Amazon Health… Third Time’s a Charm

Posted by | Michael Ratcliffe

Once again, Amazon has pivoted in its attempt to break into the US healthcare market with its acquisition of One Medical. Has it got its strategy right this time and does this herald Amazon becoming a major disrupter of the primary care sector?

Back in 2018, Amazon’s acquisition of PillPack was a definite success, as part of its enabling the online giant to become a key player in the drug supply chain. Since then, however, Amazon has struggled to leverage this move to successfully enter the primary healthcare market. With the acquisition of One Medical, it looks as though it may have finally gotten it right.

Primary Healthcare Disruption – The First Attempt

It is all too easy to forget that Amazon has been in the healthcare market for nearly 25 years. Back in 1999, it bought drugstore.com, but did little with it apart from including it as part of its growing online retail store. It wasn’t until 2017 that Amazon made its first major play in the healthcare market.

Few would disagree that the US primary care market has serious issues. Primary care doctors are underpaid and overworked. Appointment waiting lists can stretch into months if not years, and appointments often need to be made weeks, if not months, in advance.

Amazon has long identified the health care market as ripe for disruption. Back in 2017, it set up “Amazon 1492”, a secret lab to explore tech-driven healthcare disruption. A year later in 2018, it launched its first attempt, “Haven,” a joint venture between itself, JP Morgan, and Berkshire Hathaway. The idea was to build an affordable, high-quality healthcare program around a potential membership of 1.2 million customers. This initiative never got off the ground, as Amazon badly underestimated the complexity of the healthcare market, and it was disbanded in 2021.

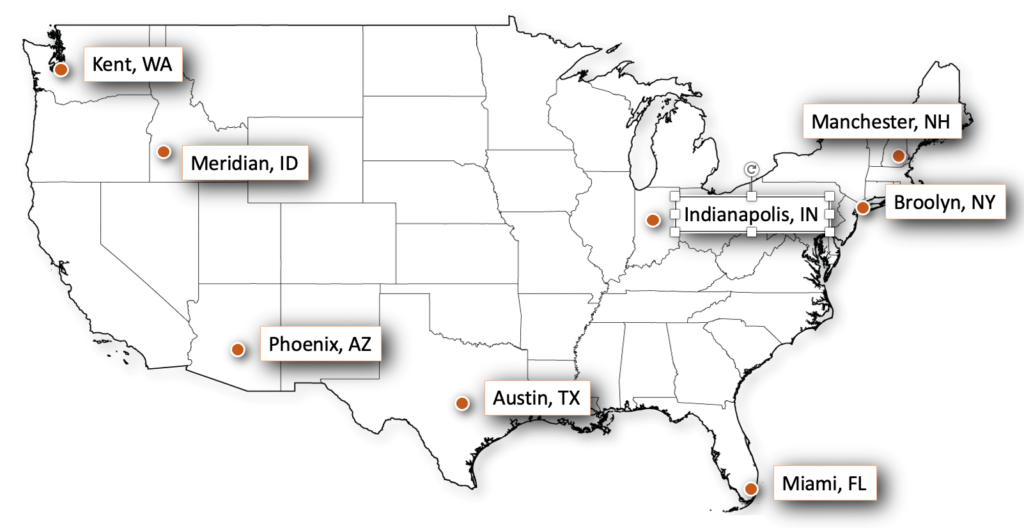

Amazon PillPack’s Network of 8 Central Fill Facilities

Also in 2018, Amazon had made a parallel move into the pharmacy market with the acquisition of PillPack for $753 million. This move was much more in its wheelhouse with its focus on delivery and got the company’s foot in the drug value-chain door. Rather than packing up pills in the traditional small orange vials, PillPack used a technology more commonly used in Europe and the long-term care market — small plastic pouches backed up by online technology.

The service could be managed through the web with a user-friendly smartphone app, email reminders and updates. Medications were delivered monthly in pouches with the day and time for each medication to be taken printed on each pouch. Although this form of delivery was more expensive than the traditional vials, it was more user-friendly. Amazon quickly took over PillPack’s distribution network and expanded it to eight high-tech, fully automated central-fill facilities around the country. It focused on what the customer wanted, made the service free, simplified online sign up, guaranteed two-day delivery for one-off meds, sent email pre-alerts for regular monthly delivery, and provided high-quality customer support. Even today, neither traditional mail-order nor retail pharmacies can match Amazon PillPack’s offerings, and are at best, fast followers.

