Global EV shifts: how BYD is navigating tariffs and reshaping supply chains

Posted by | Michael Ratcliffe

One of the biggest dangers to the US economy from China is the threat to US auto manufacturers with the import of less expensive, high-quality Chinese EVs and hybrids. Following the first Trump administration and its imposition of a 25% tariff on Chinese-made cars and auto parts in 2018, China has been actively planning to circumvent tariffs. The Chinese government has been pushing major manufacturers to establish plants outside of China and so create radically new and complex global supply chains far more difficult for the US to tariff. Now, a whole new round of US tariffs has been imposed and raises the question of how effective will they be, especially against a well-thought-out and executed strategy by China to complexify their supply chains?

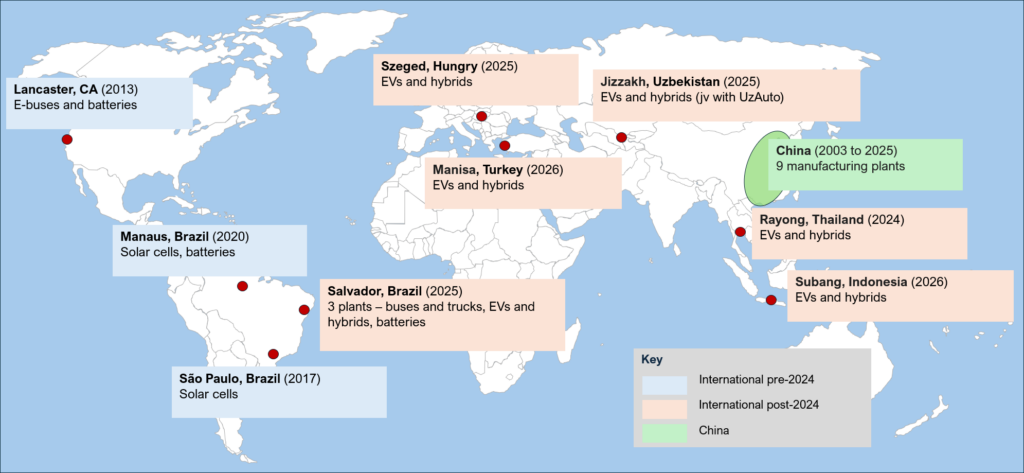

Let’s look at BYD as an example, already the largest EV manufacturer in the world. Prior to 2024, it had only three manufacturing plants outside of China, one in California and two in Brazil for electric buses, solar cells, and batteries. Then in 2024, it started opening up a major international network of six brand new plants for EVs and hybrid passenger cars from Brazil to Europe to Southeast Asia, plus another two in Brazil for buses, trucks, and batteries. A seventh new EV plant is also being discussed for Europe, bringing the total EV plants in Europe to three, while none in the USA!

The situation in the EU is very interesting as the EU had imposed a tariff of 45.3% on Chinese-built EVs last year. Reuters is reporting that this has now been switched to a negotiated minimum price agreement, taking effect immediately. As a result, the EU has an agreement to protect its auto manufacturing with minimum prices, plus three plants just from BYD, each needing between 5,000 and 10,000 high-paying jobs.

In contrast, the US auto manufacturing industry is facing significant tariffs on any parts imported from China, increasing international competition from BYD’s international network of plants, plus anti-American sentiment in many of its export markets. The US tariffs on Chinese imports are likely to be a paper tiger as far as BYD is concerned, as it has “complexified” its supply chain to such a degree.

Added to this, there is no immediate prospect of BYD investing in plants in the US, but there is the threat that it could start importing from any of its network of international plants to directly compete against US passenger cars and light trucks.

Newton’s third law of motion is that for every action in nature, there is an equal and opposite reaction.

So, in light of China’s and BYD’s “reaction,” which strategy seems better? The EU’s or the US’s?

If you want help understanding the “reaction” by China to tariffs on your supply chain, reach out to Mike at info@fuld.com.