Assessing market size and market entry opportunities within Emerging Markets

Posted by | Fuld & Company

Background:

A multi-national consumer goods (CPG) company wanted to better understand the market size and their own market share for one of their products in a number of Emerging Markets around the globe. They also wanted to analyse opportunities for entry into specific Emerging Markets where a more precise understanding is required, e.g., when the company needs to make an informed investment decision related to these specific markets.

The company had tried to estimate this itself using different methodologies but wanted a third party who is familiar with the product and has expertise in market sizing to provide an objective opinion and also research the key players and brands, pricing structure, and customers’, distributors’ and importers’ roles and perceptions.

In addition, the company wanted the support of an outside firm to partner with it in the investigation of these markets to build an effective business strategy to support direct investment, and develop a Route-to-Market (RTM) strategy that would enable it to meet its growth targets, whilst taking into consideration the unique features which characterize this market.

In one of the regions:

- a local partner with the insights and resources to navigate the political and economic risks has been manufacturing and distributing the company’s products under license for over 30 years

- There is now an opportunity for the company to rethink its investment in that region as those risks have diminished and the company has made a name for itself with strong brand awareness and a positive brand image in the region.

- The company needed to inform its partner in the very near future of its intentions to continue their relationship or if the time was right to make its own direct investment in the region.

Challenge:

Within Emerging Markets, the product is primarily sold through traditional trade outlets such as independent groceries and newsagents, sourced via a highly fragmented distribution chain, making it difficult to access the information needed to assess the market accurately or to make an informed decision.

The existing data the company has relies on internal estimates, based on its own sales volumes, the limited data available on the modern mass market channel, imports from other countries, and estimates of competitors’ sales, which has sufficed as a general indication of the size and growth of the market. However, the company lacks the hard data and insights produced by global syndicated research agencies and industry analysts that is readily available in markets such as the USA or the EU.

The company also relies on models used in other, more advanced economies to build market estimates, but this is liable to result in incorrect interpretations when applied to fragmented Emerging Markets where disparities and inconsistencies surround the data available and how it is collected, compared to advanced economies which aren’t as impacted by complicating factors such as undocumented imports and exports.

Approach:

Fuld & Company took a 3-phased approach to the project to gather reliable research from a range of sources which were then triangulated to deliver analysis and assessment to the client.

Phase 1 – Secondary Research

We began with identifying the core questions to build a robust market size and market entry project, including sales growth, the drivers promoting or inhibiting growth, respective weights of the different distribution channels, brand segmentation and analysis, pricing structures and the main Clients, Distributors, Importers and Competitors.

We then exhausted all readily available secondary research in the public domain and combined this with relevant research from the client, including data and insights, to provide greater context and reduce the time required to conduct any necessary background research, including details of any known distributors, wholesalers or retailers, to build estimates and address the objectives of this engagement.

Secondary sources:

- Trade and production data including:

- Government Ministries/Sources, e.g., Ministry of Trade, Ministry of Health, Ministry of Industry and Technology, etc.

- International and Regional Bodies/Agencies/Sources including existing and proposed trade agreements, the World Bank, IFC and IMF

- Import/Export Trade Databases

- Business Publications, company websites, social media sites, marketing material, investor presentations, press releases and news articles

- Market reports from global syndicated research houses

- Consumer regression studies

- Estimates from additional third party reports

Phase 2 – Primary Research / Fieldwork

Based on the data from Phase 1, we conducted telephone interviews with key industry players and industry experts, and traveled to three retail locations (two urban, one in a smaller, more rural area) to conduct field research and collect representative data to validate our Phase 1 findings.

Phase 3 – Analysis and Insights

The final phase of the project brought together the findings from Phase 1 and Phase 2 to size the market using a number of techniques including regression analysis, and comparing the results with the client’s other estimates to triangulate the results, and identify and probe any discrepancies. By necessity, the estimates had to rely heavily upon the findings from the secondary sources interrogated in Phase 1, combined with on-the-ground in-depth interviews where available, to identify market size, pricing structures, key players and brands, and the roles and perceptions of clients, distributors and importers.

This phase included an assessment of market drivers and inhibitors based on the desk research in Phase 1, including economic growth, urbanization, growth in adult population, changes in spending/consumption and consumer demographics, growth in retail infrastructure (in particular, modern trade), penetration of substitutes, political instability and corruption.

