Corporate Venture Capital News and Trends – April 2022

Posted by | Fuld & Company

Every month we publish the latest news and developments relating to Corporate Venture Capital (CVC).

If you would like a PDF version of this news please download here.

Corporate Venture Capital Market Summary

The following chart illustrates the number of deals that took place, how many Corporate Venture Capitalists took part, and the largest deal this past month.

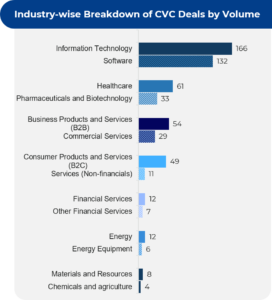

The number of deals that took place by industry is illustrated below.

A breakdown of the number of deals by region shows that the highest number took place in North America (139) followed by Asia (136) and Europe (62). The US and China account for the most deals per country with 132 and 79 deals respectively.

The leading Corporate Venture Capitalists and the recipients of the funding are listed below.

Key Corporate Venture Capital News

A summary of the key Corporate Venture Capital news that has occurred over the past month is listed below.

11-MARCH-2022

Indian EdTech firm Byju’s raises $800 million in a funding round led by its founder (CVC involved: Sumeru Ventures)

- Bengaluru-based EdTech major Byju’s has raised $800 million in a new round, making it the most valued start-up in India

- This funding round saw the participation of investors Sumeru Ventures, Vitruvian Partners, and BlackRock. Byju’s founder and CEO Byju Raveendran also participated and invested $400 million

- The firm has decided to open 500 tuition centers across 200 cities in 2022 after a pilot test. It plans to invest $200 million in offline tuition centers over the next 12-18 months and launch its IPO in the next 9-12 months

- Byju’s has over 150 million learners on its platform, an annual renewal rate of 86% and an NPS score of 76

11-MARCH-2022

MetaMask parent company ConsenSys secures $450 million in Series D round (CVC involved: SoftBank Vision Fund 2 and UTA VC)

- Cryptocurrency developer ConsenSys raised $450 million in the Series D round and attained a total value of about $7 billion – nearly double since its last funding in November 2021

- The investment round was led by ParaFi Capital alongside other existing investors such as Third Point, Marshall Wace, True Capital Management and UTA VC (United Talent Agency’s venture fund). New investors such as Temasek, SoftBank Vision Fund 2, Microsoft, Anthos Capital, Sound Ventures and C Ventures also participated

- The latest funding will support growth across the entire ConsenSys product suite. It will also support the rapid expansion of MetaMask and the roll-out of a plug-in extensibility system that will allow integration with a wide variety of blockchain protocols and account security schemes. ConsenSys hopes to grow its team from 700 to about 1,000 employees on both developer and user wallet sides by the end of 2022

- ConsenSys is a leading Ethereum and decentralized protocols software company. It has been a pioneer in creating the foundational software for Web3, the next wave of the internet

09-MARCH-2022

Consumer-tech company Nothing raises $70 million in Series B funding (CVC involved: GV)

- UK-headquartered company Nothing Tech has raised $70 million in its latest fundraising round. With this, the total funds raised by it have reached $144 million

- The financing round was co-led by EQT Ventures and C Ventures and saw the participation of GV, Future Shape, Gaorong Capital and Animoca Brands

- The funding will be used to scale the company’s product ecosystem by creating new product categories in partnership with Qualcomm Technologies and its Snapdragon platform and grow operations at its new London Design Hub

01-MARCH-2022

Veev grabs $400 million to scale tech-enabled home construction (CVC involved: JLL Spark Global Ventures)

- California-based technology-enabled homebuilder Veev secured $400 million in a Series D funding round, bringing its total funding to date to $600 million

- The round was led by BOND with participation from LenX, Zeev Ventures, Fifth Wall Climate Tech and JLL Spark Global Ventures

- The company will utilize the funding to scale its operations, accelerate its research and development and expand into new markets

- Veev is a vertically integrated building technology company taking a revolutionary technological path to build turnkey, high-quality homes

23-Feb-2022

Somatus raises $325 million in Series E round to deliver its proven value-based kidney care model to more people in the US with kidney disease (CVC involved: Optum Ventures)

- Somatus, a McLean, Virginia-based kidney care company, raised $325 million in Series E funding at a valuation of over $2.5 billion. This latest investment has brought the total capital raised by the company to nearly $500 million

- The funding round was led by Wellington Management and included new investments from RA Capital Management, GIC, Fidelity Management & Research Company and other leading investment organizations. Other contributors included existing investors Anthem, Blue Venture Fund, Deerfield Management Company, Flare Capital Partners, Inova Health System, Longitude Capital and Optum Ventures

- Somatus intends to use the funds to further the reach and impact of its value-based kidney care model

- Through the use of its proprietary technology, multi-disciplinary community-based care teams and partnerships with nephrologists and primary care physicians, Somatus has built a model focused on prevention and awareness, which empowers people with kidney disease to take control of their health

21-Feb-2022

Digital asset platform Amber Group bags $200 million in Series B+ round (CVC involved: Coinbase Ventures)

- Hong Kong-based global digital asset platform Amber Group secured a Series B+ funding of $200 million at a valuation of $3 billion. The total capital raised by the company now stands at $328 million

- The round was led by investment company Temasek with participation from existing shareholders such as Sequoia China, Pantera Capital, Tiger Global Management, Tru Arrow Partners and Coinbase Ventures, among others

- The funds raised will be used to hire staff in Europe and the Americas. Some of the funds will be used to expand WhaleFin, a retail-targeted app that allows consumers to earn returns on their cryptocurrency holdings

- Amber Group provides a full range of digital asset services spanning investing, financing and trading, catering to over 1,000 institutional clients and a growing number of individual investors worldwide

16-Feb-2022

California-based CelLink raises $250 million in Series D Funding (CVC involved: 3M Ventures, BMW iVentures and Robert Bosch Venture Capital)

- Hardware tech start-up CelLink closed a $250 million Series D funding round

- The round was led by Whale Rock Capital and included other new investors D1 Capital Partners, T. Rowe Price Associates Inc., Fidelity Management & Research Company LLC, Park West, Standard Investments and Atreides. It also included participation from existing investors 3M Ventures, BMW iVentures, Fontinalis Partners, Franklin Templeton, Lear Corporation, Robert Bosch Venture Capital and Tinicum Venture Partners

- The company intends to use the funds for the construction of a new 300,000 sq. ft. manufacturing facility in Georgetown, which is set to open in mid-2022. It also aims to expand its team of engineers and technology experts at its San Carlos headquarters and Novi sales and engineering facility and establish a Europe-based team to service a growing list of international customers

- CelLink manufactures electrically and thermally conductive flexible circuits to redefine automotive electrical distribution systems to make vehicles lighter, cleaner and less expensive, both in their manufacturing and daily use

16-Feb-2022

Genesis receives $200 million to expand its fintech-focused low-code platform (CVC involved: GV and Salesforce Ventures)

- Genesis, a London-based supplier of a low code platform for capital markets development, has raised $200 million in a Series C funding round

- The funding round was led by Tiger Global Management. Other backers included Accel, GV (formerly Google Ventures), Illuminate Financial, Insight Partners, Salesforce Ventures, Tribeca Early Stage Partners and Genesis’ clients Citi and ING

- The new funding will be used to expand the Genesis platform, its developer community and the company’s buy-to-build model

- Genesis was founded in 2021 and has been working with various financial services companies, providing non-technical employees with the tools they need to monitor and manage real-time risk, high-frequency trades and other activities

For a PDF copy please download: Corporate Venture Capital News – March 2022.