Benefits of hiring an investment bank to manage a sales process

Posted by | Vinit Gala

Managing the sale of a business is complex and time-consuming. It is a once-in-a-lifetime event for many entrepreneurs and business owners (sellers) and likely to be one of their largest business deals, both financially and emotionally. The realization of the sale and the accompanying excitement are the culmination of their life’s hard work, but these can distract the sellers from their core responsibilities of successfully managing the day-to-day operations and growth of the firm at the very worst time. So having an investment banker by their side allows sellers to focus on their business – increasing the probability of a better outcome, as an investment banker can adopt a neutral stance towards the business and develop objective recommendations while evaluating strategic options.

Many sellers in the middle market decide to hire an investment bank when they have inbound interest or an actual offer is on the table. In most of these instances, an investment bank is able to command a higher value for the business by running a competitive bidding process, something a seller is less likely to be able to do. Given investment banks’ wide network, experience, and execution capabilities, they can ramp up the competition by casting a broader net to include strategic, sponsor-backed strategic, and financial buyers. In addition, this competitive process transfers the bargaining power from the lone offeror to the sellers, allowing them to interact with multiple buyers while having better control over the negotiations.

In instances where sellers are contemplating a sale, hiring an investment banker from the outset will enable them to run a fully-fledged sale process as investment banks will meticulously work on positioning the company to its strengths to attract maximum buyer interest. They will also have the necessary time to structure and negotiate an ideal transaction for the seller, and assist in developing financial forecasts, marketing materials, and preparing the sellers for management presentations.

Investment banks play a significant role during the due diligence process by helping bridge the massive information asymmetry caused by the mismatch in buyers’ expectations and the sellers’ financial and operational reporting. The fact that investment bankers have been privy to multiple due diligence processes enables them to foresee many issues likely to be raised by potential buyers, and proactively work with the sellers to make the required information available and, more importantly, present it in a manner that reflects positively on the company. Many sale processes fail due to the sellers’ inability to provide the requisite information in a timely and accurate manner. Hence, having an investment banker alongside adds credibility to the seller while being better prepared to manage the process.

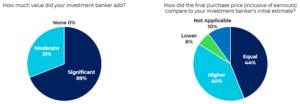

Revisiting a study published by Fairfield University, 100% of sellers who hired an investment bank indicated that investment bankers added value to the sale process.

While 84% of the sellers in the study indicated that the final purchase price was equal to or higher than the initial estimate provided by the investment bank, the expectations of sellers and buyers are exactly opposite – sellers expect a higher valuation and buyers want to acquire at a lower valuation. Investment banks not only manage these difficult conversations but also strive to find buyers with the right cultural and strategic fit to enable successful integration post-financial close and develop healthy working relationships. Investment banks also assist in working out the synergies and the vision of the combined entity, and, irrespective of the valuation, would often advise against a buyer who is detrimental to the sellers’ strategy and vision.

We at Fuld & Company work closely with investment banks in all phases of the deal life cycle and help them add significant value to the sale process. Read more about our services or get in touch with our experts now.

Author: Vinit Gala

Tags: Banking, buyer, investments, sales, seller