund), led the funding round.

- The company will use the proceeds from the financing to diversify its pipeline and develop medicines/drugs for diseases related to the central nervous system, liver, and, oncology.

29 Jun 2022

California-based Twelve raises USD 130 million to deploy the world’s first industrial-scale carbon transformation platform (CVC Involved: Microsoft Climate Innovation Fund)

- Twelve, a carbon transformation company, has raised USD 130 million in a Series B funding round, increasing the total funds raised since its inception in 2015 to USD 200 million.

- The round was led by DCVC, with participation from Series A lead investors Capricorn Technology Impact Fund and Carbon Direct Capital Management. Breakout Ventures, Munich Re Ventures, Elementum Ventures, and Microsoft Climate Innovation Fund also participated. In addition, twelve secured a strategic program investment from the Chan Zuckerberg Initiative (CZI).

- The company aims to use the funds for expanding the reach of its carbon transformation platform. The company’s proprietary catalyst technology transforms CO2into critical chemicals, materials, and fuels that are conventionally made from fossil fuels. Using Twelve’s technology, industry and brands can meet emissions targets faster.

For a PDF copy please download: Corporate Venture Capital News – July 2022.