Result for the Client

We concluded the project by delivering our assessment of the market size for their product in Emerging Markets, our insights into the implications of the different Route-to-Market options available to the client, combined with our final recommendations for the next steps for the client to take.

Fuld +Company’s Methodology

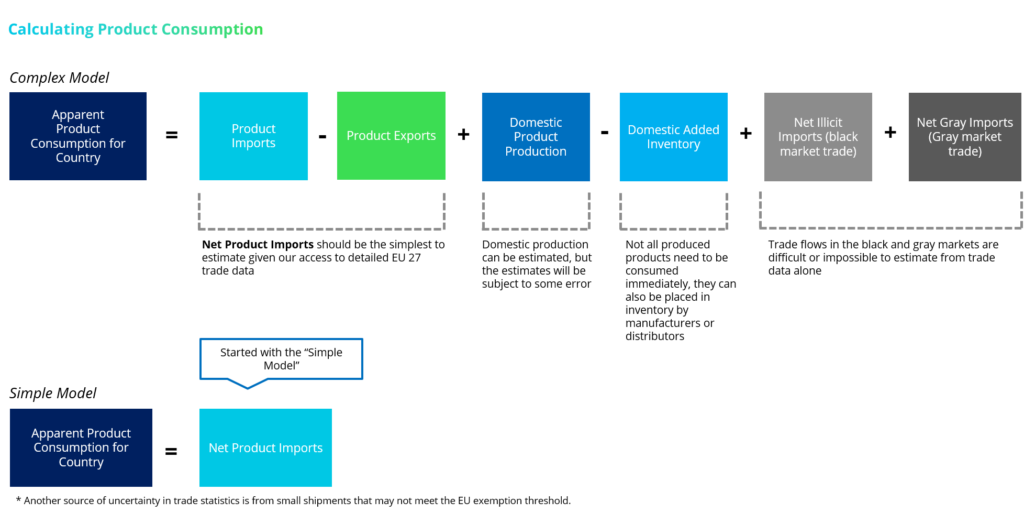

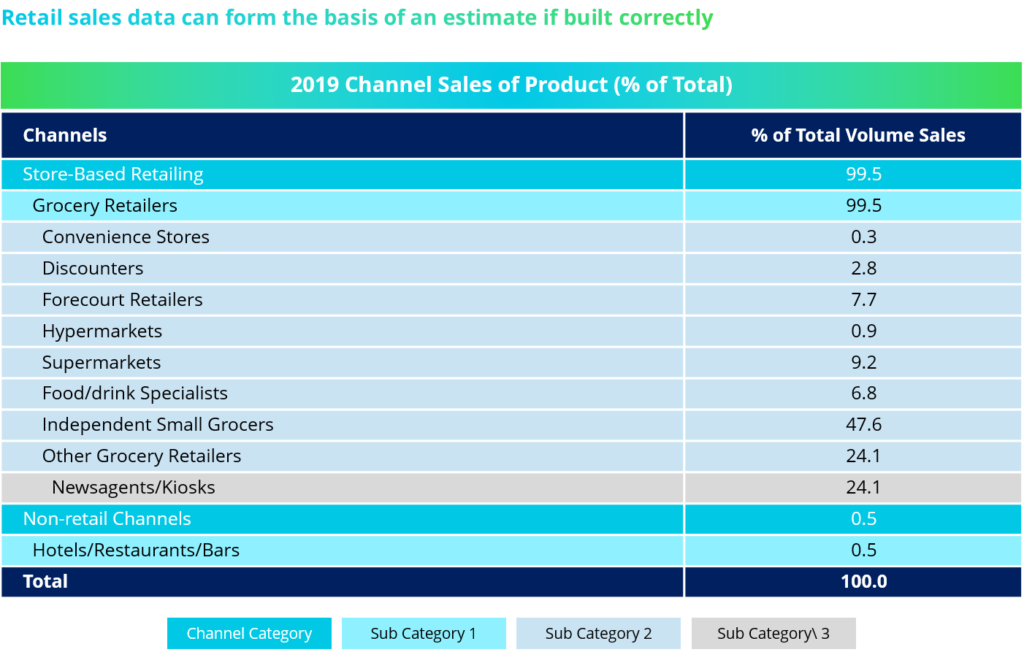

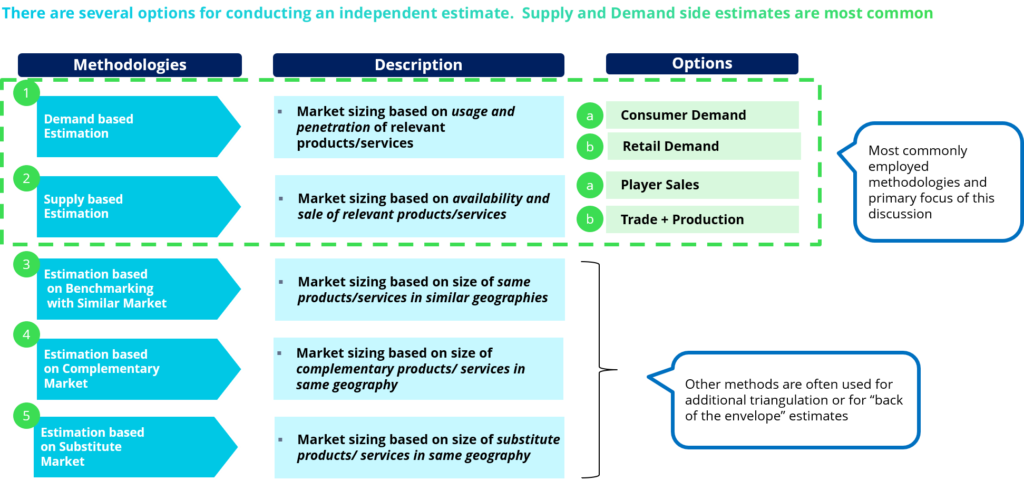

To estimate the market size, supply and demand side we used a variety of approaches to include the key variables contributing to the market size calculations including:

- Demand side

- Retail segmentation (# of stores by type x volume x weighted average price point)

- Supply side

