BP refines energy transition strategy

Posted by | Rauf Mammadov

International oil companies (IOCs) are facing challenges in navigating the energy transition as they struggle to balance their economic and financial objectives with net-zero commitments.

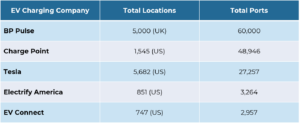

BP is no exception. Following Shell’s cuts in low-carbon jobs[1], BP announced their own plans to scale back some of its non-core businesses. On April 15, the company announced that it will be cutting over 10%[2] of its BP Pulse EV charging business workforce and withdrawing from eight countries. BP had acquired Chargemaster in 2018, changing its name to BP Pulse, hoping to capitalize on the rapid expansion of the commercial EV segment. BP Pulse now has 60,000 charging points in 5000 locations in the UK alone, more than any EV charging company in the United States.

Total EV Charging Points by Location

The BP EV charging layoffs shed light on the new CEO’s approach to running the company, suggesting a more cautious pivot to new energies, rather than an immediate shift towards becoming an integrated energy company. However, despite scaling back non-core operations, EV charging remains a critical element of BP’s 2050 net-zero goals, as the company prioritizes mobility and convenience as significant growth areas amidst the energy transition challenges for IOCs. BP Pulse’s continued presence in key markets such as Germany, the United States, Britain, and China, and its recent acquisition of Ashford International Truckstop, one of Europe’s largest truck stops, are further indications of the company’s selective approach to new energies.

References

- Reuters: Shell cuts low-carbon jobs, scales back hydrogen in overhaul by CEO

- CNBC: BP’s EV charging arm cuts jobs, reduces global ambitions

Tags: Electric Vehicle, Energy, Renewables