Amazon clearly felt its move to acquire PillPack was positive and, in 2019, launched “Amazon Pharmacy”. This service covered over-the-counter medications and other healthcare products, not just pills. It used PillPack for mail-order fulfillment, and deliveries were made in specially designed recyclable boxes. The traditional pharmacy delivery model was another sphere that had long been ripe for disruption – medication was available to be picked up only at brick-and-mortar stores with little or no online service. Amazon could now chalk up a win in the pharmacy segment, but medication delivery was only the beginning; the retailing colossus wanted to get into the healthcare market.

Amazon Care – The Second Attempt

Flush with the 2018 success of PillPack, in 2019 Amazon made its second attempt at a full-service healthcare offering with “Amazon Care”. This initiative was initially limited to Amazon employees and their families as an alternative to the floundering Haven joint venture.

The key concept behind Amazon Care was centered around telehealth with limited in-person care as an add-on. Employees and their family members could connect with a physician or nurse practitioner 24/7 through live chat or video. In addition, in-person care would be available for follow-up care, vaccinations, or blood draws through a registered nurse who would be made available at a location of the patients’ choosing, at home or in the office.

Soon after its soft launch, Amazon began testing the idea with potential corporate clients, but had little success. Apart from Hilton Hotels, Amazon Care did not get buy-in from large accounts and it looked as though this second attempt to enter the mainstream healthcare market was going to falter. Adding to the problems was the outbreak of the Covid 19 pandemic in 2020, and the traditional primary market was forced to emulate the Amazon Care model with a mix of telehealth and in-person care.

One Medical – The Third Attempt

After two years of struggling to achieve success with Amazon Care, in mid-2022 the company purchased One Medical for $3.9 billion in an attempt to change its strategy.

One Medical already had a reputation as a high-tech Silicon Valley startup. Its founder Tom Lee made his name with his amazingly successful medical reference app, Epocrates, in 1998. With over 50% of physicians reported to be using it, Epocrates had gone public in 2011. Lee then turned his focus on One Medical, which he had launched in 2007.

One Medical’s Network 176 Facilities

Additional facilities are planned in Connecticut and Wisconsin

The concept behind One Medical was to focus on fixing the key issues around physician access. By doing so, it radically changed the economics of primary care. It had become common industry practice for physicians to be supported by 3.5 to 4.5 FTEs; Lee’s model slashed this to 1.5 FTEs.

One Medical did this by using technology and by eliminating unnecessary labor. Patients would book virtual or in-person same/next day appointments online through an app. If in-person, when patients arrived at the clinic, they would only see a receptionist and a doctor. There would no longer be a nurse checking weight, blood pressure and other vital signs. Technology was used to handle costly administration issues.

The Resulting Package

By 2020, it was clear that One Medical was hitting a positive note with the market, and so it went public. In the same year, its patient base had grown to 800,000 members and its nationwide network to over 170 clinics.

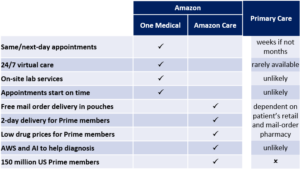

It did not take long for Amazon to put its imprint on One Medical’s operation following its 2022 acquisition. Almost immediately, Amazon announced that One Medical’s membership fee would be slashed by 28% to $144 for the first year. For just $12 a month One Medical was offering 24/7 personalized primary care services, on-site labs, virtual care and mail order prescription delivery – a compelling package when compared to the typical primary care offering.

Additionally, in January 2023 Amazon launched RxPass, a $5 monthly subscription plan for U.S. Prime and, of course, One Medical members. Going forward, it will not be surprising to see Amazon attempt to migrate its 150 million Prime members into One Medical’s services and even linking its leading-edge AI tools to help analyze health data through AWS, and so move into predictive value-based healthcare.

One Medical and Amazon Care vs Primary Care

Reviewing the joint offerings of One Medical and Amazon, it is clear that Amazon will now be able to attack a wide swath of incumbents in the primary care market, such as:

- Retail and mail-order pharmacies as well as major players in the drug channel like PBMs and distributors

- Primary and urgent care clinics

- Telehealth and online consulting services

It will be most interesting to see how the major retail pharmacies react, like CVS, Walgreens and Walmart. All three have already been forced to make major strategic changes to try to compete against Amazon Pharmacy and PillPack, offering online services, more user-friendly mail-order, in-store clinics and basic care services.

The key sign that Amazon’s new strategy is working will be the expansion of One Medical clinics. The company is already planning new clinics in Connecticut and Wisconsin which will likely take its total count to over 180. This network can be compared to CVS with 1,100 Minute Clinics around the country, and Walgreens with its 230 value-based primary care clinics, VillageMD. Walgreens plans to increase its number of clinics to 600 by 2025 and Walmart, with only 50 Health Centers today, has plans to grow to 75 by the end of 2024. This is clearly a space to watch!