- Competitors’ sales (sum of in-country sales for primary players and estimates of their market share)

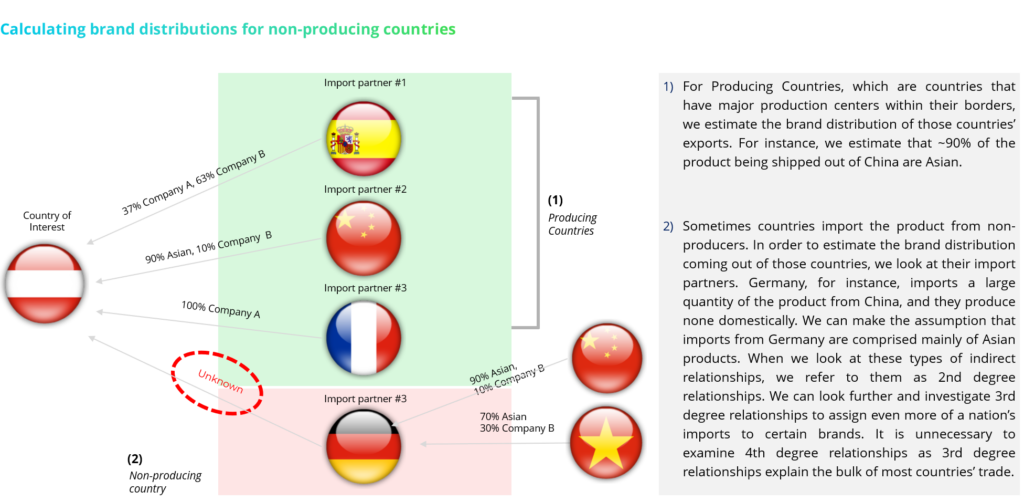

- Trade estimates (Import + production – exports) based on:

- Import and export data

- Domestic production figures (excluding added inventory)

- Trade flows in the black and gray markets (estimates)

- Consumption Regression Analysis to determine the relationship between product sales and the population across different countries.

- This was first conduct on a wider set of countries and then separately using only Emerging Markets to refine the coefficients (where we were able to find reliable data)

- Test and consider the potential impact of any differences in the percentage of illegal or gray trade in each country included in the regression study, making adjustments or assumptions as necessary.