Challenges and Opportunities in Investment Research

Posted by | Nilesh Sharma

The investment research industry, particularly the sell-side banks and broker-dealers, has undergone significant changes in the last few years. Broker-dealers across the board have seen both their commissions and trade volumes compress as the buy-side institutions (large asset and wealth managers) curtail their research budgets, and increasingly face intense competition for assets or assets under management (AUM) from the passive investment management industry – largely index mutual funds and index exchange-traded funds (ETFs).

Indeed, sell-side banks have lost revenues to the tune of US$3 billion as institutional investment managers (asset and wealth managers and hedge funds) reduced their research spending, according to estimates from Eidosmedia, a digital transformation technology firm. In addition, regulatory costs thanks to legislation such as MiFID II (Markets in Financial Instruments Directive II) and research unbundling, and the need for more effective monitoring and high levels of transparency, have increased. This has exerted additional pressure on an industry already struggling with having to do more with less! Rightfully, sell-side research has suffered.

Nonetheless, innovation in the form of technological advancements including automation and algorithmic trading has significantly reduced the need for trading desks to focus on simple and repetitive tasks thereby allowing them to focus more on complex and high-margin trades. Algorithmic trading has already significantly reduced trade transaction costs without having any adverse impact on market prices.

The Rise of Passive Investment Management

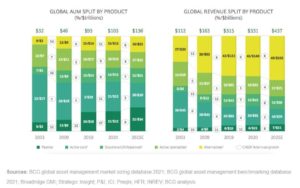

This past decade has seen a significant increase in assets under management (AUM) in the passive investment management industry. Large asset allocators such as pension funds, endowment funds as well as global sovereign wealth funds have increased their allocation toward passive funds. Indeed, the global consulting firm Boston Consulting Group (BCG) in its Global Asset Management Report 2021 estimates that the asset under management (AUM) for passive funds is likely to grow at a CAGR of 9% to US$34 trillion by 2025 from around US$22 trillion in 2020.

Value of Research

The significant rise in passive investing has exerted additional pressure on active fund managers to generate that ‘alpha’ and justify higher allocation and management fees. As a result, the fund managers have become more judicious in their consumption of research looking specifically for actionable intelligence and unique insights from sell-side analysts.

Once again, independent research estimates that the top-tier sell-side banks in the US only produce nearly 40,000 research reports annually. However, only a fraction (less than 1%) of these reports are read by the asset and wealth managers. While increasing compliance and research unbundling due to MiFID II have forced asset managers to evaluate and reevaluate how much and where exactly these research dollars are getting spent.

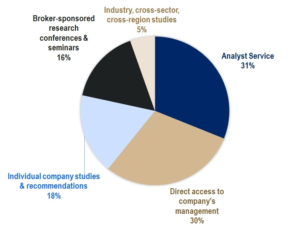

According to the global research firm Greenwich Associates, buy-side investors (asset and wealth managers) now value corporate access i.e., direct access to company management almost as high as analyst services.

Resultantly, it has become increasingly important for the sell-side to better understand the needs of the buy-side and thereby drive engagement – right from what is being consumed, to who is reading the research; where are they reading it; what is working, etc. This will allow for a greater degree of personalization of research and help in better investment process integration – into their trading systems and order books.

At Fuld & Company, we work with several broker-dealers, sell-side analysts, and independent research providers helping them with their one-time as well as ongoing research needs. Talk to us to better understand how we can help you expand and maintain the coverage universe, generate actionable intelligence and unique insights and support thematic and new idea generation research.

References

- The rise and rise of passive investing! | LinkedIn

- The 5 Things Buy-side Analysts Value Most from Sell-side Analysts – Analyst Solutions